BEML Share Price Target From 2025 to 2030: BEML Limited is India’s leading producer of heavy engineering products, mainly earthmoving and mining equipment and railway and metro coaches and also defense systems. As a Public Sector Undertaking under the ministry of defense it provides services across the sectors in defense, transport, and infrastructures. So, with a wide range of activities and healthy growth, investors have been keen on BEML. Analyzing the Future Potential of the Company, this report provides BEML share price targets from 2025 to 2030 on the bases of its fundaments, market performance, and technical indicators.

Current Stock Overview For BEML Share Price

BEML’s stock is valued at INR 3,544 per share, with a market capitalization of INR 16,01,000 crore at the latest reporting date. Here’s the performance of the company in the recent period:

- Opening Price: 3,544.00 INR

- High Price: 3,872.70 INR

- Low Price: 3,544.00 INR

- Previous Close: 3,540.60 INR

- 52-week high: 5,488.00 INR

- 52-week low: 2,671.90 INR

- P/E Ratio: 56.08

- Dividend Yield: 0.53%

Stock Movement Summary For BEML Share Price

- Volume: 8,76,874

- Total Traded Value: 339 Cr

- Upper Circuit: 4,248.70 INR

- Lower Circuit: 2,832.50 INR

Fundamental Analysis For BEML Share Price

BEML has good strong fundamentals and robust growth momentum. The business underways of the company lie diversified, and it will surely help in grabbing the opportunity in the booming infrastructure and defense market of India. Now, let us look at the major financial ratios, which are divided in the following table.

- Market Cap: 14,738 Cr

- P/E Ratio (TTM): 51.61

- P/B Ratio: 5.46

- ROE: 10.58%

- EPS (TTM): 68.57

- Dividend Yield: 0.58%

- Book Value: 648.16 INR

- Debt to Equity: 0.24

- Face Value: 10 INR

RoE stands at 10.58%, which shows that it has efficiently generated its earnings for the shareholders. The P/E ratio of 51.61 depicts high premium valuations and reflects that investors would expect good growth in the future. The company has a debt-to-equity ratio of 0.24, which is relatively low. This depicts that its financial discipline is good.

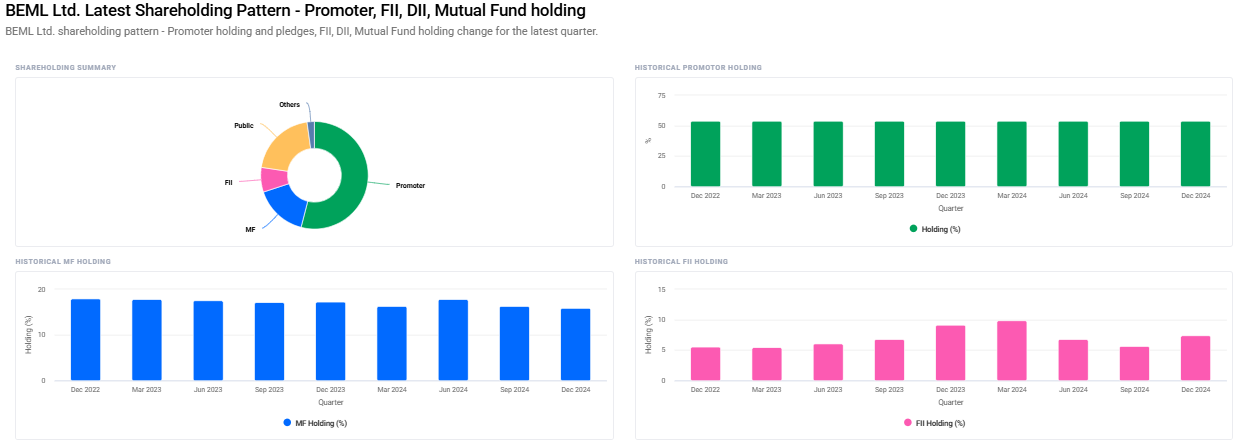

Shareholding Pattern For BEML Share Price

The institutional and retail investors have a dominant shareholding structure of BEML, as shown below:

- Promoters: 54.03%

- Retail and Others: 20.45%

- Mutual Funds: 15.94%

- Foreign Institutions: 7.41%

- Other Domestic Institutions: 2.16%

Promoters have kept it the same at 54.03%, therefore showing a vote of confidence in the long term growth of the company. FIIs have increased their holdings from 5.66% to 7.41%, thereby showing an increased vote of confidence in the stock.

Technical Analysis of BEML Share Price

The fundamentals are good, but the technical of BEML are going a bit through some volatility. This is a snapshot of how things are in technical terms currently.

Momentum Score (Trendlyne): 32.7

Any score below 35 places a stock in the bottom 30% of momentum stocks. Hence, the technicals of the stock are technically weak. MACD: -140.5

The MACD is below both its Signal Line and Center Line, which is a very strong bearish indicator.

ADX: 28.1

The ADX reading is moderate about trend strength, but still, the number less than 30 indicates that probably the stock is not in a strong enough trend either uptrend or downtrend.

RSI: 41.0

RSI is 41.0. So, the stock is neither overbought nor oversold. It is overbought if the reading is above 70 and, if the reading is below 30, that would have counted as being over-sold for the stock. Now, from the perspective of this time now, BEML’s stock would fall into a neutral range.

ROC (Rate of Change): -14.1

Because the ROC is a negative value, there is downtrend for last 21 days for the stock.

MFI (Money Flow Index): 40.8

This implies the stock is near the brink of entering into an oversold area since MFI is at 40.8. Conditions are considered to be overbought when MFI is more than 70, but in case it moves down to less than 30, then that particular condition is stated to be over-sold.

ATR (Average True Range): 147.8

ATR is high in case the stock witnessed some highly volatile trading sessions in recent times.

BEML Share Price Prediction from 2025 to 2030

While BEML technical indicators are foretelling some short-term concerns, the long-term seems to be good. Here is the expected BEML Share Price from 2025 to 2030.

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹5500 |

| 2026 | ₹8200 |

| 2027 | ₹10900 |

| 2028 | ₹13600 |

| 2029 | ₹16300 |

| 2030 | ₹19000 |

The areas that the company would be expanding in are defense and infrastructure sectors with these strategic initiatives of BEML. The diversified portfolio of the company will reap the benefits arising from the upsurge of demand for defence equipment, development of infrastructure and urban transportation solutions in the metro rail systems.

Drivers for BEML Share Price

There are several key drivers of the stock price movement of BEML over the next few years:

- Defense Sector Growth: BEML is one of the leading defence manufacturing companies in India, with increasing defence spends in India being a reality and long-term contracts for the company.

- Infrastructure development in India : The work in infrastructure development undertaken by India-its metro rail projects and the smart city initiative-would bring standard machinery and railway solutions into BEML’s fold.

- Government Policies: The policy of the government towards improvement of domestic manufacturing as well as developing infrastructure will act as a benefit for BEML.

- Economic Condition: Gross Domestic Product, inflation, as well as interest rate of India affect the stock investor related to that stock.

BEML Share Price Frequently Asked Questions

1. What types of business operations does BEML conduct?

The main products developed by BEML Limited are heavy engineering products meant for defense, mining, and construction industries. It also produces the metro rail coaches and develops and manufactures railway rolling stock.

2. How have been the performance of BEML shares in last one year?

BEML has momentum in positive stocks with +10.26 percent in previous years. The investors are highly optimistic about the stock, yet is very volatile toward the domestic market and the global circumstance.

3. What is the market Capitalization of the Company for BEML Share Price?

The shares of BEML have a market capitalization worth INR 14,738 crores and are mid-cap category stock of India.

4. What are the BEML Share Price Main Risks?

It has defense sector risk and infrastructure sector risk; apart from that, it also has policy changes in the government, market volatility, and it also comprises short-term bearish trends as indicated by technical indicators.

5. Does BEML pay out dividends?

Absolutely a big yes; it comprises 0.58 percent dividend yield and is highly attractive for income investors.

The company is very well founded in very good fundamentals. One of the promising opportunities to grow very strongly is BEML, boasting outstanding chances in defense, infrastructure, and transport sectors. The short-term technical picture will continue to look rather challenging from this point in time; however, long-term prospects are very favorable for the company. The developments in the defense sector and the policies of the government that are driving the same should be closely monitored for future growth potential for the stock. With its strategic positioning, the stock of BEML is expected to appreciate by a significant value and reach INR 19,000 by 2030.