Sakuma Exports Share Price Target From 2025 to 2030: Sakuma Exports Ltd. is one of the established companies in business with special focus on agro-based products mainly for exporting purposes, especially for food and other crops. Even if the share market has seen considerable fluctuations over time, the outlook of the export industry in a company and this particular strategic outlook of the business enterprise is interesting for many investors.

Although the finer detailed forward and future time scale for 2025 through 2030 for the Sakuma Exports Share Price, within the framework of Sakuma Exports, apart from all that is portrayed in terms of pre-defined criteria set for financial criteria in relationship to company fundamentals as well as analytical tools relating to judging the performance of a stock based on parameters such as technical studies and predictive analysis that guide one in terms of their investment as a wiser one.

Key findings of the organization:

Sakuma Exports exports an extensive range of commodities. Some of those consist of processed fruits and vegetables along with other food products. Export has been a matter of great concern as it started with the onset of globalization, the increasing demand for organic and natural products, and open access to the markets of continents. Sakuma Exports has gained a stranglehold on both the local as well as global markets and is continuously expanding its scope.

Company Basics For Sakuma Exports Share Price

- Market Capitalization: 559.68 Crores INR

- P/E Ratio: 11.30

- Dividend Yield: 0.28%

- 52-Week High: ₹10.30

- 52-Week Low: ₹3.39

- Debt to Equity Ratio: 0.07

- ROE: 5.65%

- Book Value: ₹4.45

- Face Value: ₹1

The debt-equity is low, which means that the company does not rely heavily on borrowings. The P/E ratio is much lower at 11.30 compared to the industry P/E of 37.53. It is more attractive to investors seeking undervalued stocks which can eventually move up.

Sakuma Exports Share Price Performance

Sakuma Exports is in a kind of volatility in the short-term period and one can attempt to do the short-term forecasts on more sure shot ground of its day to day trading and technical signals.

Details For Sakuma Exports Share Price

- Opening Price: ₹3.51

- Previous Closing Price: ₹3.51

- Number of Trades in Total Volume: 6,84,534

Depth For Sakuma Exports Share Price

- Order Quantity Buy: 86.01%

- Order Quantity Sell: 13.99%

- Upper Circuit Limit: ₹3.68

- Lower Circuit Limit: ₹3.33

Technical Analysis For Sakuma Exports Share Price

Technical view regarding Sakuma Exports Ltd. is that it’s going in a bearish trend. Some weakness and bad performance signs from this stock are reflected for the short term. Let’s see one by one now.

- Momentum Score: 25.5- This score tells us that the stock is technically weak because it stays in the bottom 30% of the market.

- MACD (12, 26, 9): -0.1 Negative MACD below the signal and center line shows a high degree of bearishness.

- ADX (Average Directional Index): 30.4 ADX above 20 reflects that there is a strong trend; however, this must be observed in the direction.

- RSI (Relative Strength Index): 36.0 The RSI being below 30 suggests that the stock is getting near the oversold stage, which would reflect a future rebound.

- MFI (Money Flow Index): 45.2 Below 50; it gives an impression of selling pressure being stronger than the buying pressure.

- ATR (Average True Range): 0.2 Low Volatility

- ROC (Rate of Change) (125 days): -42.4 It is a very large negative number as the stock keeps on moving straight down for the last few periods.

Sakuma Exports Share Price Target From 2025-2030

Even though at present, the stock may have some strong short-term positions, in the long term, and with more or less further expansion of an export market along with operational optimums, then Sakuma Exports may show signs of better development. With respect to market drifts and company performance, hence its price target in the subsequent few years would be through:

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹11 |

| 2026 | ₹20 |

| 2027 | ₹29 |

| 2028 | ₹38 |

| 2029 | ₹47 |

| 2030 | ₹56 |

These Sakuma Exports Share Price target depicts that this can surge with improvement in the company’s financial health along with broadening market. When it grows up to 2030, appreciable appreciation of stock will be witnessed because the company will continue its execution towards achieving success in its strategic plans.

Sakuma Exports Share Price

- Financials: Sakuma Exports is essentially underpriced against the industry’s peers revealed through the relatively lower P/E ratio. This company maintained an excellent balance sheet with minor debts and hence stands better in being resistant to this uncertain economic condition. Return on equity also depicts the profitability but should improve for better performance.

- Technical indicators: In this regard, Sakuma Exports portrays very poor short-term signs. This stock requires cautious investors for short horizons of time but indicates broader selling scenarios through both RSI and MFI, and appears to depict some buying room at decline provided one is in sync with its direction.

- Market Trend: The exports market will continue to gain momentum. Again, most of these benefits will come through agro-based items, which include processed food products, organic goods, and still-emerging market segments. With the increased capacity reflecting these changes, Sakuma Exports will benefit enormously from all these macro-trends.

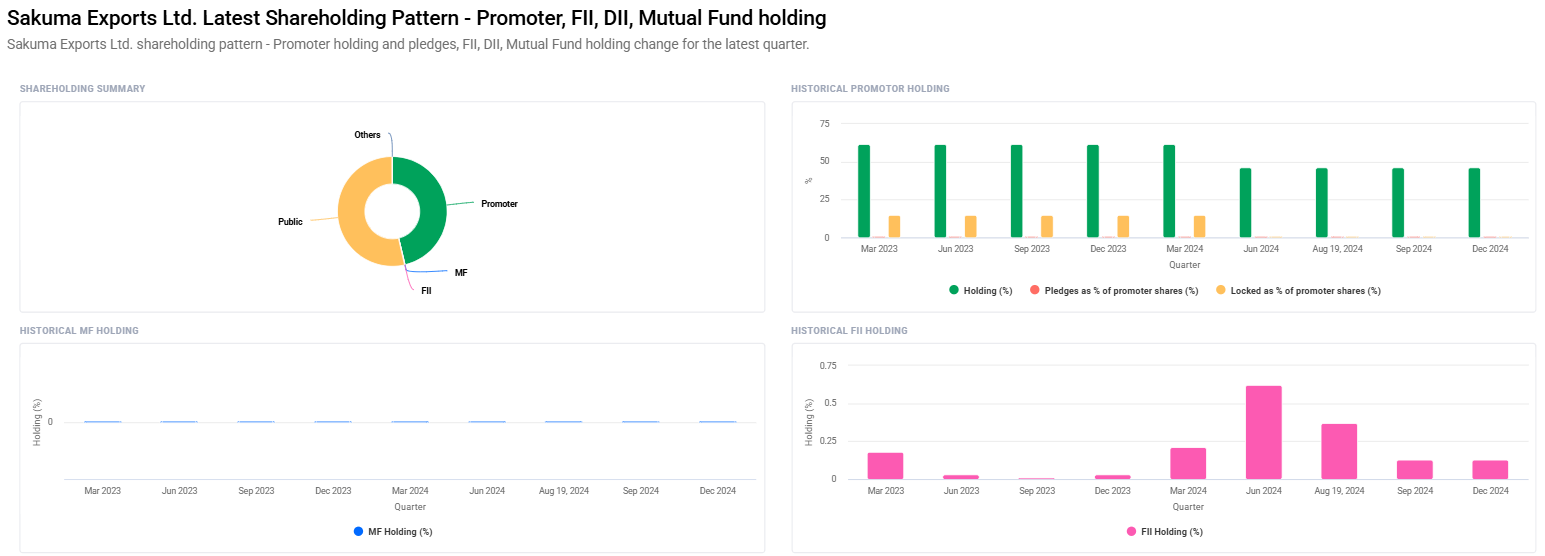

- Promoter and Institutional Holding: The promoters hold 46.29% and have an ownership level stable, with a negligible amount of foreign institutional investment. That means that it is an essentially a home game and such directions to companies would have given stable ones.

FAQs For Sakuma Exports Share Price

1. What is the current market capitalization of Sakuma Exports?

At the date on which the latest published figures are available, Sakuma Exports Inc. has a market capitalisation of ₹559.68 Crores INR.

2. What is the P/E of Sakuma Exports Ltd.?

The P/E of Sakuma Exports Ltd. stands at 11.30. That would make the stock rather undervalued when compared with the industry average.

3. What are the 52-week high and low for Sakuma Exports shares?

52-week high stands at ₹10.30 and 52-week low stands at ₹3.39. The company shares have seen a lot of volatility in the last one year.

4. Sakuma Exports Share Price in 2030?

According to the current trend and market study based on the trend, the Sakuma Exports Share Price by the end of 2030 will be around ₹56 .

5. Shall I invest in Sakuma Exports stocks in the short run?

The short run technical indications are bearish. Investor needs to be vigilant. The view in prospects looks better for long-term consideration.

6. Which are the technically provided indications of the stock of Sakuma Exports?

From the technical side, MACD, RSI, and ROC say that the stock possesses weak momentum and is falling with a negative trend in short run.

7. What yield does the dividend provide for Sakuma Exports?

That puts the dividend yield of the company at 0.28%, however, for the firm’s ability to make returns of profit to its respective shareholders at the ridiculously low rate.

Sakuma Exports Company is strength with the export but short term will be weak since found from technical results using stock prices. An investor has to observe the stock movement very closely and watch the long run growth of Sakuma Exports Share Price since there will be growth till 2030 from 2025. A current weak stock is expected to look forward positively in the long run if it manages to keep on functionally and effectively continue to execute its growth plan.