Adani Enterprises Share Price Target From 2025 to 2030: AEL is the flagship company of the Adani Group, one of the largest multinational conglomerates from India. In 1988, AEL emerged as a commodity trading company. However, in the recent years, it diversified itself as a multi-faceted player in diverse areas including mining, renewable energy, airports, and infrastructure development. Today, these areas make it a prime part of the growth story in India.

This is completely a new and innovative driver for the infrastructure development process, and hence, the long-term investor would highly prefer this. Its potential growth can be further supported through adaptability in new markets, portfolio expansion concerning renewable energy, green hydrogen, as well as integrated resource management.

Current Financial Metrics of Adani Enterprises Share Price

Let’s glance at the financial and operational metrics of the company before hitting the share price targets:

- Current Share Price: ₹2,382.00

- Market Cap: ₹2,56,672 Cr

- P/E Ratio (TTM): 46.37

- Industry P/E: 39.93

- Debt-to-Equity Ratio: 1.92

- ROE: 13.21%

- EPS (TTM): ₹47.96

- Book Value: ₹399.38

- Dividend Yield: 0.06%

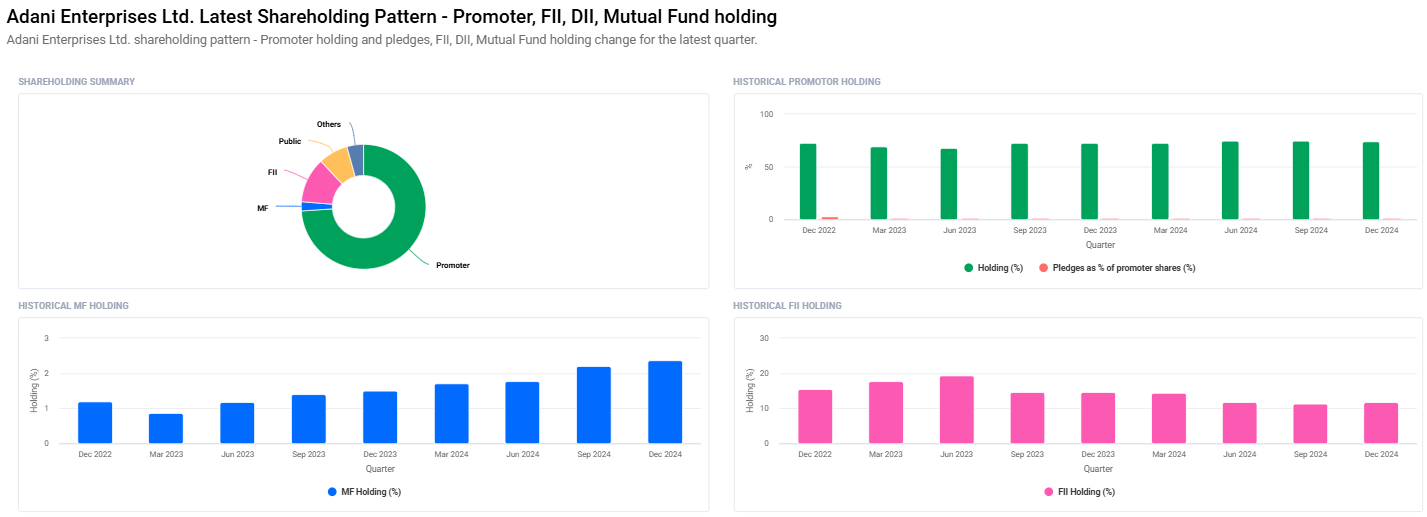

- Promoters’ Shareholding: 73.97% that is pledged holding 0.90%

Performance and Trends at Adani Enterprises Share Price Levels

The share prices of the company have been fluctuating erratically in the last two years due to market trends and other external influences. Two-year price movements are as follows:

- 52 Week High: ₹3,743.90

- 52 Week Low: ₹2,025.00

- Yearly Performance: ₹2,382.00 (-22.90%)

Reduction in the share price of Adani provides an excellent investment opportunity to the long-term investor who intends to benefit from infrastructure and focus on renewable energy of Adani. The volatilities may have been tremendous but the overall business fundamentals have not been deterred because the group has various diversifications with good strategic activities.

Adani Enterprises Share Price Forecast 2025-2030

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹4000 |

| 2026 | ₹5800 |

| 2027 | ₹7600 |

| 2028 | ₹9400 |

| 2029 | ₹11200 |

| 2030 | ₹13000 |

2025: Adani Enterprises Share Price Target ₹4000

It will enter into a stabilization phase in a lower range with uncertainty in the global economy and regulatory scorching heat. It would be the consolidation year for the company that would prepare itself for growth.

2026: Adani Enterprises Share Price Target ₹5800

Revenue growth would be slow but steady with the green energy projects flying high. The confidence of the investor would start building up, and the share price would start picking up.

2027: Adani Enterprises Share Price Target ₹7600

This would be a very significant year for Adani Enterprise primarily through renewable energy and mining sectors. New project completion and the government side’s favorable policies would boost its profitability.

2028: Adani Enterprises Share Price Target ₹9400

Adani Enterprise is going to reach a pretty big scale in its renewable energy, logistics, and the management of an airport. The need for sustainability would add foreign and local investments.

2029: Adani Enterprises Share Price Target ₹11200

More likely, it will affirm its leadership in renewable energy and infrastructure development. A much higher multiple for the company may be driven up by greater institutional investor interest.

2030: Adani Enterprises Share Price Target ₹13000

Adani Enterprises is likely to be one of the world leaders in renewable energy and infrastructure by 2030. The aggressive strategies of expansion and execution are likely to boost earnings and valuations for the company.

Factors driving the Adani Enterprises Share Price

- Renewable Energy Growth: Green hydrogen and renewable energy will have a huge impact on the valuation of Adani Enterprises.

- Debt Management: The debt-to-equity ratio is at 1.92, and its ability to reduce debt in tandem with the growth trend shall influence investor sentiments.

- Government Policies: The policies are very favorable to the infrastructure and energy sectors and are going to hugely influence the trajectory of growth in the company.

- Global Industry Trends: Since Adani is an international player, it has been exposed to various global economic factors and policies in terms of trade.

- Institutional Investment Flows: This sense of the increase in the holding by mutual funds and FIIs indicates increasing optimism on the company’s future prospect.

Major Developments by Adani Enterprises Share Price

- Promoters Holding: It shows that total promoter holding now is at 73.97%, declining trend as that of previous quarters though FII and MF increased their holding.

- Expansion Strategy: The company has announced aggressive expansion plans for its green energy and infrastructure businesses, which should deliver growth over the next decade.

- International Exposure: Strategic foreign market investments shall add strength to the global footprint of Adani and add value to revenue diversification

Best Adani Enterprises Stocks as of January 2025

- ADANIENT 2400 CALL (₹79.15): Heavy trading volumes suggest that there is highly significant market interest in the stock’s prices in the future.

- ADANIENT 2300 Put (₹50.60): It shows hedging downside by the trader.

- ADANIENT 2600 Call (₹21.85): Slightly a bull is getting on for this particular stock in medium time.

Frequently Asked Questions For Adani Enterprises Share Price

1. Is there a long-term investment opportunity in Adani Enterprises?

Yes. This is on account of diversified business operations, as well as an increased focus on renewable energy. However, its debt levels are also very high, along with market volatility.

2. What are the long term share price target for Adani Enterprises?

Based on the trend and growth prospect, the Adani Enterprises Share Price Targets may range between ₹1,600 in the year 2025 to ₹3,600 in the year 2030.

3. Why are Adani Enterprises Share Price so pretty volatile?

Primary reasons are seen in the shape of global economic factors and intense regulatory pressures besides heavy debts.

4. How does it compare with its competitors?

It has a relatively high P/E ratio at 46.37 in comparison to an industry average of 39.93 but hope of growth on investors’ minds, and a huge debt-to-equity ratio must be closely monitored.

5. What sectors does the company earn revenues from?

Revenue is generated from multiple sectors of renewable energy, mining, airports, and infrastructure development.

6. What are the risks while investing in Adani Enterprises?

High debt levels, regulatory issues, and uncertainty in the global economy are the key risks.

Adani Enterprises forms the vital part of India’s growth story. Diversified and focused on green energy, this company is ready to take on long-term challenges. The some immediate-term challenge for the near term are high debt levels and volatility in the market; however, strategic initiatives in renewable energy and infrastructure development are likely to create significant value by 2030.

Portfolio holders with an extremely high risk appetite and having a long time horizon can, therefore, have a choice of Adani Enterprises while keeping an eye on its financial health along with that of the external market.