Balrampur Chini Share Price Target From 2025 to 2030: Balrampur Chini Mills Ltd. (BCML) is one of the largest companies in India’s sugar industry. It has established itself, not only as a sugar production major, but also as an innovative company expanding its footprint in the ethanol sector. With a great track record and diversified portfolio of products that includes sugar, ethanol, and power, BCML is a comprehensive reflection of the unfolding Indian agriculture and energy markets. Let’s discuss here in detail, the Balrampur Chini Share Price from 2025 to 2030, factors for future growth drivers, technical indications, and key fundamental strengths.

Company Profile Overview

- Company Name: Balrampur Chini Mills Ltd.

- Market Cap: ₹9,862 Crore

- P/E Ratio: 22.82

- P/B Ratio: 2.78

- Debt/Equity: 0.17 (Good Structure)

- Dividend Yield: 0.61%

- EPS/Share(TTM): ₹21.40

- B.V.: ₹175.80

- Face value: ₹10

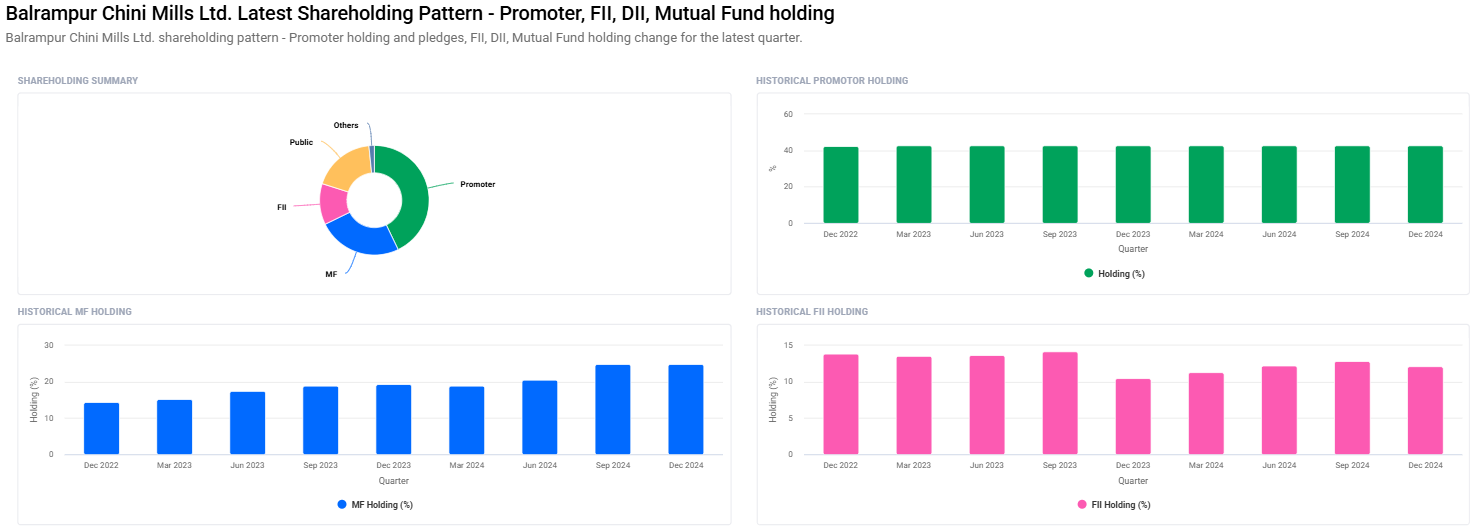

- Promoter Holding: 42.87 %

- FII Holdings: 12.11 %

- Retail and others: 18.50%

The major business of BCML relates to the sugar production and ethanol, which will act as one of the primary fuel alternatives to help the Indian government attain its renewable energy target. It is aggressively trying to support ethanol blending as presented by the government with petrol; that will be one stated goal marking the growth mileage in the times ahead.

Balrampur Chini Share Price Movements Glimpse

- Open: ₹491.20

- Previous Close: ₹488.60

- High: ₹494.80

- Low: ₹482.50

- 52 week High: ₹691.80

- 52 week Low: ₹343.50

- Trading Volume: 2,25,707

- Market Value of Shares Traded: ₹10.94 Crore

Balrampur Chini Share Price has traded very wildly between ₹343.50 and ₹691.80 in the last year but the market capitalization and institutional support makes an attractive investment option for investors willing to take the exposure of Indian agriculture and energy sectors.

Technical Analysis Break Down For Balrampur Chini Share Price

Now, before diving into the price targets, analyze the current technical indicators in order to understand the short-term Balrampur Chini Share Price direction would be:

- Momentum Score: 48.3 (Neutral; Market sentiment would be balanced and indecisive if the score would be below 50)

- MACD (12, 26, 9): -16.2 (Bearish, MACD’s presence below the center line is usually interpreted as a downward price trend)

- ADX: 18.9 (This is a weak trend neither bullish nor bearish)

- RSI (Relative Strength Index): 38.1 (Slightly oversold; the equity could be under-valued hence subject to a short term bounce)

- MACD Signal: -17.8 (Increases bearish pressure)

- ROC (Rate of Change): -7.4 (Negative momentum subject to a falling trend in the equities)

- MFI (Money Flow Index): 61.5 (Neutral to positive as more investors accumulate)

Fundamentals: Why BCML is Poised for Growth

Balrampur Chini Mills has been able to demonstrate robust operational fundamentals, which would enable it to stay strong and grow in the long run:

- Government Policies On Ethanol: The greatest growth driver for BCML would be the push given by the Indian government for the blending of ethanol into more petrol, 20% of which it is committed to do by 2025. As one of the leaders in the ethanol manufacturing sector, BCML would obviously benefit from the spin-offs of the government initiatives.

- Diversified Operations: The product portfolio at BCML includes simple sugar, ethanol, and electricity generation. This diversification provides a stable revenue stream while the company can enjoy several growth waves in the Indian economy.

- Debt Free Structure: The company has a very low debt-to-equity ratio of 0.17, which gives a healthy financial structure to the firm. Low levels of debt also make BCML have more flexibility financially in terms of handling market fluctuations while still trying to push boundaries in expansion efforts.

- Sustainable Cash Flows: BCML has always remained stable and in sustainable cash flow through its suitable operations that enable it to meet growth initiatives with funding as well as in dividend payment for its shareholders.

- Dividend Payment: Although the prevailing dividend yield remains at 0.61%, which is far from a great figure, the corporation does exhibit constant dividend payment characteristics; hence very suitable for dividend seeking investor.

Balrampur Chini Share Price Forecast (2025-2030)

Considering the technical indications and company’s fundamentals are sound, here is a view on the Balrampur Chini Share Target Price from 2025 through 2030.

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹700 |

| 2026 | ₹1050 |

| 2027 | ₹1400 |

| 2028 | ₹1750 |

| 2029 | ₹2100 |

| 2030 | ₹2450 |

2025: Balrampur Chini Share Price Target ₹700

BCML, with the progress in 2025, shall start recovering the current technical week from its financial stand. The year 2025 would be optimistic due to higher sugar prices all over the globe and growing the importance of ethanol, where favorable government policies in India are highly in favor of BCML, thus making moderate growth an opportunity of ₹700 in 2025 with high demand for ethanol and stable finance from BCML.

2026: Balrampur Chini Share Price Target ₹1050

As the ethanol production and sugar output by BCML would continue to grow, the company would see more growth in earnings. In the calendar year 2026, owing to better efficiency in operations and good government policies regarding renewable energy, the stock is likely to go up to ₹1050. This would positively influence the overall sentiments toward renewable energy and agriculture-based stocks in the market for investors as well.

2027: Balrampur Chini Share Price Target ₹1400

This will bring the Indian sugar industry, which consists of BCML, into an acceleration-growth phase in 2027. It will be as a result of an uninterrupted rise in the sugar price, increase in ethanol demand, and enhanced market share for BCML. The stock price is going to be ₹1400 at that point in time when the market will favor more the companies working on the ethanol and renewable energy space.

2028: Balrampur Chini Share Price Target ₹1750

The continuous policy support for biofuels, the business delighting investors through improved revenues and profitability, would further consolidate BCML’s leadership status in the market by 2028. Better investor sentiment and growing business sustainability confidence by BCML are expected to take the stock to ₹1750.

2029: Balrampur Chini Share Price Target ₹2100

By 2029, BCML would have harvested all the benefits that growth in the ethanol and sugar markets has to offer. With both home and international demand for ethanol increasing, the stock of BCML could reach ₹2100. With growth in earnings and an excellent history of dividends, BCML will be an ideal candidate for long-term investors looking for an exposure to India’s growing renewable energy sector.

2030: Balrampur Chini Share Price Target ₹2450

The company going into 2030 will benefit as it establishes more capacity for producing ethanol, a good increase in exports of sugar and a further acceleration in general in the use of renewable energy. While ₹2450 would appear to be too optimistic, that is money that would be there if they continue executing right on their growth plans and the useful impact of all the government policies start pouring in.

Key Questions to Ask Investors For Balrampur Chini Share Price

1. What drives the Balrampur Chini Share Price?

The major determinants of the stock price of BCML are sugar market trends, government ethanol policies, and the financial performance of the company. External factors include international sugar prices and domestic demand for ethanol.

2. Should I invest in BCML for the long term?

Yes, its strategic investments are in ethanol production and having a very robust position in the sugar industry. It continues to be a strong candidate for long-term growth. Furthermore, being debt-free, with stable cash flows, is also increasing its appeal as a long-term investment.

3. What is the growth potential of BCML in the next five years?

BCML is in a great position to cash in on the government’s ethanol blending policy and revival of sugar demand. The company’s stock price can soar high in the next five years and touch a target of ₹1050 by 2026 and ₹1400 by 2027.

4. What are the dividend yields of BCML attractive?

Although the yield of BCML is pretty modest at 0.61% currently, the company, being a stable dividend payer, is attractive to income investors.

Indeed, Balrampur Chini Mills Ltd. has a very good long-term investment case because of the diversified nature of operations in sugar, ethanol, and power. BCML is very well placed to both benefit from incentives from the government and increase in the marketplace demand. Some minor short-term technical weaknesses apart, the company is indeed a growth stock with robust fundamentals-thus, it is a good bet to tap into a rapidly growing agro and renewables sector in India.