Olectra Greentech Share Price Target From 2025 to 2030: Olectra Greentech Ltd is one of the leaders in electric mobility and green energy companies in India. As the sustainable development goes higher, Olectra’s future efforts at transforming the scenario regarding achieving a renewable energy goal for India toward its carbon emission reductions will be much more rewarding. This has attempted to estimate the target share price of Olectra Greentech for the years from 2025 till 2030 based on the fundamentals of a company and available financial data together with the market trend and probable growth drivers.

About Company

MEIL is the parent company of Olectra Greentech Ltd. The group produces electric buses and insulators. Olectra Greentech Ltd is the first entity to introduce electric mobility solutions into the country. The company has always been stringent about providing eco-friendly transport facilities and had also been a voice for green energy technologies.

Important Points:

- Industry: Electric Mobility and Renewable Energy

- Headquarters: Hyderabad, India

- Portfolio: Electric Buses (eBuzz series), Composite Insulators

- Market Leadership: India’s largest electric bus manufacturer

- Focus: Sustainability, innovation, and renewable energy solutions

About Olectra Greentech Share Price

About the company with its financials and growth. Here are the recent financials:

- Market Cap: ₹10,326 Cr

- P/E Ratio (TTM): 91.96 (which is more than industry average, so it is premium)

- P/B Ratio: 10.52

- Industry P/E: 21.55

- ROE: 11.43%

- EPS (TTM): ₹13.68

- Dividend Yield: 0.03%

- Book Value: ₹119.61

- Debt-to-Equity Ratio: 0.19 (low leverage)

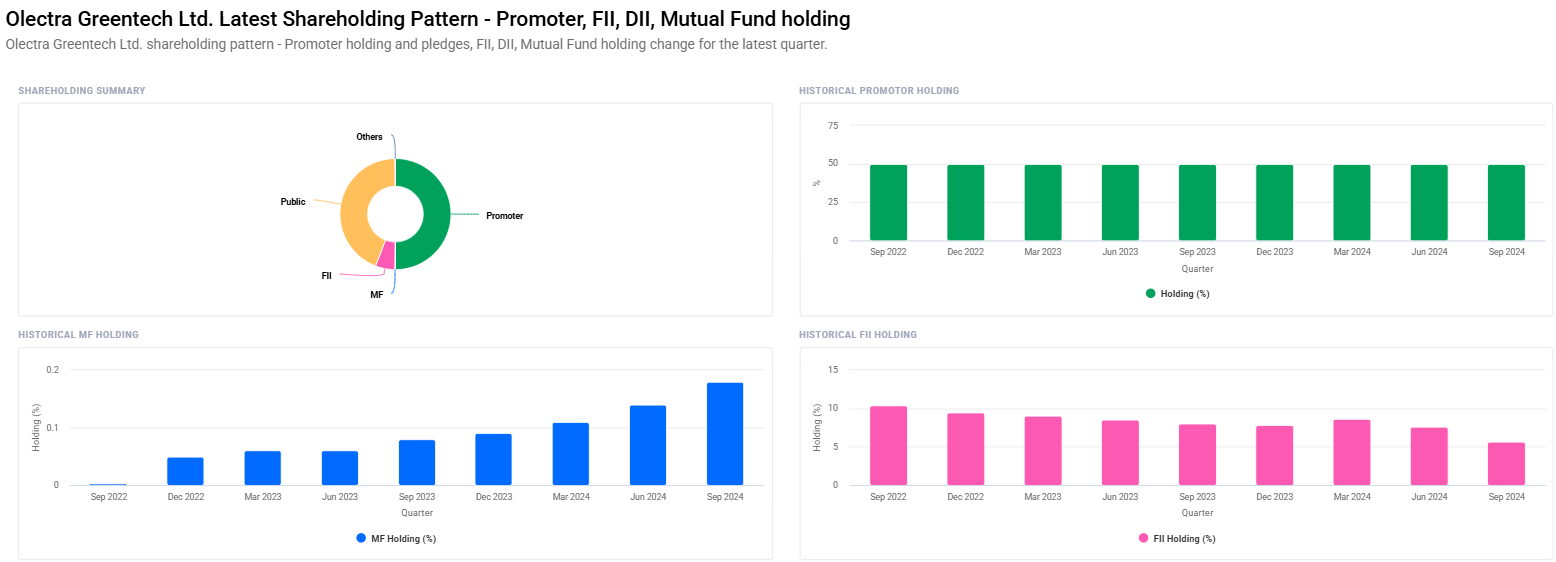

Shareholding Pattern For Olectra Greentech Share Price

- Promoters: 50.02%, No change

- Retail and Others: 44.08%

- Foreign Institutions: 5.64% decreases to 7.61%

- Mutual Funds: 0.18% rise from 0.14%

- Other Domestic Institutions: 0.09%

This fact does not change the drift of promoter holding that would suffice to conclude that the investors do have the confidence of moving upwards in the long but the FII selling would still be on profit taking or overall global headwinds.

Olectra Greentech Share Price Prediction 2025-2030

As per financials and growth drivers for electric vehicles, price targets for the same stock for trend in present market are as under:

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹2300 |

| 2026 | ₹3300 |

| 2027 | ₹4300 |

| 2028 | ₹5300 |

| 2029 | ₹6300 |

| 2030 | ₹7300 |

Growth Drivers For Olectra Greentech Share Price

- Government Policies: Favourable policy like FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and the incentives for adoption of EV

- Public Transport Switch: Ebuses’ order booked from state transport corporations

- Technological Upgrades: Advances in battery science and process of making electric vehicles

- Green Energy Surge: India as well as the world is accelerating its renewable energy source

- Export Opportunity: Electrification in buses of various geographies is going to rise with time

Technical Analysis For Olectra Greentech Share Price

- Date Momentum Score: 27.8, Technically very weak

- Date MACD: -45.0

- Day RSI (14): 47.6, Neutral Region

- Day MFI: 61.8, Neutral Zone

- Day ATR: 62.5, Reflects mid-range volatility.

Neutral on the short-term technical view but the overall trend of the industry and potential has made this a good growth play for investors.

Olectra Greentech Share Price Major Opportunities

- Electric Buses: Due to higher rates of urbanization, plus greater consciousness related to pollution, demand for electric buses as means of public transportation has risen manifolds.

- Technological Joint Venture: With world leaders concerning the EV technology through a joint venture, innovation would get a boost

- Infrastructure Development: Further investment in the EV charging infrastructure is going to increase the demand for Olectra’s offering

- Export Growth: Diversification to Emerging Markets, especially developing countries can open more revenues

Risks to Watch For Olectra Greentech Share Price

- High Valuation: The stock is priced for good growth as a P/E ratio in miles of the industry average does not allow for any scope for mistakes.

- Intensifying Competition: Competition with all other major players coming up in the Indian EV space along with global players.

- Government Policies: Almost all orders and incentives are received from the government for Olectra.

- Disruption in Global Supply Chain of EV Components

Frequently Asked Questions On Olectra Greentech Share Price

1. What does Olectra Greentech do in its line of business?

Olectra Greentech manufactures electric buses while it is a composite insulators manufacturing company, the first-generation company in India electric mobility segment

2. Is Olectra Greentech making a long-term investment viable?

Yes. The business outlook has a huge growth opportunity, with growth in electric vehicle demands and an ever-supportive government for a set of such policies that is on an imperative shift around green energy project of the whole world.

3. What are the significant risks of the stock of Olectra Greentech?

The major risks that an investor has to consider include valuations at high levels, reliance on government policies, competition that is increasing, and disruptions within the supply chain.

4. Why FII had reduced its stakes?

The downfall in the FII could be due to profit-booking or fear about market fluctuation. This in no way shows that the company does not have the confidence.

5. What is the future of Olectra Greentech?

It actually can become an opportunity for future growth, as there is an upswing demand for electric buses, and export possibilities are growing fast with the speed of technological advance in EVs.

Olectra Greentech is better positioned to ride on the tide of the green energy revolution in which it swims, on the aggressive approach the Indian government is taking on the electric mobility movement. It has a healthy product portfolio with government support in terms of increased adoption of EVs, which holds tremendous growth prospects. The stock, by taking technical as well as market dynamics, seems to be a bit volatile in the short run, while in the long run, prospects are very bright. All of these remind one of stocks to be considered for investment opportunity and exposure to the EV sector promising a good return by 2030 and Olectra Greentech.