Syrma SGS Share Price Target From 2025 to 2030: One of the major EMS companies in India is Sygma SGS Technology Ltd. Sygma SGS designs and manufactures wide ranges of various printed circuit board assemblies, RFID tags, as well as many electromagnetic components; besides, that company offers highly sophisticated electronic items. Sygma SGS has made high contributions to such fields as the industrial automation area, healthcare sectors, the car sector, as well as for consumer electronics up to now as well.

This company is working with good manufacturing capabilities, strategic investments in innovation and R&D, and with the best position it has taken regarding India’s fast-growing electronics manufacturing industry. The investors are watching this company’s financial performance and the cutting-edge technology that it has, and Syrma SGS is one stock to watch.

Syrma SGS Stock Performance Overview

- Open: INR 455.00

- High: INR 505.10

- Low: INR 443.85

- Market Cap: INR 8.99K Cr

- P/E Ratio: 85.21

- Dividend Yield: 0.30%

- 52-Week High: INR 647.10

- 52-Week Low: INR 376.35

Fundamentals of Syrma SGS Technology Ltd.

- Market Cap: ₹7,786 Cr

- P/E Ratio (TTM): 111.44

- P/B Ratio: 11.40

- Industry P/E: 70.40

- Debt to Equity: 0.24

- ROE: 10.23%

- EPS (TTM): 11.82

- Dividend Yield: 0.00%

- Book Value: 115.52

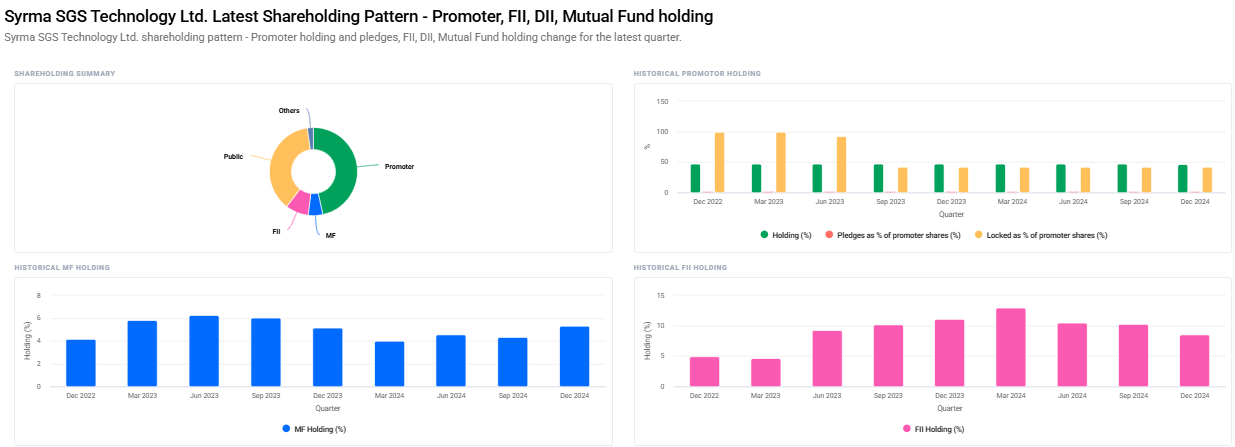

Shareholding Pattern of Syrma SGS Share Price

- Promoters : 46.58% decreased from 46.89%

- Retail and Others: 17.56%

- Foreign Institutions: 8.49% decreased from 10.32%

- Mutual Funds: 5.33% increased from 4.31%

- Other Domestic Institutions: 0.36%

Technical Analysis of Syrma SGS Share Price

- Day Momentum Score: 42.5 Neutral

- Day MACD (12, 26, 9): -70.2 Bearish

- Day ADX: 23.4 Neutral

- Day RSI (14): 26.2 (Oversold – potential bounce back)

- Day ROC (21): -20.6 Bearish

- Day MFI: 28.8 Oversold

- Day ATR: 90.1 Volatility High

- Day ROC (125): -18.9 Bearish

Syrma SGS Share Price till 2025 to 2030

2025: Syrma SGS Share Price Target INR 650

With enhanced manufacturing capabilities of this company, along with increased demand for electronic manufacturing services, this firm would log healthy growth. Improvement in government’s effort to manufacture from the region, which encourages manufacturing, is something that can elevate the stock up.

2026: Syrma SGS Share Price Target 950 INR

The partnership of Syrma SGS with the electronic giants in 2026 would enable the company to use its strength in the next years. The stock would have peaked after more investments in R&D and after advancements in technology.

2027: Syrma SGS Share Price Target INR 1,250

Although revenues might be multiplied a number of times and may provide a rich performance in stock due to consistent innovation and diversification of the emerging sector in the forms of Internet of Things and automotive electronics, it might not provide an impressive performance.

2028: Syrma SGS Share Price Target INR 1,550

This stock has an enhanced possibility to beat the market estimate as it begins consolidating in the world market. Expansive capabilities for manufacturing plants and some targeted acquisitions are most likely to create more confidence of investors in the future.

2029: Syrma SGS Share Price Target INR 1,850

As an electronics manufacturing company, Syrma SGS is expected to garner the advantage from long-term deals and stable growth in the international electronics market.

2030: Syrma SGS Share Price Target INR 2,150

By 2030, Syrma SGS will be one of the world’s largest EMS providers with diversified product portfolios and a large customer base. The share price will shoot sharply northward, rewarding long-term investors.

Factors Influencing The Syrma SGS Share Price

- Government Policies: Favorable policies on Make in India and electronics manufacturing will help Syrma SGS.

- Technological Advancement: Sustaining growth is based on technological progress, research, and development and innovation by Syrma SGS.

- Global Expansion: Going global through collaborations, mergers, acquisitions, or inorganic expansion.

- Sector in vogue: Increasing Internet of Things, Automotive Electronics and Industrial Automation segments.

- Performance Based on Revenue: Revenues are always increasing with good margin.

FAQ’s About Syrma SGS Share Price Target

1. Is it a good long-term investment opportunity?

As it has built sound and diversified products company, it is an excellent investment prospect for long-term investments.

2. What are the major risks involved in this type of investment in Syrma SGS?

The major risks involved in the investment in Syrma SGS will be market competition, disruption by technology, and dependence on governmental policies for manufacturing incentives.

3. Which factors resulted in the promoters holding decline?

Minor fall of the promoter holding is due to the strategic decision or stock restructurings.

4. What does this RSI reading say that is less than 30?

An RSI reading less than 30 states that the stock is over-sold, which reflects probable price recovery.

5. How Syrma SGS maintain their competitive edge?

Syrma SGS will be competitive in the market as they have thrust in the field of R&D, strategic tie-ups and capacity building for keeping a high market position in this very competitive business of electronics manufacturing.

6. How high Syrma SGS can the share price of Syrma SGS go in 2030?

The market trend and analysis will take it up to INR 2,150 by 2030.

Syruma SGS Technology Ltd has huge growth opportunities as it falls in the space of emerging electronics manufacturing companies. Long-term profits investors, anxiously looking at the attractive share prices against a strong set of fundamentals, technology advancements, and strategic positioning within the market can well invest in this stock for future investments as well, above unavoidable fluctuations within the market.