United Spirits Share Price Target From 2025 to 2030: United Spirits Ltd. is the leader of the Indian alcoholic beverage market, and Diageo India runs the company in the market place. It brings out a portfolio of iconic brands to the market shelf, such as McDowell’s, Royal Challenge, and Johnnie Walker. This report will present our detailed analysis based on market trend, financials, and technical indicators for United Spirits Share Price to be achieved within 2025 to 2030.

Key Financial Parameters For United Spirits Share Price

| METRIC | VALUE |

| Open | ₹1,450.00 |

| High | ₹1,464.20 |

| Low | ₹1,386.90 |

| Market Cap | ₹1,01,000 Cr |

| P/E Ratio | 76.23 |

| 52-Week High | ₹1,700.00 |

| 52-Week Low | ₹1,065.10 |

| Dividend Yield | 0.61% |

| Debt-to-Equity Ratio | 0.07 |

| ROE (Return on Equity) | 18.57% |

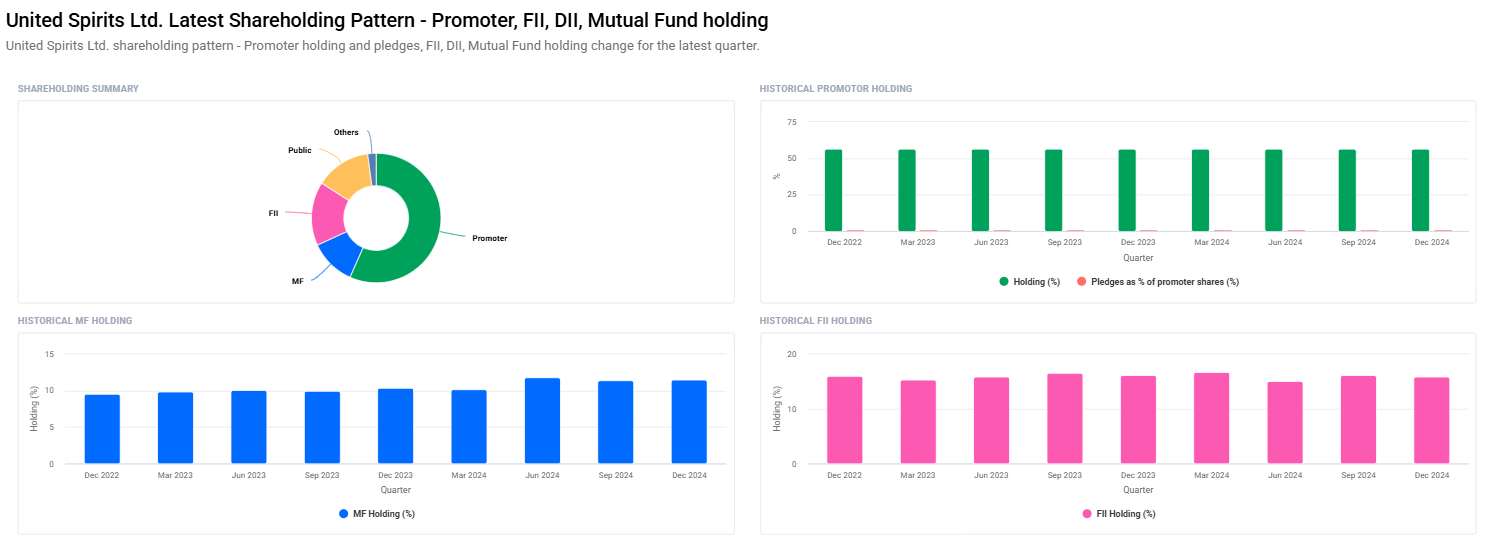

Shareholding Pattern for United Spirits Share Price

- Promoter Holding: 56.67%

- FII/FPI Holding: 15.93%

- Mutual Fund Holding: 11.50%

United Spirits Share Price Predicted by 2025-2030

| YEAR | TARGET PRICE (₹) | Analysis |

| 2025 | 1700 | It is growing through the stable demand, newly launched product and more. |

| 2026 | 2400 | Entering the Rural Markets and also Premium Level |

| 2027 | 3100 | Revenue Benefits through strategic alliance along with export. |

| 2028 | 3800 | Digitization will work in its favor, gaining more market depth. |

| 2029 | 4500 | Cost optimisation and innovation will lead to profits. |

| 2030 | 5200 | Premium segment along with strong international presence. |

Day Technical Analysis For United Spirits Share Price

| INDICATOR | VALUE | ANALYSIS |

| Momentum Score | 45.1 | Neutral – the stock neither is indicating any significant upward or downward momentum. |

| MACD | -32.9 | Bearish – the MACD has gone below the signal line. |

| RSI (Relative Strength) | 35.0 | At the edge of oversold zone, a bounce is possible. |

| ADX (Directional Index) | 21.2 | Weak trend – indicates lesser directional movement in short term. |

| ROC (Rate of Change) | -11.9 | It exhibits bearish movement over the past 21 days. |

Factors Affecting United Spirits Share Price

- Market Leadership: United Spirits enjoys a leadership position in the Indian spirits market, which makes it have an excellent competitive advantage. Its extensive distribution network and inherent brand franchise ensure a good and stable stream of revenues to the company.

- Premiumization Trend: Indian consumers are embracing premium spirits; therefore, the sales will be gaining strength in the high-margin segment of sales, and that should enhance profitability.

- Strategic Initiatives: United Spirits is keen on the new launches and sustainability as well as new digital transformation that make the company prepared for future prosperity.

This will further increase its disposable income where the sprits demand increases, and due to this, the United Spirits benefit.

Government legislation related to alcohol along with the taxation of alcohol is a threat to the prosperity of the business.

Company Details

- Est. Year: 1826

- Parent Company: Diageo Plc of UK

- Head Quarters: Bangalore, India

- Product Portfolio: Whiskey, Vodka, Rum, Brandy and Gin

More popular brands:

- McDowell’s No. 1

- Royal Challenge

- Johnnie Walker

- Black Dog

- Smirnoff

United Spirits Ltd is one of the leading Indian beverage companies in the market today. Founded more than nearly two centuries ago, the company has been consistently delivering innovative products of high quality and becoming the market leader.

Growth Drivers for United Spirits Share Price

- Diversified Portfolio: A diversified portfolio of strong premium and mass-market brands would ensure steady revenues.

- Digitalization: The company is using technology in the best possible way to optimize its supply chain efficiencies and customer engagements.

- Rural Expansion: More focus on rural markets to unlock unpenetrated demand.

- Sustainability Targets: United Spirits’ sustainability agenda aligns well with the sensibilities of an environmentally conscious customer.

Frequently Asked Questions For United Spirits Share Price

Q1: Is United Spirits a good long-term investment?

A. United Spirits: United Spirits is a very good long-term investing option as it holds leadership positions in the markets, has robust financials, and is witnessing growth in premium segments.

Q2: United Spirits will be closed at how much for 2030?

A. United Spirits is likely to close the year 2030 at ₹5,200, considering steady growth and a good market.

Q3: What is the risk element pertaining to United Spirits?

A: The risks include regulatory changes, high taxes on alcohol, and competition from domestic and international players.

Q4: How has United Spirits performed in the last one year?

A: The stock has witnessed a one-year appreciation of 7.30%, which is indicative of considerable confidence of the investors.

Q5: What is the promoter holding in United Spirits?

A: Promoter holding is at 56.67% with no significant change in the last quarters.

United Spirits Ltd will always be market leading within the Indian spirits market. Innovation and premiumisation plus sustainability will always help business grow in the long term; meanwhile, regulatory hurdles will forever linger ahead. Therefore, the United Spirits share appears promising and is likely to give good returns by reaching the United Spirits Share Price target of ₹5,200 in 2030. United Spirits appears to be a sound growth-oriented stable stock for an investor looking at stability along with growth in a portfolio diversification strategy.