Adani Green Share Price Target From 2025 to 2030: AGEL is the abbreviation for Adani Green Energy Ltd. It is one of the Indian players of the high and rising end of the green energy transformation. It operates on solar and wind power with increased capacities and expansion worldwide. So, one of those stocks to watch. Let’s know more about the Adani Green Share Price for the years 2025-2030 along with its market performance, technical indicators, etc.

Adani Green Share Price: Bottom Details

| Parameter | Value |

| Current Open | ₹1026.0 |

| High | ₹1047.65 |

| Low | ₹1,016.20 |

| Market Cap | ₹1.63 Lakh Crore |

| P/E Ratio | 161.00 |

| 52-Week High | ₹2,174.10 |

| 52-Week Low | ₹870.25 |

| Dividend Yield | N/A |

Market Depth For Adani Green Share Price

- Upper Circuit: ₹1,134.85

- Lower Circuit: ₹928.55

- Total Traded Volume: 16,20,863

- Total Traded Value: ₹167 Crore

Bid vs. Ask Analysis For Adani Green Share Price

- Bid Total: 1,20,821

- Ask Total: 2,07,075

Technical Analysis For Adani Green Share Price

Adani Green Energy Ltd. has so far sent mixed messages about day-to-day technical indicators.

- Momentum Score: 30.91 (Technically weak)

- MACD: -31.2 (Bearish)

- ADX: 19.1 (Weak Trend)

- RSI: 45.5 (Neutral zone)

- MFI: 66.5 (Near Overbought)

- ATR: 55.2 (Volatility is moderate)

- ROC (125 days): -39.9 (Negative momentum over long term)

The technical indicators about Adani Green, though show a cautious message, the Adani Green Share Price in the space of renewable energy is strong for long term.

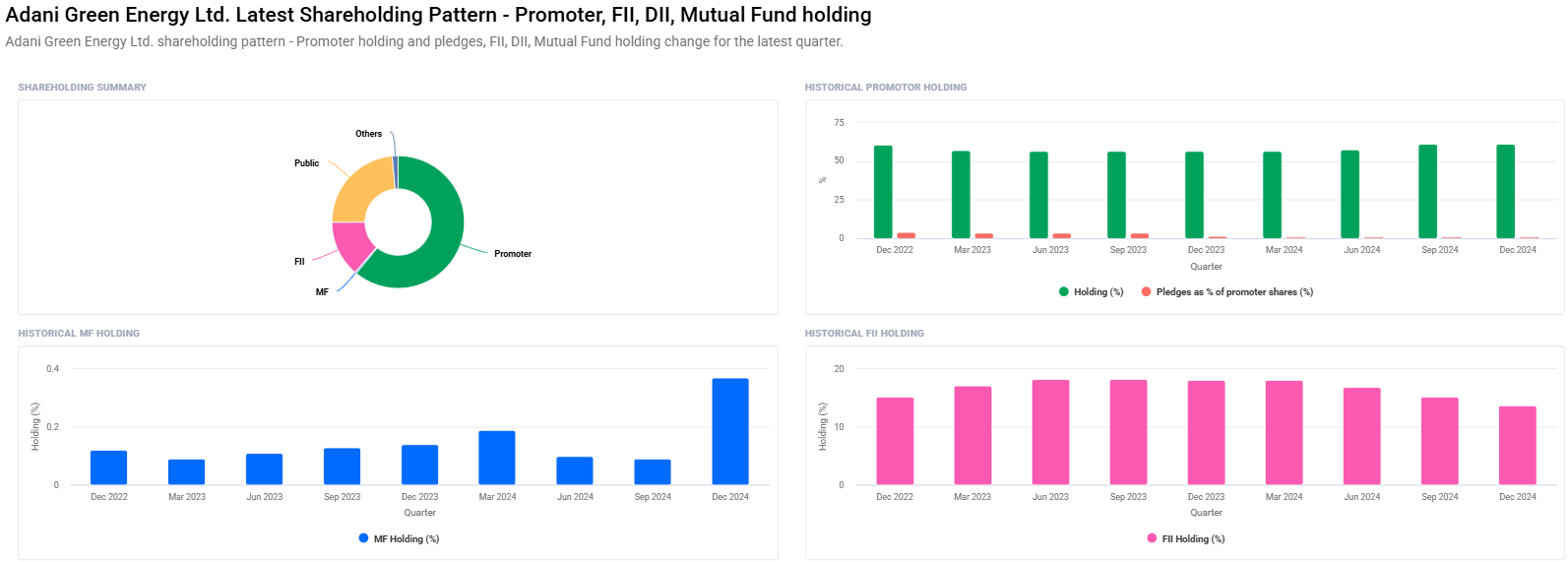

Adani Green Share Price Promoter and Institutional Holding

| Investor Category | Holding |

| Promoters | 60.94% |

| Retail and Others | 23.66% |

| Foreign Institutions (FII) | 13.68% |

| Other Domestic Institutions | 1.36% |

| Mutual Funds | 0.37% |

Changes in the last periods:

- Promoters: The same, stood at 60.94%

- FII/FPI Holdings: Increased to 13.68% from 15.16%

- Mutual Funds: Increased to 0.37% from 0.09%

- Institutional Investors: Down to 16.61% from 15.41%

Adani Green Share Price Prediction 2025 to 2030

Therefore, growth for Adani Green depends on the demand of India toward access of renewable energy and demand from the rest of the world to get into sustainable development. A few Adani Green Share Price prediction for the firm are:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2200 |

| 2026 | ₹3500 |

| 2027 | ₹4800 |

| 2028 | ₹6100 |

| 2029 | ₹7400 |

| 2030 | ₹8700 |

Growth Drivers For Adani Green Share Price

- Renewable Energy Capacity: Aggressive capacity build-up of solar and wind power.

- The long-term vision of the Company is not very different from the renewed approach of the Government of India towards renewable energy.

- Investment at a global level would be a growth vehicle and international entities’ partnerships and investments.

- The climbing awareness of climatic change is positioning Adani Green at the forefront of a trend that seeks sustainability.

About Adani Green Energy Ltd.

Adani Green Energy Ltd is the biggest renewable energy company. Established in 2015, it has developed, operated, and maintained utility-scale grid-connected solar, and wind farms. Adani Green has made a commitment towards sustainable power supply; therefore, its journey towards becoming the world’s largest renewable company by 2030.

Major achievements For Adani Green Share Price

- The biggest solar energy company developer: ranked as the world’s largest solar power developer by capacity.

- Strong pipeline: More than 25 GW of renewable projects under development.

- Global recognition: Ties to large international investors and institutions.

Frequently Asked Questions About Adani Green Share Price

1. Is Adani Green a good long-term investment?

Adani Green is very promising, and huge growth potential lies here, as it focuses on renewable energy, while the high debt-to-equity ratio and market volatility need to be followed by the investors.

2. Why is the P/E ratio of Adani Green so high?

P/E ratio of Adani Green at 161 reflects high investor expectation, since the company is a leader in renewable energy. High P/E is typical of growth stocks within new and emerging industries.

3. Risks involved in investing in Adani Green

The main risks are a leverage of 6.38, regulatory challenges, and potential project implementation delays.

4. Adani Green Compared with Other Renewable Energy Stocks

Adani Green’s scale and international partnerships are quite unique, but its valuation is a bit on the higher side from the rest of its peers in the industry, which makes it less appealing to value-conscious investors.

5. What is fueling growth in India for renewable energy?

Government schemes, such as the National Solar Mission, the rising FDI in the sector of renewables, and international climate change commitments.

Adani Green Energy Ltd is a silver lining for the renewable energy space. While technical shortcomings will be visible in the short run, the buoyant growth curve has the strength of India’s energy transition and global investments backing it. It shall be one of those ‘hidden gems’ for long-term investors as the world goes green. Whether you’re a seasoned investor or exploring new opportunities, keep an eye on Adani Green’s journey, it might just redefine the future of energy.