Azad Engineering Share Price Target From 2025 to 2030: The Company, Azad Engineering Ltd, has been primarily known as the head of precision engineering and manufacturing mainly for the aerospace, energy, and industrial sectors. A healthy growth curve and increasing confidence of investors helped attract much attention to the stock. As such, here’s an analysis of the target share prices from 2025 to 2030 of the company in comparison with prevailing market trends and technical indicators alongside company fundamentals.

Company Information

- Market Capital: ₹7,786 Crores

- P/E Ratio: 111.44 (TTM)

- Debt to Equity: 0.24

- Return on Equity (ROE): 10.23%

- EPS (TTM): ₹11.82

- Book Value: ₹115.52

Business Operations For Azad Engineering Share Price

Azad Engineering is utilized for precision parts and caters the high-value industry like

- Aerospace: Supplies to commercial and defense aircraft

- Energy: Producing the components of turbines and energy system

- Industrial Uses: Provides precision parts for heavy industries.

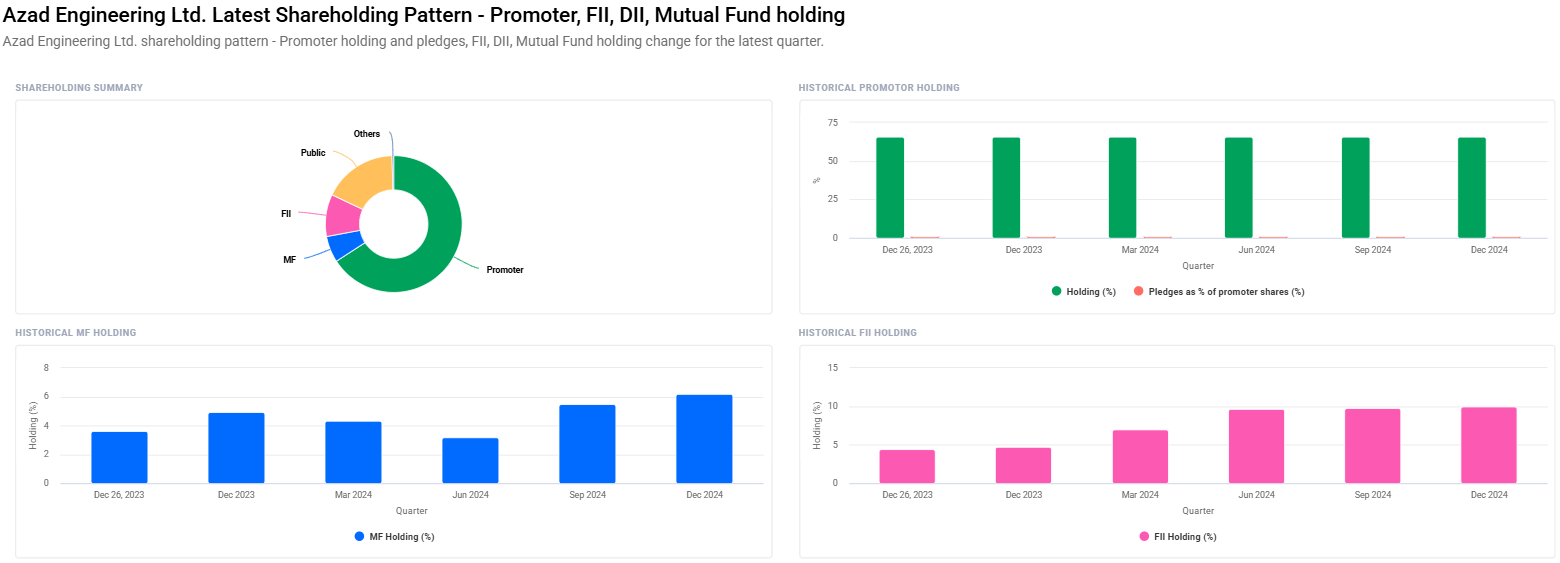

Promoter and Institutional Holding For Azad Engineering Share Price

- Promoter Holding: 65.90%

- Retail and Others: 17.56%

- Foreign Institutions: 9.98%

- Mutual Funds: 6.21%

- Other Domestic Institutions: 0.36%

Holding of institutional investors also turned northwards and hence their emotions towards Azad Engineering to turn out at better end.

Technical Analysis For Azad Engineering Share Price

- Momentum Score: 42.5 Neutral

- MACD: -70.2 bearish

- RSI (14): 26.2- Over-sold- ready for reversal

- ADX: 23.4- Average trend

- MFI: 28.8- Oversold

- ATR: 90.1 volatility indicator

Analysis For Azad Engineering Share Price

Technical Indicators are on the neutral to bearish side; however, conditions according to RSI and MFI suggest over sold. A bounce can happen at price. Share Price Predictions for Azad Engineering: 2025-2030

Year

Predicted Share Price (₹)

2025

2,100

2026

3,500

2027

4,900

2028

6,300

2029

7,700

2030

9,100

2025: Azad Engineering Share Price Target ₹2,100

The aerospace and energy segments are going to order higher in this company. Strategic diversification of the company in the newer market is going to take this stock to ₹2,100.

2026: Azad Engineering Share Price Target ₹3,500

Share value of Azad Engineering would go up at the compounded level to approximately ₹3,500, due to technological improvement and higher efficiency of operation.

2027: Azad Engineering Share Price Target ₹4,900

Market of this company would rise up to ₹4,900, as the customer demand would begin to rise, along with international expansion in markets.

2028: Azad Engineering Share Price Target ₹6,300

It was seen that this company was keeping at par the market levels of sustainable innovation, even remained better as its stock had to be bumped to ₹6,300 at this stage.

2029: Azad Engineering Share Price Target ₹7,700

During this year, Azad Engineering could prove out to be an engineering marvel the world would experience that the market would shoot its share to this ₹7,700 mark by then.

2030: Azad Engineering Share Price Target ₹9,100

Growth strategies to be implemented may take the share price to the touch of ₹9,100 and that may well reflect great investor sentiment coupled with business growth.

Growth Drivers for Azad Engineering Share Price

1. Growth Across International Markets: The market presence has been rising across global markets, which underlines growth.

2. Technological Competency: The latest manufacturing technologies have enabled the company to manufacture its components with extremely high precision.

3. Solid Financial Performance: Low debt complemented by continuous ROE is the witness to strong financial soundness.

4. Institutionalizing: Increasing mutual funds and FIIs are some of the points indicating rising levels of institutionalizing confidence.

5. Operational Competitiveness: The measures in terms of cost-cutting coupled with the operational efficiency would augment the margins

Risk and Challenge For Azad Engineering Share Price

1. Market Fluctuations: Normally, the price of stocks experiences a kind of trend under larger market volatility

2. Disturbance of Supply Chain: International supply chains are very hazardous to rely completely on.

3. Regulation Risks: Aerospace regulatory reforms and that of the industrial sector pose the threat of disturbance in normal running.

FAQs For Azad Engineering Share Price

1. What is the market capitalization of Azad Engineering as on today?

Market capitalization is approximately ₹7,786 Crores.

2. What is the P/E ratio of Azad Engineering?

The P/E ratio (TTM) is 111.44

3. Is Azad Engineering a good investment?

With the aspect of market strength, having technological advancement, and a growing institutional interest, Azad Engineering represents a very attractive stock to long-term investors.

4. What are the primary growth drivers for Azad Engineering?

Major growth drivers are strategic market expansion, technological innovation, increased institutional investment, and excellent financial performance.

5. What will be the share prices from 2025 through 2030?

Share prices are expected to be as follows

2025: ₹2,100

2026: ₹3,500

2027: ₹4,900

2028: ₹6,300

2029: ₹7,700

2030: ₹9,100

6. What are the Risks Involved in Azad Engineering?

Market volatility/ Supply chain disruption/Exposure to regulatory challenges

This of course does not rule out the bearish signs of short term in Azad Engineering Ltd., with a tremendous push towards growth. Implemented in a strategic way, technically driven growth to achieve long-term prospects would get the attention of those people who would like to bet on the precision engineering and manufacturing sector in making it an attractive prospect for investing where innovation, along with growth at a higher margin, would make it continue promising an investment trail higher by setting price targets in the share values up to 2025-2030.