Hindustan Copper Share Price Target From 2025 to 2030: Hindustan Copper Limited or HCL is one of the biggest mining companies in India, most of which are used for copper production. Future’s prospects, after all, shall indeed shine bright for such companies because demand will go up not only in electric vehicles but in renewable energy and infrastructure as well. This article brings to you basic concepts, current performance, share price prediction from 2025 to 2030 and expert views and FAQs associated with Hindustan Copper so that you understand everything related to its investment opportunity.

Hindustan Copper Limited is India’s only vertically integrated copper manufacturer. It offers the entire value chain from mine to beneficiation, smelting, refining, and casting of copper. The company was established in the year 1967 under the aegis of Ministry of Mines, Government of India.

Market information For Hindustan Copper Share Price

- Market Cap: ₹23,392 Cr

- P/E Ratio (TTM): 58.15

- Debt to Equity Ratio: 0.04. This also reflects that the company has relatively lesser levels of debt.

- ROE: 16.71%

- Dividend Yield: 0.38%

- Promoters’ Holding: 66.14%

Considering the increased demand for copper in India, the increase in production capacity accompanied by the operational efficiency of this company suits well in place. HCL is placed well, alongside strategic government moves such as “Make in India” and infrastructures, which will help HCL to touch its desired level of growth.

Fundamentals and Recent Performance For Hindustan Copper Share Price

- Open Price: ₹239.96

- High: ₹239.96

- Low: ₹229.85

- Previous Close: ₹242.05

- Volume Traded: 40,98,027 shares

- Market Cap: ₹23,392 Cr

- 52-Week High: ₹415.80

- 52-Week Low: ₹216.76

The company has managed to survive for a year in bad times. On the technical side, there is mixed criticism of the company. It does have short-term negative trends, but it does boast long-term positive trends.

Technical View For Hindustan Copper Share Price

- RSI (14): 39.5 Neutral, close to entering an over-sold zone

- MACD: -6.9 Bearish

- ADX: 26.9 Neutral trend strength

- ATR (Volatility): 11.1

Technically it remains neutral, and the stock would go up as macroeconomic will change positive while the demand of copper will go on increasing.

Hindustan Copper Share Price Forecast 2025-2030

| YEAR | TARGET PRICE (₹) | GROWTH CATALYST |

| 2025 | 420 | Increased demand of electric vehicles as well as Infrastructure. |

| 2026 | 620 | After capacity expansion, the production goes on increasing |

| 2027 | 820 | Global scarcity of copper is pushing the price up |

| 2028 | 1020 | Government policy in favor of domestic mining. |

| 2029 | 1220 | Technological advancement with an increase in mining efficiency. |

| 2030 | 1420 | Good financials and international ties |

Growth Drivers For Hindustan Copper Share Price

- Increasing Demand for Copper: Copper has high usage in EV batteries, renewable energy, and electrical infrastructure.

- Low Debt: Hindustan Copper has a very low debt-to-equity ratio that reflects healthy financial position.

- Government Support: Policies supporting mining industry and extending infrastructure.

- Global Trends of Geopolitics Global Trends: Very good trend related to renewable energy and e-vehicle as this metal demand would increase for boosting.

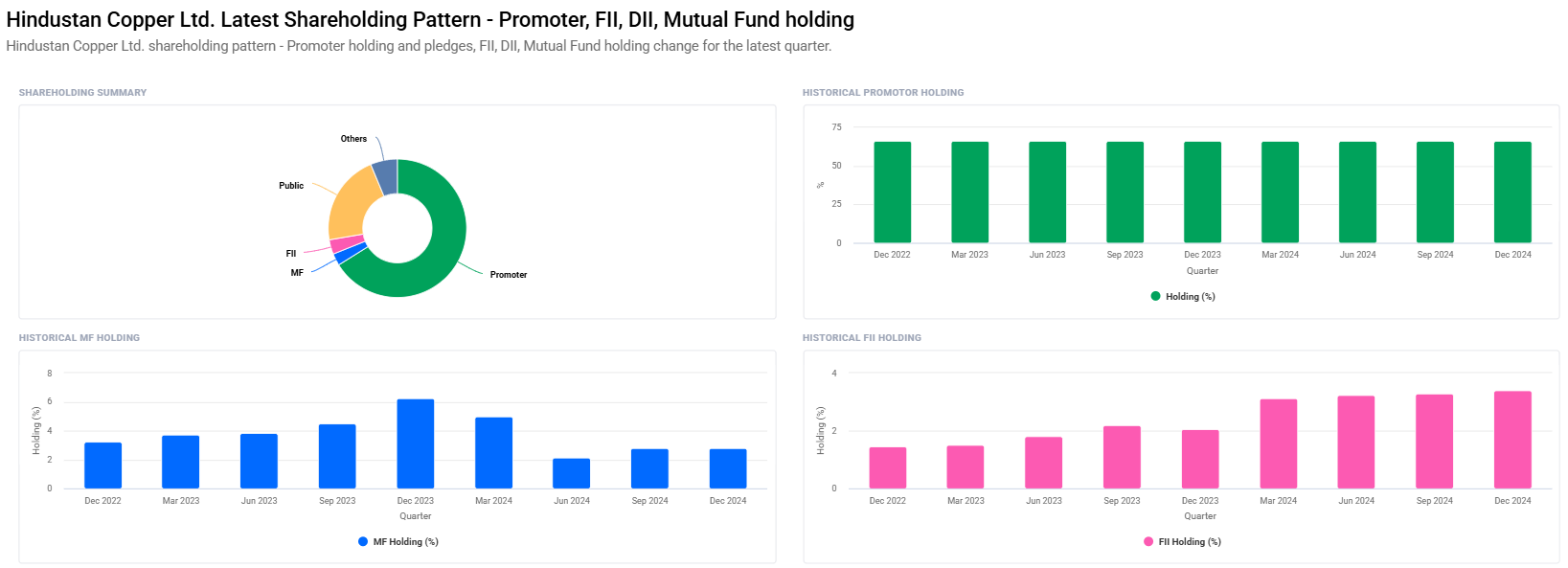

Promoters and Institutional Holding For Hindustan Copper Share Price

- Promoter Holding Increased: NO change found in the record during the fiscal year of Dec.2024 with at 66.14%.

- FII/ FPI Holding Increased: FPI / FII jumped to 3.41% in DEC. 2024 from 3.30%.

- Mutual Fund Holding: Relatively decreased from 2.80% to 2.81%.

- Holding FII/FPI: Increased evidences foreign investment going up. It is good in the long term for HCL too.

Technical Analysis for Hindustan Copper Share Price

| Indicator | Value | Interpretation |

| Momentum Score | 35.8 | Neutral, consolidating. |

| MACD Signal | 8.8 | Bearish, needs to reverse for positive movement. |

| MFI (Money Flow Index) | 46.1 | Neutral, not overbought or oversold. |

| ROC (125 Days) | 26.8 | Performance was decreased last six months. |

Frequently Asked Questions on Hindustan Copper Share Price

1. Is Hindustan Copper a good long-term investment?

Yes, the underlying fundamentals of Hindustan Copper are sound, debt low and perfectly well-positioned to leverage maximum benefit from increased demand for copper in the rest of the world. Five-year long term share price targets show steady growth over the period.

2. What is the prime reason for this surge in consumption of copper?

Major drivers of increase in demand for copper are electric vehicles and renewable energy with infrastructure development. So, copper has a long-term positive trend as the entire world goes green.

3. Why has Hindustan Copper moved in a bearish pattern recently?

There have been bearish trends due to the volatility of the market and subsequent profit booking accompanied by uncertainty in global economies. Its long-term prospects are still very positive.

4. What is the risk with Hindustan Copper investment?

- Global copper price volatility

- Policy sensitivity

- Competitive local private players, International copper producers

5. How does it impact HCL stock from promoter and institutional holding?

Very promising holding by the promoter at 66.14% for the company. FII/FPI holding increase is also a good sign that reflects the interest of foreign investors.

Hindustan Copper is a good long-term investment stock. The growth in infrastructure in India and the global push toward green energy will support the demand for copper. Strategic initiatives at Hindustan Copper, debt at low levels, and government support have laid good growth foundations. Hindustan Copper Share Price targets in 2025 would rise up to ₹420 and reach ₹1,420 in 2030. It would be an exponential return. The investor should first find out the current trend of the market, do his proper due diligence, and then wait for the trend of global copper prices before investing.