MRPL Share Price Target From 2025 to 2030: Mangalore Refinery and Petrochemicals Limited has been at the heart of the energy and refining industry for centuries in India. Keeping this in mind, as investors and market enthusiasts trace its trends and performance for the future, it would be constructive to discuss performance metrics, financials, technical analysis, and future potential. So, this article is all about the share price target for MRPL from 2025 to 2030.

About the Company – MRPL

- In the Bag: 1988

- Headquartered: Mangalore, Karnataka, India

- Business Category: Oil Refining and Petrochemicals

- Parent Company: Oil and Natural Gas Corporation (ONGC)

Mangalore Refinery and Petrochemicals Limited is a public sector undertaking primarily working on crude oil refining and petroleum products. Value addition in refining is more at a higher capacity, and MRPL is allowed to sell with a well-balanced portfolio. It can cater to both domestic as well as international markets. The subsidiary factor of the ONGC gives more robust positioning in the energy sector.

MRPL Share Price Financial Highlights

- Market Cap: ₹23,423 Cr

- P/E Ratio (TTM): 27.08

- P/B Ratio: 1.90

- Debt to Equity Ratio: 1.10

- ROE (Return on Equity): 7.37%

- Dividend Yield: 2.36%

- Book Value: ₹70.22

- Face Value: 10

The number is correct, and one may like to monitor how the sustainability level of the company would be over energy in terms of MRPL. The decent yield and the holding of the promoter make it a good thing.

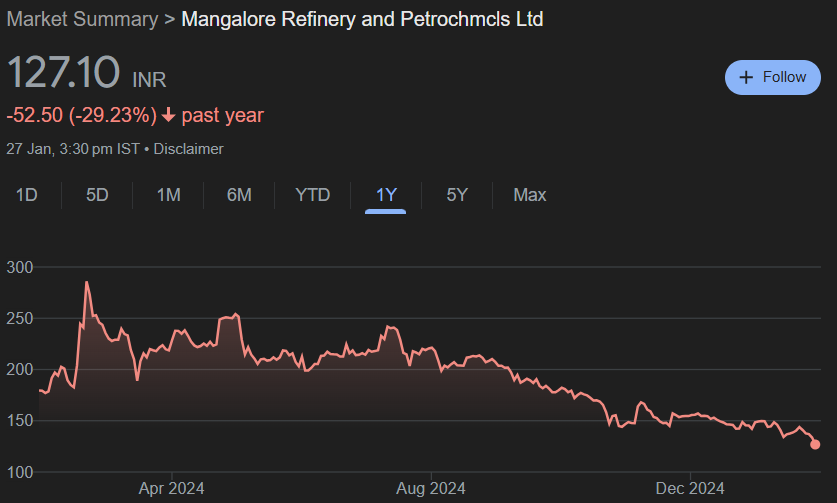

MRPL Share Price Movements for last Year

- Open: ₹131.96

- High: ₹131.96

- Low: ₹126.00

- 52 Week High: ₹289.25

- 52 Week Low: ₹126.00

- Last Close: ₹133.59

- Turnover: 18,82,719 shares

- Total Traded Value: ₹23.90 Cr

The stock of MRPL has been in a downtrend for the last one year with a decline of 29.23%. That might be due to market and industry-specific fluctuations. However, the long-term view is sound as it is a sensitive sector company.

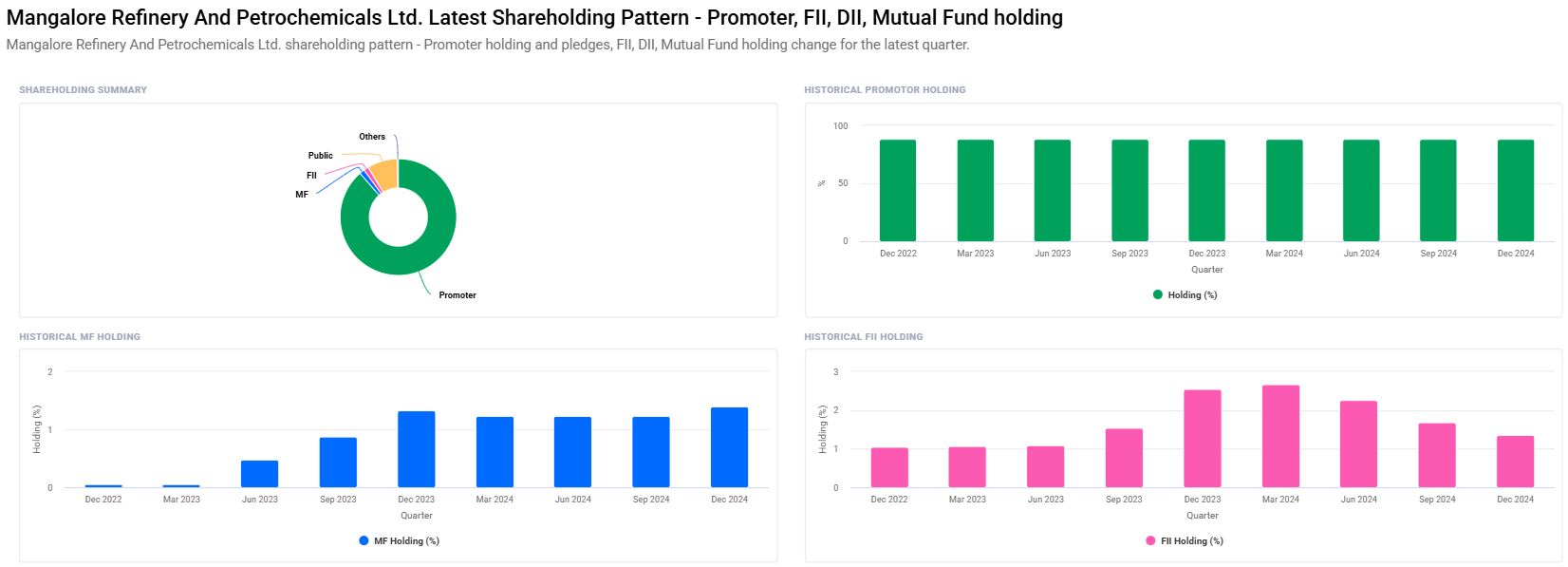

Shareholding Pattern of MRPL Share Price

- Promoters: 88.58%

- Retail and Others: 8.39%

- Mutual Funds: 1.40%

- Foreign Institutions: 1.36%

- Other Domestic Institutions: 0.27%

The holding of MRPL in the promoter is high and stable as well it is with institutional support. Mutual fund holding surprisingly has seen an up-tick in the recent quarters while showing confidence of institutional investors.

MRPL Share Price Day Trading Technical Analysis

- Momentum Score: 23.1 (Technically weak; below 35 indicates weakness)

- Day MACD: -4.0 (Strong bearish)

- Day RSI (14): 30.1 (Nearing over sold territory)

- Day ADX: 11.2 (Weak trend strength)

- Day ATR: 6.0 (Volatility)

- Day ROC (21): -12.7 (Mom is down)

- Day MFI: 66.4 (In the middle space)

Technical Charts currently indicates that MRPL stock is in its weakness phase. Yet, currently the signals are technically over-sold and this might be an inventory stock for long term investor.

MRPL Share Price Targets (2025-2030)

It is futuristic, going by the historical performance, funds used in the market, financial fundamentals, and market trends. Share price targets projected for MRPL as follows:

| YEAR | TARGET PRICE |

| 2025 | 300 |

| 2026 | 470 |

| 2027 | 640 |

| 2028 | 810 |

| 2029 | 980 |

| 2030 | 1150 |

Growth Potential Analysis For MRPL Share Price

- 2025: After the stabilization of crude oil prices along with a raised refinery capacity, the stock price will reach ₹300 by 2025.

- 2026: Higher petrochemical and renewable diversification of MRPL will force the petrochemical up energy demand globally; the stock price will touch ₹470.

- 2027: Along with higher efficiency, higher volumes of crude will then drive the stock to ₹640.

- 2028: Market share gains coupled with expansion plans are likely to drive the stock towards ₹810.

- 2029: Refining leadership along with exports will propel the stock to around ₹980.

- 2030: Investment in judicious mix of renewables and petrochemicals will be an interesting affair to push share price to Rs 1,150.

USPs of MRPL Share Price

- Promoters Support: The ONGC-subsidiary enjoys robust support in terms of finance and operational networks.

- Diversified Product Portfolio: From the crude refining and petrochemicals manufacturing end, MRPL serves so many markets.

- Location Advantage: Located on a coastal region ensures easy import as well as exports.

- Dividend Yield: In fact, stable dividend policy attracts long term investors.

Weaknesses Of MRPL Share Price

- Unpredictable Crude Prices: The profit margins are impacted by the volatile price of crude oil.

- Debt Levels: To be slightly high at 1.10 it is manageable.

- Global Energy Transition: This is a story of cost that the conventional role played by oil refiners has taken onto the shifting tob scenarios of renewable energy.

MRPL Share Price FAQs

Q1: Is MRPL investment long-term?

A1: Long term due to sound fundamentals, promoter support still and scope of further expansion thru refinement and petrochemicals; MRPL to factor in market risks and sector adversity.

Q2: Why MRPL share price is low in present times?

A2: Falling crude prices; technical and general market are weak.

Q3: What’s the dividend yield of MRPL?

A3: MRPL gives a dividend yield of 2.36% and gold for income-focused investors.

Q4: How is MRPL embracing the current trend of renewable resources?

A4: MRPL has picked up investment in the areas of projects for renewable energies, petrochemical diversifications, and others, which is a perfect match for global trends for energy.

Q5: P/E ratio for MRPL

A5: P/E ratio (TTM) is 27.08 and is absolutely fit into the competition under the industry line.

MRPL stands at that crossroads where challenges and opportunities abound. However, current performance depicts technical weakness but strategic positioning, promoter backing, and long-term growth prospects look good. Here’s the case for it will undoubtedly be pretty attractive to investors wishing to invest during 2025 to 2030 while the portfolios will incorporate MRPL since growth for this entity comes from evolution in the energy sector. Always research thoroughly or seek a financial advisor’s opinion before investing. If executed well, then MRPL might well form the foundation of an investment portfolio that’s diversified in nature.