Motisons Jewellers Share Price Target From 2025 to 2030: It may well become possible for that name to stick with the gold, diamond, and silver jewelry business with Motisons Jewellers Ltd, who, during the course of years, inculcated market presence over trust along with superior craftsmanship therefore giving a fine reputation of coming up new designs to accommodate all the wishes and tastes, considering the fact that Motisons Jeweller Ltd is one of those outfit headquartered at Jaipur and thus has stretched their shops all along India primarily treating as destinations in premium jewelry purchasing.

It has also witnessed its growth curve attract huge investor interest and, hence, it is a very significant player in the Indian stock market.

Current Financial and Technical Analysis For Motisons Jewellers Share Price

- Open: ₹20.90

- High: ₹21.59

- Low: ₹20.75

- Market Capitalization: ₹2,030 Cr

- P/E Ratio (TTM): 52.87

- Debt to Equity Ratio: 0.26

- ROE: 11.11%

- EPS (TTM): ₹0.39

- Book Value: ₹3.50

- Dividend Yield: 0.00%

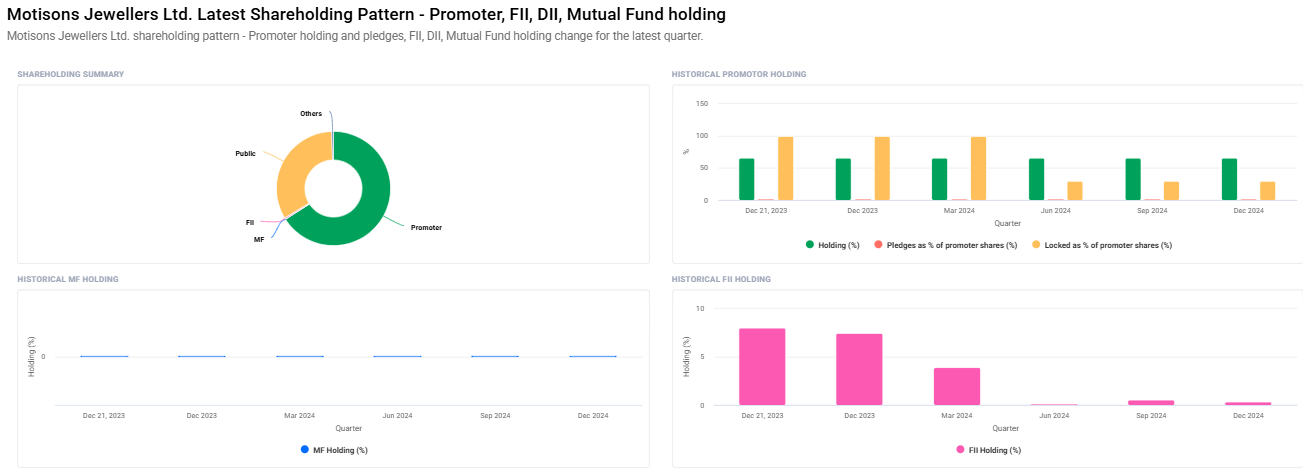

Ownership Structure For Motisons Jewellers Share Price

- Promoters: 66.00%

- Retail and Others: 33.15%

- Other Domestic Institutions: 0.48%

- Foreign Institutions: 0.37%

Key Market Indicators For Motisons Jewellers Share Price

- 52-Week High: ₹33.80

- 52-Week Low: ₹12.70

- Volume: 9,92,849

- Total Traded Value: ₹2.14 Cr

- Upper Circuit: ₹21.59

- Lower Circuit: ₹19.54

Technical View For Motisons Jewellers Share Price

- Day MACD (12, 26, 9): -1.6 (Bullish)

- Day ADX: 29.1 (Neutral)

- Day RSI (14): 21.5 Over-sold; rebounding in the near term

- Day MFI: 7.9 Strongly over-sold

- Day ATR: 1.27

- Day ROC (125): 32.0 Strong bullish momentum

Motisons Jewellers Share Price Forecast between 2025 and 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹35 |

| 2026 | ₹55 |

| 2027 | ₹75 |

| 2028 | ₹95 |

| 2029 | ₹115 |

| 2030 | ₹135 |

2025: Motisons Jewellers Share Price Target ₹35

Motisons Jewellers would rise mildly in 2025 with the uptrends in the demand of gold and diamond jewelry. Marketing plans and the opportunity of venturing into newer markets would increase chances of better performance.

2026: Motisons Jewellers Share Price Target ₹55

Economic readjustment in 2026 would create space for a revival of the jewelry market for the company. Simultaneous reduction of investor pressures, coupled with an affirmative market, would further increase buoyancy in the stock, to end up in an upward trajectory.

2027: Motisons Jewellers Share Price Target ₹75

The market prospects for the company, in regard to locomotives, will see an upward spiral due to the addition of new product lines and strategic partnerships. A rising customer base with increased levels of operational efficiency will make the company benefit greatly through great appreciation of its stocks.

2028: Motisons Jewellers Share Price Target ₹95

The Move with the stronger market position will help Motisons Jewellers reach more grounds. Perhapse the pursuance of innovation along with the customer engagement strategy would be the positive factor in this rise.

2029: Motisons Jewellers Share Price Target ₹115

The company adherence to excellence in design and construction along with the growth of the economic streams will bring good financial performance along with an upward movement in the share price.

2030: Motisons Jewellers Share Price Target ₹135

Motisons Jewellers would grab the jewelry market by 2030 with healthy finances and faithful customers. The shares would go sky-high because the long-term performance of the company is realized.

Determinants of Motisons Jewellers Share Price Appreciation

- Growth Strategy: Aggressive growth strategies would unlock new sources of revenue.

- Product Differentiation: The new designs with a look that resembles modernity would attract the changing consumer preferences.

- Market Trends: The increasing prices of gold and investment-grade jewelry demand.

- Operational Efficiency: Cost control and supply chain management would be better.

- Technological Linkage: Latest available technology will be used while designing and manufacturing.

Risks and Challenges For Motisons Jewellers Share Price

- Market Fluctuation: The fluctuation in gold price would make profitability vary

- Economic Condition: A bad economic condition will alter customer spending.

- Competition: The jewellery industry also operates in a very competitive market

- Policy Change: Any change in government policy will hinder proper running of the company.

Frequently Asked Questions (FAQs) For Motisons Jewellers Share Price

1. What is the market capitalization of Motisons Jewellers at present?

Market Capitalization is at around ₹2,030 Cr.

2. What is the P/E ratio of Motisons Jewellers?

P/E ratio (TTM) is 52.87

3. What are the promoter holdings in Motisons Jewellers?

Promoter holding is 66.00 %.

4. What is the Motisons Jewellers Share Price target forecast for 2025?

Share price target for 2025 is seen at ₹35.

5. Why is RSI considered important in technical analysis?

R.S.I. Stands for Relative Strength Index. The above value may be used in determining whether the stock is over bought or sold. Motisons Jewellers R.S.I. Of 21.5 indicates the stock is oversold and comes back.

6. What is the level of long term growth left to Motisons Jewellers?

With respect to its current market position and innovative strategies being followed by it, Motisons Jewellers boasts of a massive long term growth potential along with the ever- increasing customer base of its.

Motions Jewellers Ltd. is one of the promising stock investments in Indian markets. Aggressive business strategy, market resilience, and innovative product offerings put the company on the trajectory for commensurate growth between the period of 2025 to 2030. Investors must always keep the focus on market trends, basic corporate fundamentals, and technical indicators while deciding their investment calls.