Aarti Industries Share Price Target From 2025 to 2030: Aarti Industries Limited is a front-line company in India in specialty chemicals and pharmaceuticals. It was built with innovation at the helm and giving the world the best chemical products. Through this, Aarti Industries took on diversified products and became committed to sustainability to be one of the big players in the market. Its businesses are scattered across industries such as agrochemicals, dyes, pigments, and pharmaceuticals.

Current Market Performance Summary

- Open: 466.90

- High: 467.85

- Low: 451.65

- Market Cap: 16.50K Cr

- P/E Ratio: 44.95

- Dividend Yield: 0.22%

- 52-Week High: 769.25

- 52-Week Low: 390.25

- Previous Close: 465.40

- Volume: 8,21,435

- Total Traded Value: 37.42 Cr

- Upper Circuit: 511.90

- Lower Circuit: 418.90

Fundamental Analysis For Aarti Industries Share Price

- Market Cap: 16,863 Cr

- ROE: 8.18%

- P/E Ratio (TTM): 45.96

- EPS (TTM): 10.12

- P/B Ratio: 3.10

- Dividend Yield: 0.21%

- Industry P/E: 47.51

- Book Value: 150.15

- Debt to Equity Ratio: 0.71

- Face Value: 5

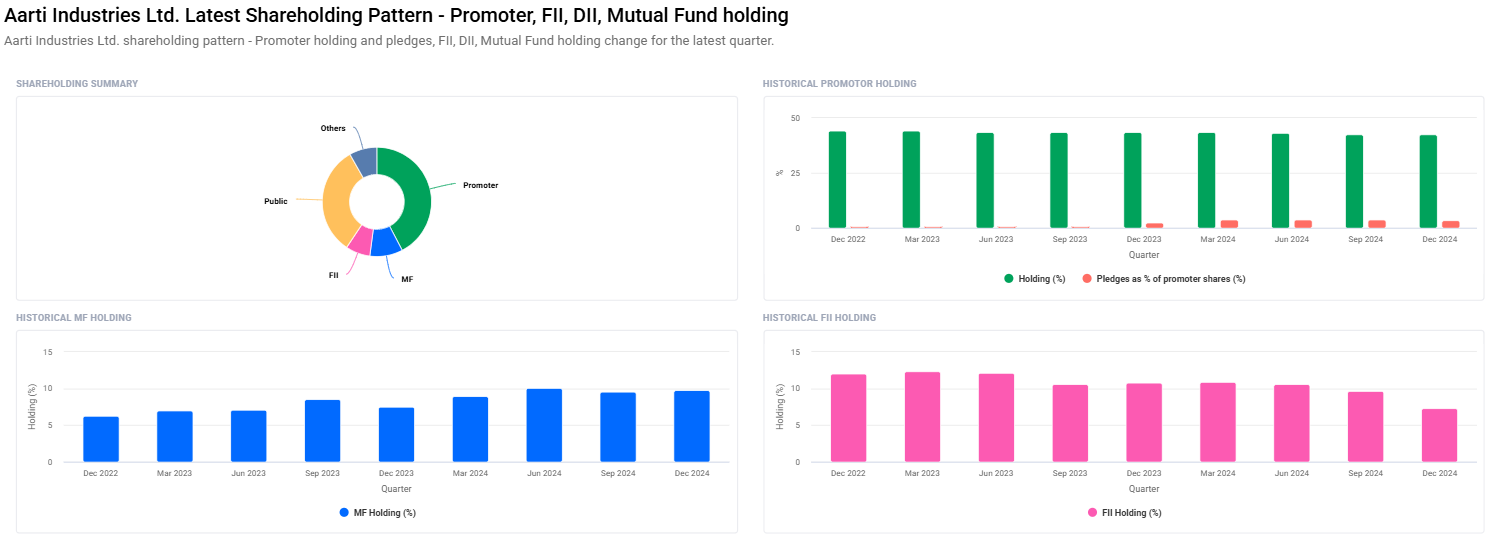

Promoter and Investor Holdings For Aarti Industries Share Price

- Promoters: 42.35% (Promoters have reduced holdings from 42.61%)

- Retail and Others: 32.47%

- Mutual Funds: 9.75% (increased from 9.53%)

- Other Domestic Institutions: 8.18%

- Foreign Institutions: 7.25% (Vs 9.68%)

- Promoter Pledge: 3.55% (Unpledged 0.30% shares)

- FII/FPI Investors: From 225 to 197

- MF Schemes: At the same number at 25

Technical Analysis For Aarti Industries Share Price

- Day Momentum Score: 47.5 (Technically neutral)

- Day MACD: 9.1 (Above center and signal line bullish indicator)

- Day ADX: 17.5

- Day RSI (14): 55.8 (Neutral since below 30 is over-sold and above 70 is over-bought)

- Day MFI: 59.3 (Neutral)

- Day ATR: 16.7

- Day ROC (21): 11.3

- Day ROC (125): -26.7

Aarti Industries Share Price Target for the year 2025 – 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹800 |

| 2026 | ₹1200 |

| 02027 | ₹1600 |

| 2028 | ₹2000 |

| 2029 | ₹2400 |

| 2030 | ₹2800 |

2025: Aarti Industries Share Price Target INR 800

For the same justification, because the company plans to expand specialty chemicals business line and has delivered investments on sustainable manufacturing procedures

2026: Aarti Industries Share Price Target INR 1200

It is going to do with an improvement in demand by the international market for the specialty chemical as well as operational efficiency.

2027: Aarti Industries Share Price Target INR 1600

The drivers that would move the valuation at international market fronts would be geographical expansion along with strategic partnership bases.

2028: Aarti Industries Share Price Target INR 2000

Pharmaceuticals segment would add huge margins too. Chemical products are in line with innovation and growth, hence potential.

2029: Aarti Industries Share Price Target INR 2400

Strong market positioning along with diversified product line of Aarti Industries will push the target on to its neck.

2030: Aarti Industries Share Price Target INR 2800

All strategic plays could add up with market support that brings Aarti Industries to this level.

Critical Aarti Industries Share Price Growth Drivers

- Operational Scale-Up: R&D and infrastructural development would be a capital-intensive investment boosting the production capacity.

- Environmental Sustainability: Sustainability will be ahead of competition.

- Global Demand: There is a rising demand for specialty chemicals and pharmaceutical ingredients.

- Strategic Alliances: International footprint expansion and customer base.

- Financial Stability: It is well-built with strong fundamentals and healthy debt management practices.

Risks and Challenges For Aarti Industries Share Price

- Regulatory Compliance: Higher environmental and industrial regulatory policies are in place.

- Market Volatility: Fluctuations in the prices of raw materials have an impact on profitability.

- Geopolitical Factors: Trade policies and the global economic scenario keep changing.

- Competition: The competition is intense at the domestic as well as the international level.

FAQs For Aarti Industries Share Price

1. Is Aarti Industries a good stock for long-term investment?

Aarti Industries is a long term investment. It has very strong presence in specialty chemicals and pharmaceuticals. Market trends as well as performances of the company should be closely watched.

2. What are the growth drivers for Aarti Industries?

Some of the significant growth drivers would be operational expansions, increased demand for specialty chemicals globally, investment in R&D, and strategic international partnerships.

3. Risks to be watched out for Aarti Industries Share Price?

These are regulatory changes, raw material price fluctuations, and geopolitical risks for which the investors need to be on notice.

4. What has been the change in promoter holding recently?

The promoters have decreased their holding from 42.61% to 42.35% and freed up 0.30% of shares.

5. What is the future prospect for Aarti Industries?

With strategic initiatives and global expansion plans, Aarti Industries will be viewed in steady growth and thus it may be a highly rewarding investment.

6. Why has FII/FPI holding declined lately?

FII/ FPI holding declined due to market correction and rebalancing of portfolios.

7. What is the debt-to-equity ratio of Aarti Industries?

The debt-to-equity ratio of Aarti Industries is 0.71. This means the company has been guided by proper strategy in the terms of leveraging.

With diversified portfolios and strategic growth plans, Aarti Industries is more than well-prepared to realize the potential in higher share price appreciation by 2030. However, with proper due diligence, investors must not hesitate to hire financial advisors for guidance prior to making a financial investment decision.