HDFC Bank Share Price Target From 2025 to 2030: One of the most leading private banks in India, HDFC Bank has well-crafted and wonderful financial performances, combined together with a tremendous customer base. Very often, it is the first choice for people for their investment options. It grew quite well with quite good management. This paper is based on an overview of HDFC Bank’s share price targets ranging from 2025 to 2030 based on market data and technical indicators as well as industrial trends.

About the Company: HDFC Bank

HDFC Bank Limited is one of the largest and most trusted private sector banks in India. HDFC Bank Limited was incorporated in 1994, and its registered office is located in Mumbai, Maharashtra. HDFC Bank is a full-service bank offering a wide range of banking and financial services under retail banking, wholesale banking, and treasury operations.

HDFC Bank Share Price Major Highlights

- Market Capitalization: ₹12.58 lakh crore

- P/E Ratio (TTM): 18.21

- Dividend Yield: 1.18%

- Book Value per Share: ₹625.70

- Backward Looking Return On Equity (ROE): 14.46%

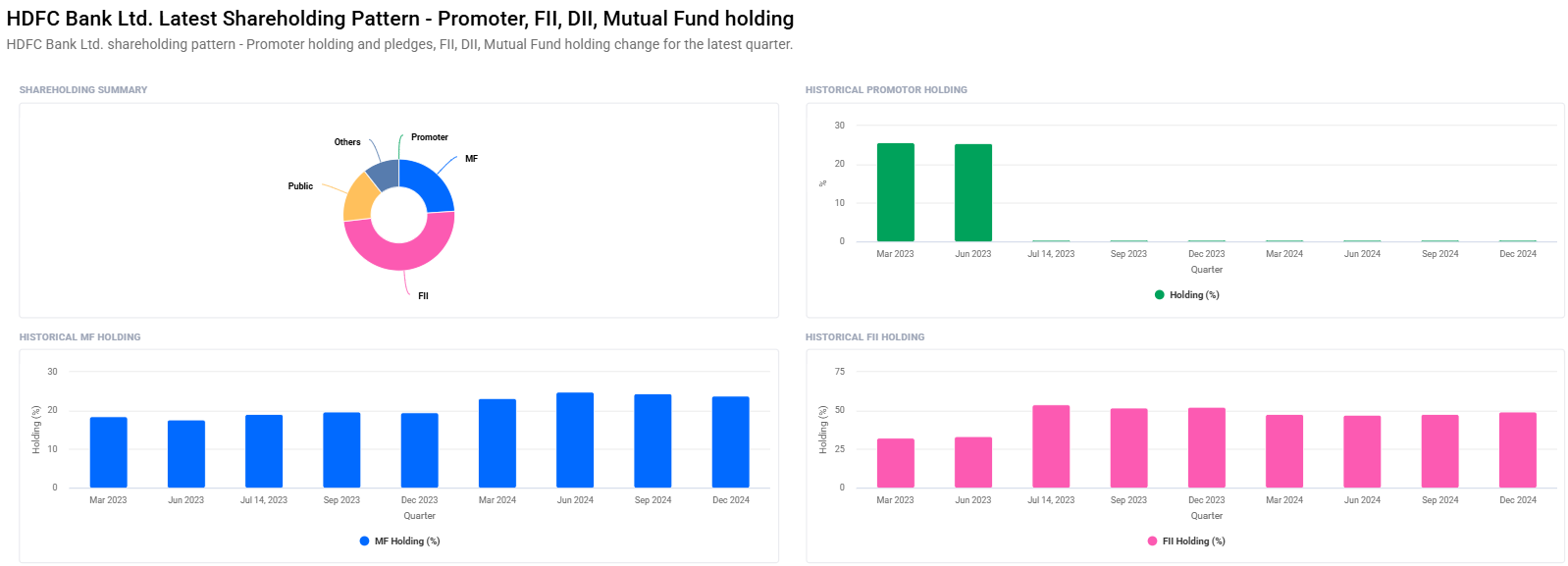

Share Holding Pattern For HDFC Bank Share Price

- FII: 49.20%

- Mutual Funds: 23.93%

- Retail And Others: 16.23%

- Other Domestics Institues: 10.63%

HDFC Bank HDFC Bank maintains significant institutional holding coupled with strong fundamentals, that will make the investment very attractive for long-term growth.

Current Market Data For HDFC Bank Share Price

- Opening Price– ₹1,639.90

- Day High– ₹1,656.20

- Low of the day– ₹1,637.00

- Previous Day’s Close Price-₹1,630.85

- Volume (No.)– 1,33,30,716 ,

- Total Traded Value-₹2,195 crore.

52- Week Range

- High– ₹ 1,880.00.

- Low-₹1,363.55.

Day wise Technical Analysis Report For HDFC Bank Share Price

- Dayline Momentum-48.1 Neutral

- 12, 26, 9 MACD (-39.2 Bearish)

- RSI (14): 28.5 (Oversold, Potential Rebound)

- MFI: 22.9 (Oversold, Potential Rebound)

- ADX: 34.4 (Average Trend Strength)

- ATR: ₹31.0 (Volatility Indicator)

HDFC Bank Share Price Targets from 2025 to 2030

Underlying and growth in the sector of HDFC Bank, with the market scenario, the share price targets for the subsequent years are as follows:

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹1900 |

| 2026 | ₹2400 |

| 2027 | ₹3000 |

| 2028 | ₹3600 |

| 2029 | ₹4200 |

| 2030 | ₹4800 |

These estimated prices are expressed in terms of CAGR with HDFC Bank’s performance that has been witnessed through its market existence and growth in the new sectors of digital banking and fintech.

Discover HDFC Bank Share Price Growth

1. Strong Base: The consecutive continuous performance of HDFC Bank for its financial history holds a P/E ratio of 18.21 and ROE of 14.46%. This reflects profitability and cost-efficiency

2. Market Leadership: The bank is one of the largest in India’s private banking sector with large branch networks and digital services for sustaining market share.

3. Institutional Confidence: High FII and mutual fund holdings reflect robust confidence in the management and future growth prospects.

4. Digital Transformation: The bank has gained a lead with the adoption of technology through seamless digital banking solutions. The parameter should primarily guide the future going ahead.

5. Macroeconomic Environment: The growing Indian economy, coupled with a high disposable income, may boost demand for banking services.

6. Regulatory Environment: The HDFC growth will be positively influenced by promising policies by Reserve Bank of India and government initiatives towards financial inclusion.

Risks/Concern to be kept in mind For HDFC Bank Share Price

Despite the solid fundamentals, HDFC still holds some risk –

- Slowing down in the Indian economy can negatively affect the growth of credits as well as profit

- Operational impact due to increased regulatory requirements or a policy change

- New-age fintech competition intensifying and eroding the margins

- Global uncertainty fuelled by geopolitical concerns and market volatility

FAQs For HDFC Bank Share Price

1. What is the HDFC Bank Share Price target in 2025?

The share price of HDFC Bank will reach ₹1,900 by the year 2025, driven by financial strength as well as an overall growth-driven market.

2. HDFC Bank an Investment Destination?

HDFC Bank has strong fundamentals, solid institutional holding, and dominance in digital banking. Thus, the investor’s hub.

3. Is HDFC Bank a long-term investment-worthy?

HDFC Bank is one of the good long-term investments as it has been growing positive and maintaining a stronghold in markets while financially staying very strong.

4. What are the risks involved for HDFC Bank Share Price?

Some few primary risks there are include recession in economic growth, regulatory, and also threaten increased competition brought about by players in the Fintech group.

5. How is HDFC Bank positioning compared with the peers?

On parameters of profit, market shares, and on technology upgrade in order to gain the top ground in the marketplace in banking HDFC Bank surpasses most its peers.

6. What is the Institutional Investors Contribution for HDFC Bank Share Price?

The institutional investors holding significant stakes of FIIs and mutual funds show confidence in its management and its growth prospects.

7. What is HDFC Bank’s digital transformation for its future?

The digital banking solutions are expected to keep fueling the customer acquisition, operational efficiency, and long-term growth by HDFC Bank.

With strong fundamentals, market leadership, and an innovation focus, HDFC Bank will continue to remain one of the most dominant players in the Indian banking space and stand poised for huge opportunities in the HDFC Bank Share Price for longer-term investors, looking from 2025 to 2030.

There is related risk, though the nimbleness of the bank with changes in the market conditions quickly coupled with adaptation toward technology would help HDFC Bank be a long-term good investment. But with that it must go hand in glove with macroeconomic trends along with the trend of changes.