Bajaj Auto Share Price Target From 2025 to 2030: Bajaj Auto Limited leads the automobile markets in two-wheelers and three-wheelers across India. Due to innovative engineering and a large reach throughout the world, Bajaj Auto has marked incredible marks both at home and in international markets. With electric mobility trends setting in and consumers changing, Bajaj Auto will always be on top with strategic innovation and a very strong financial framework.

Such an analysis would be helpful to the investor who wants to follow up with the performance and the future of Bajaj Auto as it is a deep technical insight together with historical performance and projected targets for the share price from 2025 to 2030.

Market Information For Bajaj Auto Share Price

- Open: 8,922.00 INR

- High: 8,961.65 INR

- Low: 8,811.00 INR

- Market Cap: 2.49 lakh crore INR

- P/E Ratio: 33.10

- Dividend Yield: 0.90%

- 52-Week High: 12,774.00 INR

- 52-Week Low: 7,665.60 INR

- Volume: 5,80,590 shares

- Total Traded Value: 514 crore INR

- High of the Day: 9,820.55 INR

- Low of the Day: 8,035.05 INR

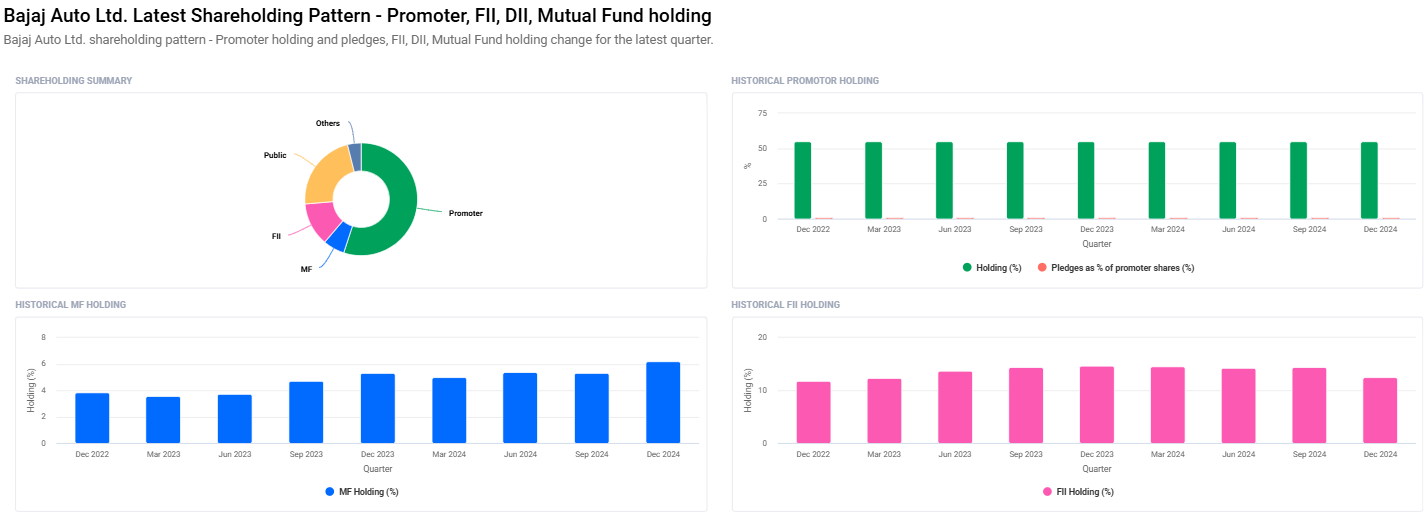

Promoter and Institutional Shareholding For Bajaj Auto Share Price

- Promoters: 55.04% (No Change from Previous Day)

- Retail and Others: 22.45%

- Foreign Institutions: 12.45%

- Mutual Funds: 6.19% (Increased from previous day 5.34%)

- Institutional Investors: 22.51%

- Promoter pledge: 0.01%

Technical Analysis For Bajaj Auto Share Price

- Day Momentum Score: 51.23-Neutral technically

- MACD (12, 26, 9): 18.6-Bullish Indicator

- Day RSI (14): 56.6-Neutral; below 30 is over-sold and above 70 is overbought

- Day ADX: 25.7-ADX is at moderate trend

- Day ATR: 201.6-Reflects market volatility

Key Indicators Analysis For Bajaj Auto Share Price

- MACD: This is a momentum indicator that is indicating a buy sign since it’s above the center and the signal line.

- RSI: This is in neutral region, and in short term, it does not reflect overbought or oversold condition.

- ADX: This reflects the strength of market trends in the moderate region.

- ATR: High ATR indicates the continuous fluctuations in the market.

Bajaj Auto Share Price Targets from 2025 to 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹13000 |

| 2026 | ₹18000 |

| 2027 | ₹23000 |

| 2028 | ₹28000 |

| 2029 | ₹33000 |

| 2030 | ₹38000 |

2025: Bajaj Auto Share Price Target 13,000 INR

Given a stable demand both for internal combustion engine and electric vehicles, market recovery and strategic launches are to drive growth at Bajaj Auto.

2026: Bajaj Auto Share Price Target 18,000 INR

Expansion in the global markets especially in emerging economies and increased production capacity are going to push up the stock price of the company.

2027: Bajaj Auto Share Price Target 23,000 INR

By then, Bajaj Auto would appear to capture the maximum market share of electric vehicles but would continue at the top for conventional two-wheelers as well.

2028: Bajaj Auto Share Price Target 28,000 INR

All these target prices would be contributed by export, R&D and the electric vehicle markets as well.

2029: Bajaj Auto Share Price Target 33,000 INR

Investment in R&D will definitely make it offer sustainable mobility solutions that can hike the price of this company.

2030: Bajaj Auto Share Price Target 38,000 INR

A fully developed portfolio of EV with a strong market position plus expansion across global markets will push the share price to this desired level.

Company Overview

Bajaj Auto was founded back in 1945 as part of the Bajaj Group. The two and three wheeler manufacturer exists in over 70 countries. The house brands including Pulsar, Dominar, and Chetak Electric have huge popularity in all markets.

Strengths For Bajaj Auto Share Price

Innovation Leadership: Innovation leadership in the electric scooter market with the help of Chetak Electric.

Global Reach: Reaching across emerging as well as developed markets.

Strong Financials: Revenue growth, debt to equity is low and ROE

Recent Developments For Bajaj Auto Share Price

- Mutual fund holdings rise up from 5.34% in the December quarter of 2024 to 6.19%.

- Launches next-generation electric vehicles

- Extends its presence across the emerging markets.

Frequently Asked Questions (FAQ) For Bajaj Auto Share Price

1. What would be the Bajaj Auto share price at the end of 2025?

Around 13,000 INR would be the Bajaj Auto share price at the end of 2025.

2. Why is the share price of the shares of Bajaj Auto increasing?

Major factors due to the upward surge of shares of Bajaj Auto in the share prices would include market expansion into the electric vehicle domain, hike in production volumes, excellent performance during exports, and steady and undeteriorated demand in traditional two-wheeler segment.

3. Does Bajaj Auto Invest in electric Vehicles?

YES. Absolutely, the giant Bajaj Auto had hugely invested into Electric Vehicles along with the introduction of a product through the nomenclature of Chetak Electric also.

4. What is Bajaj Auto market cap currently?

The Bajaj Auto market cap now stands at roughly 2.49 lakh crores INR.

5. What is Bajaj Auto dividend yield?

Bajaj Auto’s Dividend Yield sits at 0.90%

6. Institutional holding in the Bajaj Auto share

By institutional investors, mutual funds, foreign institutions and other domestic institutes, 22.51%.

7. How is Bajaj Auto Debt to Equity?

The debt-to-equity ratio is 0.17, so the finance condition is stable.

Bajaj Auto is one of the stalwarts in the automobile sector due to being financially strong, based on innovative strategy, and aligned with sustainable mobility solutions. Share price projection from 2025 to 2030 highlights the growth possibilities that the firm offers, making this a good window of opportunity for investors to create long-term wealth.