Anant Raj Share Price Target From 2025 to 2030: Anant Raj Ltd is one of the prominent real estate development companies in India. The group focuses on luxury residential, commercial, and hospitality projects. By providing the highest quality of real estate solutions through quality, design, and innovation, Anant Raj has established an excellent reputation in the Indian real estate sector by its vast portfolio and customer-centric approach.

Company Fundamentals For Anant Raj Share Price

- Market Capitalisation: 21,640 Cr

- P/E Ratio (TTM): 56.16

- P/B Ratio: 5.65

- Industry P/E: 43.80

- Debt to Equity: 0.10

- ROE: 9.06%

- EPS (TTM): 11.27

- Dividend Yield: 0.12%

- Book Value: 111.94

- Face Value: 2

Anant Raj’s share has opened at INR 632.95 during the recent trading sessions and a high at INR 633.60, and a low at INR 583.05. The stock of the company has a fantastic growth of 72.50% in the last year and has closed at INR 591.15.

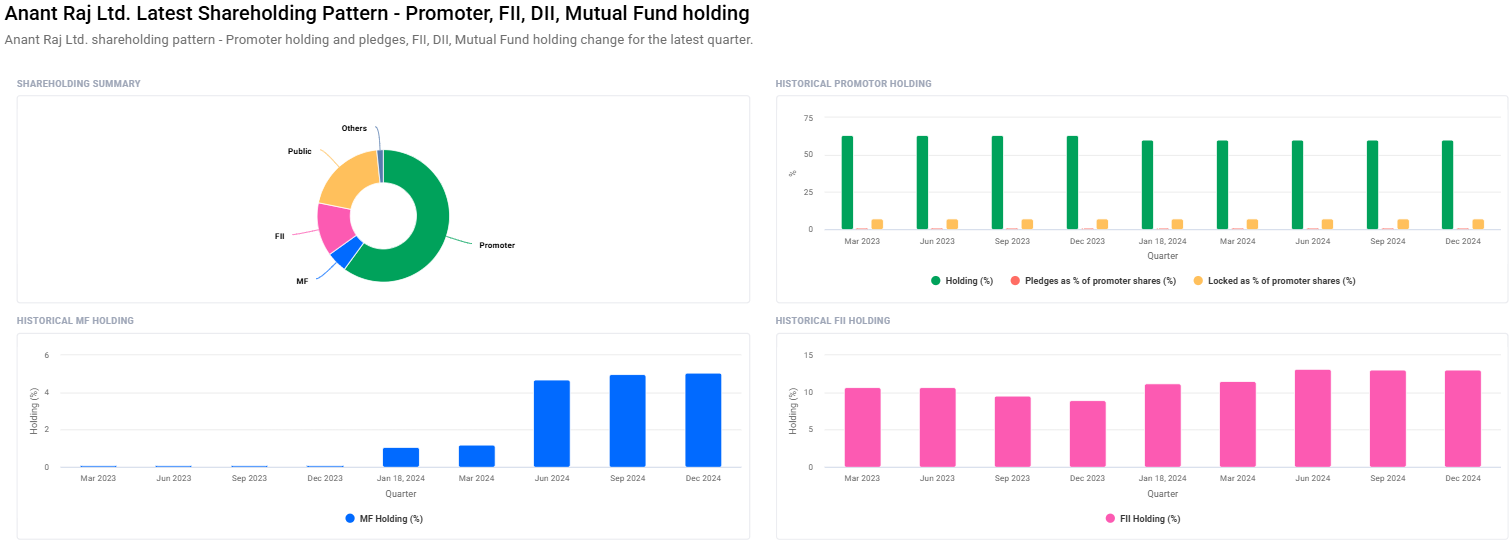

Ownership Structure For Anant Raj Share Price

- Promoters: 60.00% (no change)

- Retail and Others: 20.22%

- Foreign Institutions: 13.07%

- Mutual Funds: 5.07%

- Other Domestic Institutions: 1.64%

Key Highlights For Anant Raj Share Price

- FII/FPI rose from 13.04% to 13.07%

- FII/FPI investors rose from 185 to 209

- Mutual Fund schemes have risen from 14 to 17 with the holding percentage rise of 4.98% to 5.07%

- Institutional investors have increased their holding percentages from 19.73% to 19.78%.

Technical Analysis Summary For Anant Raj Share Price

- Day Momentum Score: 44.1 (Neutral)

- Day MACD: -60.2 (High bearish sign)

- Day ADX: 33.3 (Neutral trend strength)Day RSI (14):42.1(Neutral, close to oversold)

- Day MFI: 40.0(Neutral)

- Day ATR: 50.5

- Day ROC (21): -23.3 (Bearish)

Projected Anant Raj Share Price targets from 2025 to 2030

Year

Share Price Target (INR)

2025

1,000

2026

1,650

2027

2,300

2028

3,000

2029

3,700

2030

4,400

These targets appear to be almost step-like in growth. Provided that the market conditions remain stable and the real estate sector continues to grow, these targets will tend to increase with time. The determinants of these targets will be market demand, regulatory changes, and whether the company maintains its financial discipline.

Growth Drivers for Anant Raj Share Price

- Improving Realty Market: Indian urbanization and housing needs form a strong foundation to the growth story of Anant Raj.

- Robust Project Pipeline: The company’s quality residential and commercial projects are placed well to fetch future returns.

- Strong Financial Health: The debt-to-equity ratio being very low and the ROE is positive indicates the financial discipline shown by the company.

- Institutional Investments: Incremental build-up through FIIs and mutual funds seems a testimony to a confidence reposed in the company.

Risks and Challenges for Anant Raj Share Price

- Regulatory Changes: Changes in government policies towards the real estate sector will also affect time and profitability.

- Market Volatility: Fluctuations in demand will affect the sales and share prices.

- Economic Slowdown: It can affect real estate investments.

- Bearish Technical Indicators: MACD and ROC, which are current technical indicators, suggest short-term caution.

FAQs on Anant Raj Share Price Predictions

Q1: Is Anant Raj Ltd. a good long-term investment?

A1: Long term potential is enormous with a firm foundation, ever-growing pipeline of projects, and institutional investment which is now on the growth track.

Q2: What makes one feel that the company shares would be in appreciation?

A2: The key drivers for appreciation are the growth in India real estate, financial health, and the spurt in institutional investment into the stocks of the company also.

Q3: Out of the MACD lines which one is technically bearish for Anant Raj Ltd.

A3: In case the MACD has crossed below its signal and center line, it is then short-term momentum which is bearish and may be due to market corrections or investor sentiment.

Q4: What does this low debt-to-equity ratio signify for Anant Raj Ltd.?

A4: Low debt to equity ratio indicates the company is not overly dependent on debt for raising growth capital, hence reduces the risk of financial.

Q5: Effect of promoter holding on company stability:

A5: With 60% promoter holdings, there is stability and assurance shown by the promoters for the future.

Q6: Is Anant Raj Ltd. likely to yield dividend?

A6 Dividend yield stands at 0.12%. Despite this, the company can declare a higher rate of dividend with profitability.

Anant Raj Ltd. is one that best can be suited to major growth in the coming years. It’s undoubtedly a strong company in the real estate sector with good financial management and rising investors’ confidence. It’s believed that the share price of the company would trade positive from 2025 to 2030. Negative short-term technical indicators would be irrelevant to the longer-term investor seeking exposure in the real estate space.