ABB India Share Price Target From 2025 to 2030: ABB India Limited is a subsidiary of the world leader in the power and automation technology business, the ABB Group. The company offers innovative solutions and industries in robotics, motion, electrification, and automation that can significantly contribute to the industrial growth of India. With strong product lines and robust financials, ABB India is an investment favorite among several investors who are looking for an entry into the industrial automation space.

This article predicts the ABB India share price between 2025 and 2030. Technical analysis, market trends, and investor sentiments have been used for the forecasting process.

Company Information

- Market Capitalization: ₹1.21 Lakh Crores

- P/E Ratio: 72.00

- Dividend Yield: 0.42%

- 52-Week High: ₹9,149.95

- 52-Week Low: ₹4,340.30

- Debt to Equity Ratio: 0.01

- Return on Equity (ROE): 25.30%

- Promoter Holding: 75.00%

ABB India is one of those companies that is marked with most technological advancements and sustainable solutions. This company was debt light in its structure and had consistent operating efficiency, thus becoming the investment favorite for institutional as well as retail investors.

ABB India Day Technical Analysis

- Day Momentum Score: 28.1 (Technical weakness)

- MACD: -242.3 (Below signal and center line A bearish indicator)

- ADX: 37.7 (Suggests moderate trend strength)

- RSI (14): 35.9 (Hovers around oversold region)

- MFI: 37.6 (Neutral zone)

- ATR: 204.9 (Market fluctuations reflected)

Fundamental strength For ABB India Share Price

Long term prospects are in good health. Therefore, so will such stability bring enough strength for such sustainability of investor confidence.

ABB India Share Price 2025-2030 Forecasting

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹9200 |

| 2026 | ₹14200 |

| 2027 | ₹19200 |

| 2028 | ₹24200 |

| 2029 | ₹29500 |

| 2030 | ₹34800 |

2025: ABB India Share Price Target Rs 9,200

Which will be driven by:

A well-established sectoral growth with persistent requirements of automation solutions

Tech successions and green-energy product line and other such robotics products besides expanding its product portfolio

2026: ABB India Share Price Target ₹14,200

What will energize them first:

- Launches of new products

- New alliances formations

- Solar energy and electrification projects gain momentum

2027: ABB India Share Price Target ₹19,200

Parked:

- Policies give thrust to industrial automation

- Boost in emphasis on AI-based manufacturing solutions

2028: ABB India Share Price Target ₹24,200

- Ever-increasing demand for smart grid and IoT solutions

- Exports and international market shares increase

2029: ABB India Share Price Target ₹29,500

- Strong operating performance through high-margin businesses.

- Notable market leadership in renewable energy technology

2030: ABB India Share Price Target ₹34,800

- Sustained innovation and industrial automation leadership

- Energy efficiency solutions are in high demand

Fundamentals Analysis For ABB India Share Price

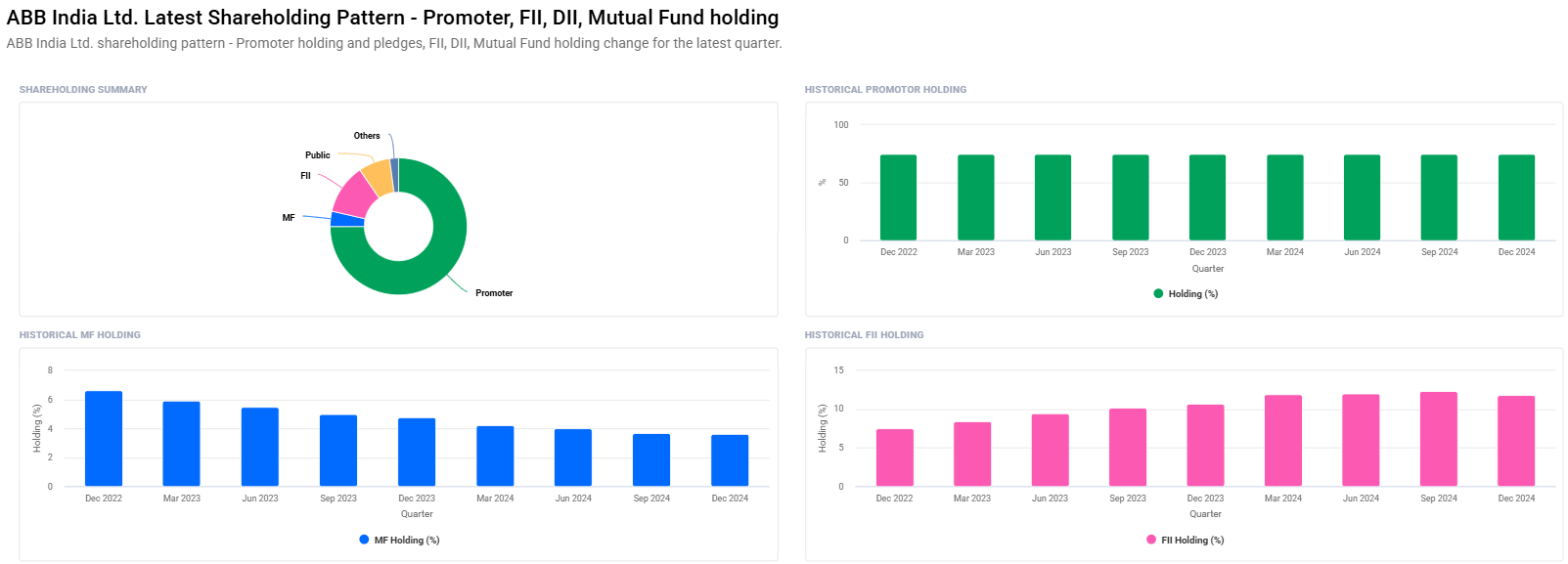

- Promoter Holding: At 75%.

- FII Holding: Had dropped to 11.85%. Foreign investors seem risk-averse.

- Mutual Fund Investments: Had dipped marginally to 3.62% though the number of mutual fund schemes had risen from 31 to 32.

- Debt-to-Equity Ratio: Highly low at 0.01, hence debt insignificant.

- ROE: At 25.30%, return on equity is healthy, which means the capital is being used in a very efficient manner.

Market Trends and Investor Sentiment For ABB India Share Price

- Technological Innovation: ABB India leads the pack in automation and AI-based solutions.

- Sustainability: Sustainable and renewable energy projects are of focus.

- Government Initiatives: The government supports initiatives of smart manufacturing and energy efficiency policies. All of these trends turn in favor of long-term performance of the stock of ABB India.

FAQs For ABB India Share Price

Q1: Is ABB India a good long-term investment option?

A: Yes, ABB India is one of the safest long term investment options because of its leadership position in automation and sustainable technologies with a low debt structure.

Q2: What will drive ABB India growth from 2025 onwards until 2030?

A: Technology, strategic partnerships, increased energy efficient solution and pro-government policies

Q3: An estimate value for the ABB India share price in 2025?

A: ABB India Share Price in 2025: about ₹9,200.

Q4: What does low debt-to-equity ratio help the investors in?

A: Low debt-to-equity ratio depicts stability and judicious management of debt, lower financial risk, and value with good equity.

Q5: Why FII declined recently?

A: Short-term volatility in the market and risk aversion among foreign investors.

Q6: What does it imply when ABB India had high ROE?

A: An ROE of 25.30% may mean that equity capital is optimally used to generate the returns which are a healthy sign from an investor’s end.

Q7: Risks involved in investing in ABB India

Market volatility, the slow pace of the world’s economy, and other competition through different automation solutions.

ABB India has a good base and is the leader in the technological innovation space. Such factors give very good growth prospects and, therefore, long-term investment value. Although its short-term technical indicators have turned weak, still the strategic initiative of the company and its position as market leader would work towards future growth and performance. An investor needs to monitor market trends and financial performances for appropriate judgment.