Tata Consumer Share Price Target From 2025 to 2030: Tata Consumer Products Limited is one of the most credible FMCG firms in India. The company has validated its capabilities by riding market dynamics and delivering value to stakeholders. It has a robust portfolio in beverages and food products besides a growing global footprint. Investors and analysts are keenly watching how this stock is ready for future growth. Let’s take a deep review of Tata Consumer share price target for the period 2025 to 2030 along with its financial performance, technical insights, and investment potential.

Company Overview

Tata Consumer Products Limited is the consumer products arm of one of the most branded conglomerates in the world, that is, Tata Group. The group portfolio comprises tea, coffee, salt, packaged water, pulses, spices, and ready-to-eat snacks. TCPL has now become the household name throughout the country. The company lists some of its key brands such as Tata Tea, Tata Salt, and Tetley at the pinnacle of their market.

- Market Coverage: More than 40 countries

- International Brands: Tata Tea, Tetley, Eight O’Clock Coffee, and Himalayan Water

- Sustainability: Sustainability in sourcing and community well-being remains the same.

- Innovation: New product lines-plant-based protein and ready-to-drink beverages are its innovations.

Tata Consumer Share Price Performance Summary

- Current Price: ₹989.05 (Open)

- 52-week High: ₹1,253.69

- 52-week Low: ₹882.90

- Market Cap.: ₹95,620 Cr

- P/E Ratio: 81.14

- Dividend Yield: 0.79%

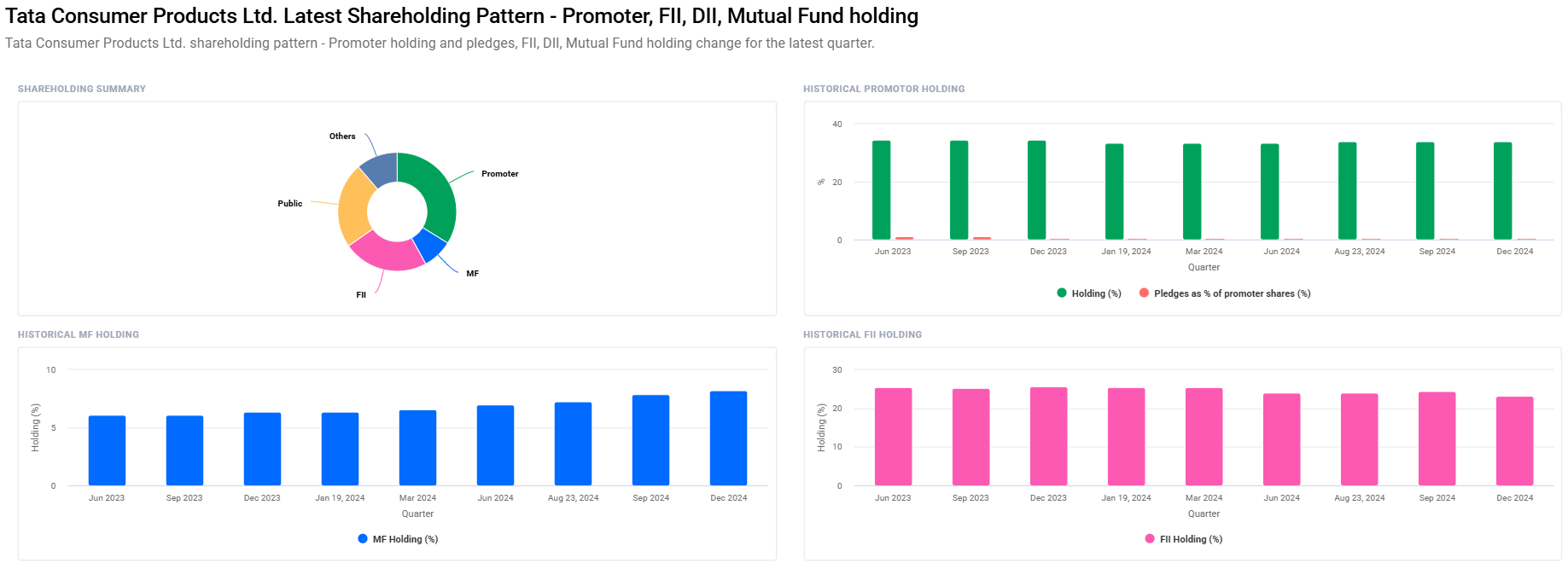

Shareholding Pattern For Tata Consumer Share Price

- Promoter: 33.84%

- Retail & Others: 23.46%

- FII: 23.23%

- MF: 8.20%

Institutional Holding Trend Analysis For Tata Consumer Share Price

- The FII holding has dipped 24.35% to 23.23%.

- Mutual fund has strengthened their positions at 7.89% levels to 8.20%.

Tata Consumer Share Price Target for the Year: 2025-2030

The share price targets of trends and industry estimates of the company rely on its growth policy.

Some of which follows .

Year Share Price Target (₹)

2025 1,300

2026 1,660

2027 2,020

2028 2,380

2029 2,740

2030 3,100

Growth Drivers For Tata Consumer Share Price

- International Markets: International markets with the new product development that caters to different kind of demographics.

Health and wellness products like green tea, herbal infusions, low-sodium salt are in more demand at a higher level. - Focus On Health And Wellness: E-commerce and digitization: More online channels arising, which will reach directly to the end customer

- Environmental initiatives: This year onwards will be adding higher value toward the sustainable initiatives too at a global level

Investment Analysis For Tata Consumer Share Price

- P/E ratio (TTM): 85.35- It’s an absolutely pricy stock and a growth rate has to come from equity side.

- Debt/ Equity: 0.15 – The leverage is incredibly low, which portrays a very balanced book.

- ROE : 7.20%.

- Book Value: ₹193.36.

Fundamentals look fairly healthy as well, as with significant scope for higher growth due to its debt very low and it has done correct investment into emergent categories,

Technical Analysis For Tata Consumer Share Price

Momentum and Indicators

- RSI (14): 53.7 Neutral- not overbought neither over-sold.

- MFI: 51.1 Neutral Zone

- MACD: Positive trend – the momentum of a Bull

Volatility Metrics

- ATR Average True Range: 23.6 average price movement.

- ADX Directional Movement Index: 19.7 Neutral Trend.

There seems to be stabilization in the stock of Tata Consumer, at least on these indicators right now. It is quite likely to breakout up in the medium to long term period.

Growth Driving Factors

With the increase in the middle-class population throughout the nation, TCPL would open both rural and urban markets as a benefit to TCPL because the disposable income would increase.

- Portfolio diversification: In any premium or value-added product category, positive revenue would come through and be amortized over time.

- Cost Management: The margins would increase with efficiencies in operations and cost optimization.

- International Markets: Continuous focus on international markets will surely lead to revenue diversification.

Analyst Recommendations For Tata Consumer Share Price

From the consolidated data of 25 analysts,

- Buy: 84%

- Hold: 12%

- Sell: 4%

This is a very persuading positive view as it depicts that the investors will be having a smooth returns.

FAQ Section For Tata Consumer Share Price

1. Is Tata Consumer a Good long-term investment stock?

Tata Consumer is a fundamentally sound company with diversified portfolios, minimum debts, and influence of globalization. Its expansion strategy coupled with sustainability makes it a very attractive investment for a long term.

2. Risk of Tata Consumer Shares:

There are a few risks associated with the Tata Consumer shares.

The major risks associated with this are raw material volatility in terms of tea and coffee, currency exchange risk, and also the regulatory hurdles that may occur in international markets.

3. What is the reason behind a high P/E for Tata Consumer?

A high P/E reflects the positivity of the market towards the growth prospect of the company in the future, and also its expansion plans and initiatives.

4. Tata Consumer in the prism of competition :

The company’s strengths are many-one rich portfolio of brands, international outreach, and gradual innovation. Nonetheless, there remain areas where this entity competes against other monoliths- Hindustan Unilever and Nestle.

Tata Consumer Products Limited has been among the better performers in the FMCG space; support arises from its franchise portfolio, diversification of the portfolio, and new product development policies. The firm has a healthy growth perspective with defined sustainability initiatives that will help it to deliver value for shareholders.

As long as it holds over ₹3,100 in 2030, Tata Consumer would likely push up the share price gradually. Any short-term movements in the market might occur; however, its fundamentals and the growth trajectory it is on provide for an excellent long-term investment opportunity.