Tata Steel Share Price Target From 2025 to 2030: Tata Steel is the world’s largest steel-making company. The company has high market presence and legacy with innovation, sustainability, and strategic investment. Most of the future for the steel sector goes with Tata Steel. For this article, share price targets for Tata Steel from 2025 to 2030 have been discussed along with much more detailed insight into the stock trend and growth opportunities that this company has been witnessing.

Company Overview

Tata Steel has emerged as a flagship company of Tata Group as early as in 1907. The company has developed into a global steel business operating in more than 26 countries and commercially available in over 50 countries. These products fall in the gigantic categories of flat steel products, long steel products, and special steel solutions for automotive, construction, and infrastructure.

- Headquarters: Mumbai, Maharashtra, India

- Market Capital: ₹1.56 Lakh Crores

- P/E Ratio: 53.06

- Dividend Yield: 2.88%

- 52-Week Range: ₹124.18 (Low) – ₹184.60 (High)

Current Performance For Tata Steel Share Price

- Intrday Open Price: ₹126.00

- High Price: ₹126.50

- Low Price: ₹124.18

- Current Price: ₹124.98

- Yearly Performance: The stock has fallen by 7.35% in the last year.

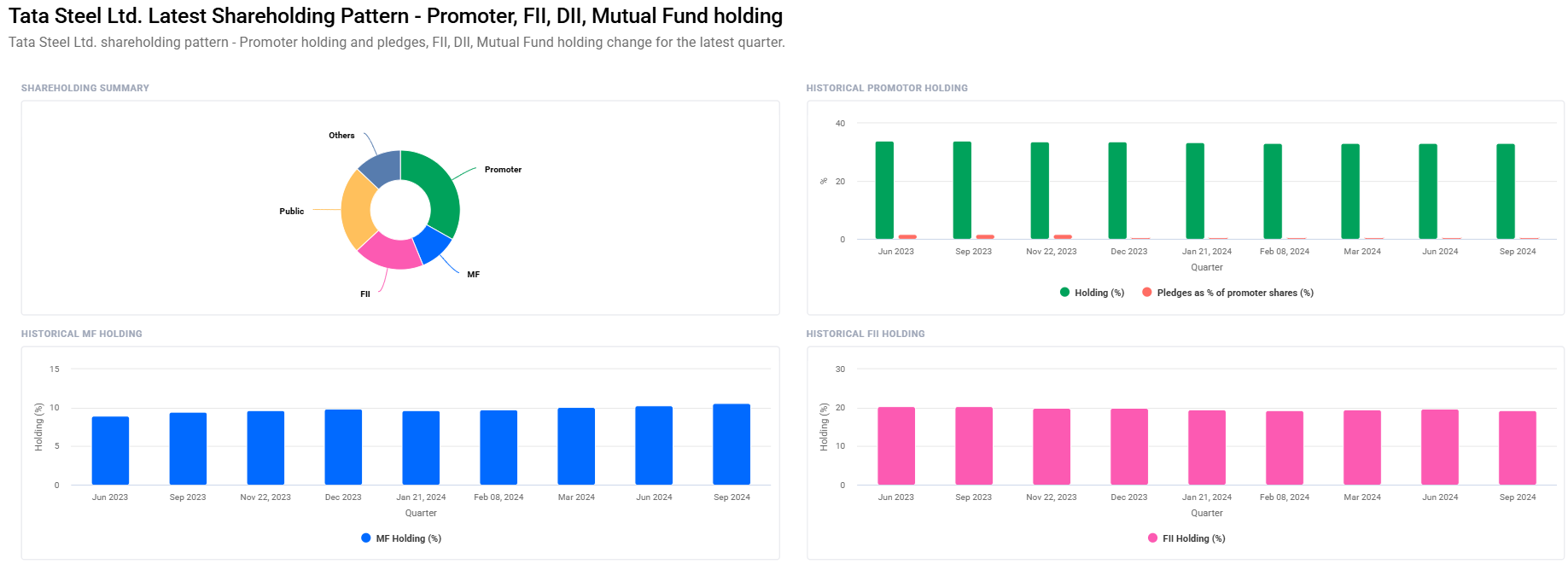

Share Holding Pattern For Tata Steel Share Price

- Promoters: 33.19% No change

- Retail and Others: 24.02%

- Foreign Institutional Investors (FIIs): 19.25% Lower than the earlier number of 19.68%

- Mutual Funds: 10.62% Higher than that of Earlier of 10.32%

- Other Domestic Institutions: 12.23%

FII Reduced their holding from 1,088 to 1,025 wherein Mutual Fund Schemes reduced from 65 to 62. Institutional investors share percentage reduced from 43.83% to 42.79% during the period.

Tata Steel Share Price Target for the calendar year 2025-2030

It will grow steadily for the next six years due to infrastructural development, demand of electric vehicle, and other renewable energy projects. Based on the above graph, the following is the Tata Steel share price target:

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹190 |

| 2026 | ₹250 |

| 2027 | ₹310 |

| 2028 | ₹370 |

| 2029 | ₹430 |

| 2030 | ₹500 |

Growth Drivers For Tata Steel Share Price

- Global demand for steel has mainly been driven by infrastructure and construction booms around the world and more usage of steel in electric vehicles and renewable energy projects. The ongoing process of carbon emission reduction and sustainable practices worldwide has kept Tata Steel on a better pedestal in the race.

- Strategic investments would include facility upgradation and capacity expansions that have led to higher profitability as well as added market share.

- Government Policies: The present policy decisions look to enhance the railway, house, and port infrastructures of the country that will be useful in higher absorption of domestic sector steel usage of India while this will eventually benefit Tata Steel.

- Portfolio: Product as well as geographical spread for diversification and stability in revenues.

2025: Tata Steel Share Price Target ₹ 190

Tata Steel share price can be ₹ 190 in 2025 once the international steel prices begin to move and there is escalation of infrastructural spend in the country. For the reasons shown below, profit margins of the firm improve better and controlling cost.

2026: Tata Steel Share Price Target ₹ 250

The shining glory of Tata Steel is going to shine through strategic acquisition and ramp up in the production capacity by 2026. Government transport and urbanization projects are going to require astronomical amounts of steel. So, that should take it to ₹250 by stock price.

2027: Tata Steel Share Price Target ₹310

2027: For the simple reason of which it would offer more high-margin products and exports. In simple words, Tata Steel would lead the innovation not only in the horizon but also a sustainable way to produce steel. Raise the stock price to ₹310.

2028: Tata Steel Share Price Target ₹370

This will be because surging renewable energy and electric vehicles are always going to add to the continuous increase in the demand for steel products. The special solutions of sectors will enable the company support up-journey at ₹ 370.

2029: Tata Steel Share Price Target ₹430

Tata Steel would also experience enhanced operational efficiency and profitability as investment in the digital transformation and automation increases. With good fundamentals and market position, the stock will reach ₹430 in 2029.

2030: Tata Steel Share Price Target ₹500

Tata Steel to lead by 2030 which will come hand in glove with a massive revenue and profit milestone that is being propelled by a high quality demand pipeline; focusing on sustainability innovation would cement Tata’s position among the global steel leaders and take share price close to ₹500

Frequently Asked Questions For Tata Steel Share Price

1. Is Tata Steel a good long-term investment?

Due to well-based grounds, diversified operations, and much importance provided to sustainability in addition to innovations, it is a very good long-term investment option .

2. What is the current dividend yield of Tata Steel?

Current Dividend Yield: 2.88 %.

Due to the fact that the company ensures it has excellent dividends that return back, it will be an excellent investment alternative for investors as well .

3. Why has FIIs shareholding in Tata Steel declined?

It has declined due to global economic uncertainty and profit-booking by institutional investors. It is a short-term phenomenon and does not affect long-term growth.

4. Which sectors are the contributors to the growth of Tata Steel?

It caters to sectors like construction, automotive, infrastructure, renewable energy, and packaging, hence diversified revenue streams.

5. What are the risks in Tata Steel?

The risks are steel price fluctuations, geopolitical risks, and the economy slowing down. On the other hand, Tata Steel enjoys a good market position and Tata Steel has initiated strategic moves.

6. What is Tata Steel doing towards sustainability?

The company will reduce carbon in emissions, recycled steel, and eco-friendly manufacturing processes to match the world sustainability goals.

Between 2025 and 2030, the Tata Steel Share Price target are likely to go through the roof impressively with some strategic moves; on the side of a winner, innovation, sustainability, and operational excellence will be at its core and prepared enough to seize all emerging opportunities of the global steel industry. For long-term investors this sectoral goliath shall generate phenomenal short-term movements along the way to this future result.