Adani Total Gas Share Price Target From 2025 to 2030: Adani Total Gas Ltd. is a market leader in the Indian piped natural gas (PNG) and compressed natural gas (CNG) distribution city gas distribution (CGD) business. The company is in association with TotalEnergies, the global leader in the energy business. Adani Total Gas diversified its business and services in India and was a key contributor to India’s shift to clean sources of energy.

Adani Total Gas has a robust business model, strategic partnerships, and increasing consumption of natural gas and is set to grow exponentially in the next two to three years. In this article, we will give the company’s share price targets in the future period 2025 to 2030 based on company fundamentals, technicals, and market trend.

Current Market Outlook For Adani Total Gas Share Price

- Open Price: ₹599.00

- High Price: ₹605.00

- Low Price: ₹580.80

- Market Cap: ₹65,499 Cr

- P/E Ratio (TTM): 98.11

- Dividend Yield: 0.04%

- 52-Week High: ₹1,190.00

- 52-Week Low: ₹545.75

- EPS (TTM): 6.07

- Book Value: 35.56

- Debt to Equity Ratio: 0.37

- Industry P/E: 15.59

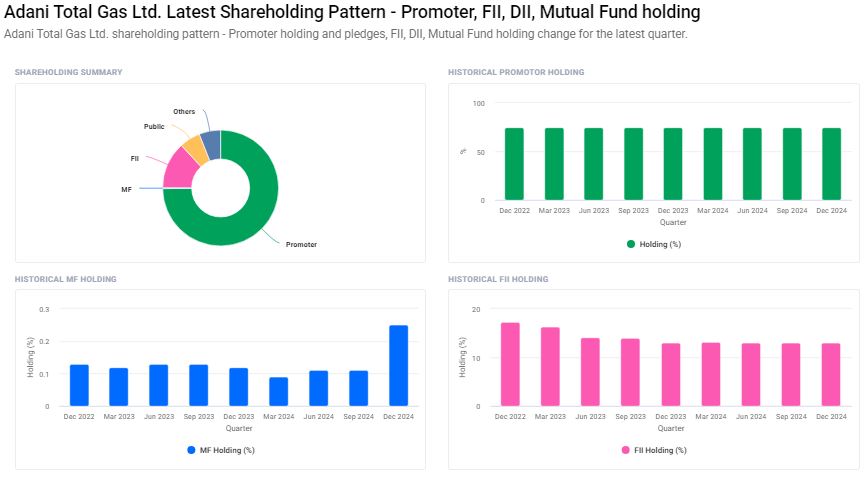

- Promoter Holding: 74.80%

- FII Holding: 13.06%

- Mutual Fund Holding: 0.25%

Adani Total Gas Share Price Target Forecast (2025-2030)

| YEAR | TARGET PRICE |

| 2025 | INR 1200 |

| 2026 | INR 1800 |

| 2027 | INR 2400 |

| 2028 | INR 3000 |

| 2029 | INR 3600 |

| 2030 | INR 4200 |

The above projections are given based on the market trend, company growth, and increasing demand for natural gas in India.

Fundamental Analysis For Adani Total Gas Share Price

- Strong Market Standing: Adani Total Gas is well-positioned in India’s market for natural gas distribution. Being an associate of Total Energies means state-of-the-art technology and expertise in the energy business.

- Consistent Financial Growth: The company has shown a consistent trend of growth in revenues, backed by increasing uses of CNG and PNG in urban as well as rural India. The fact that the P/E ratio is 98.11 means overvaluation at current levels, however, due to its high-growth nature, the valuation has to correct itself some day.

Institutional Investor For Adani Total Gas Share Price

- Other Domestic Institutions: 6.02%

- Strong institutional holdings reflect strong conviction about the long-term future of the company.

Technical Analysis For Adani Total Gas Share Price

- Momentum Score: 27.2 (technically weak)

- MACD: -18.6 (indicative of bearish trend)

- RSI (14): 33.6 (near oversold levels)

- MFI: 41.3 (middle zone)

- ROC (21): -11.0 (negative momentum)

- ADX: 17.6 (weak strength of trend)

Adani Total Gas is currently facing short-term bearish momentum. In the long term, however, it is positive owing to the company’s expansion plan and rising demand for cleaner energy sources.

Growth Drivers for Adani Total Gas Share Price

- Expansion of CGD Networks: The company is expanding its CGD network in cities, adding more customers.

- Government Push for Natural Gas: India aims to raise the proportion of natural gas in its energy basket to 15% by 2030 from 6%, which would be a blessing for CGD players such as Adani Total Gas.

- Partnership with Total Energies: The tie-up brings in technological smartness and capital infusion for long-term growth.

- Increasing Demand for CNG and PNG: Fuel price hikes and environmental concerns are compelling consumers and industries to shift to CNG and PNG.

- Smart City Initiatives: Government’s Smart City initiatives include clean energy solutions, which would be helpful for Adani Total Gas’s expansion plan.

Risks and Challenges For Adani Total Gas Share Price

- Regulatory Challenges: Government policy changes concerning gas price and gas distribution may affect profitability.

- Competition: Players such as Indraprastha Gas, Gujarat Gas, and Mahanagar Gas are strong competitors.

- Market Volatility: The stock has remained volatile over recent years, with a 52-week high of ₹1,190 and a low of ₹545.75.

- High P/E Ratio: The stock with a P/E ratio of 98.11 is overpriced compared to the industry P/E of 15.59.

Frequently Asked Questions (FAQs) For Adani Total Gas Share Price

1. Is Adani Total Gas a good long-term investment?

Yes, due to its robust market position, government preference for cleaner energy and consistent business growth, it has long-term growth potential.

2. Adani Total Gas’s share price in 2025 is?

Based on financials and market scenario, the target price in 2025 would be ₹1,200.

3. What are the factors that can drive the stock price up?

CGD network expansion, CNG/PNG demand growth, positive government policies, and robust financial growth can drive the stock price up.

4. Is there any risk in investing in Adani Total Gas?

Yes, regulatory issues, market volatility, and competition from other CGD players are risks.

5. Why is Adani Total Gas’s P/E ratio so high?

The high P/E ratio reflects investors’ expectation of future growth, but it also reflects that the stock is overvalued now compared to its peers.

Adani Total Gas Ltd. remains a giant in India’s natural gas space with the benefit of increasing demand and efforts by the government to encourage cleaner sources of energy. Even though the stock is experiencing short-term technical weakness now, its long-term outlook is promising, with a price target estimate of ₹4,200 by 2030. The investors must consider the growth opportunities and the risks before making investment decisions.