Bharat Dynamics Share Price Target From 2025 to 2030: Bharat Dynamics Limited is an Indian public sector undertaking company engaged in designing and manufacturing guided missiles as well as related defense equipment. The legacy of national defense now empowers this BDL corporation, which came up gradually according to the pace of changing next-generation technology for its market establishment. This is the report given regarding the expected share price targeting BDL over 2025 to 2030, that would be driven both by potential future growth scope along with fiscal and technical strength indicators.

Company Overview

Bharat Dynamics Limited was incorporated in 1970 and is working with the Ministry of Defence, Government of India. The company is helping the country strengthen its defence with surface-to-air missiles and anti-tank guided missiles along with underwater weapon systems. BDL has always proven technology and financial prowess which proves to be a bright investible opportunity in the defence sector.

Company Key Metrics For Bharat Dynamics Share Price

- Market Capitalization: ₹43,978 Crores

- P/E Ratio (TTM): 77.75

- Book Value: ₹101.81

- Dividend Yield: 0.44%

- Debt-to-Equity Ratio: 0.00

- ROE (Return on Equity): 14.83%

- EPS (TTM): 15.43

- Face Value: 5 INR

Bharat Dynamics Share Price Target from 2025 till 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1800 |

| 2026 | ₹2800 |

| 2027 | ₹3800 |

| 2028 | ₹4800 |

| 2029 | ₹5800 |

| 2030 | ₹6800 |

2025: Bharat Dynamics Share Price Target – ₹1,800

Bharat Dynamics Limited would be spurred by slow growth on account of continuous investment in research and development of advanced missile systems and stable order book from the Indian government. This would also gain from the thrust of indigenous defense manufacturing under “Make in India.”

2026: Bharat Dynamics Share Price Target – ₹2,800

BDL will see an increase as large Defense contracts become operational. International joint ventures and exports will also be reflected in its growth. An estimated rise in institutional investment and government orders will further boost price appreciation.

2027: Bharat Dynamics Share Price Target – ₹3,800

The company is expected to launch several new products and systems, which would improve its market reputation. Technological advancements and a deeper integration with the defense ecosystem are two factors that would result in substantial growth.

2028: Bharat Dynamics Share Price Target – ₹4,800

BDL may consolidate its global footing by exporting missile systems and technology to other countries. New innovations and government incentives for exporting defence products might result in higher growth.

2029: Bharat Dynamics Share Price Target – ₹5,800

With consolidation in BDL’s position as a market leader in the domestic as well as international defense sectors, its financial performance will continue mounting to greater heights. Operational efficiency and strategic partnership will be some of the critical success factors driving the upward curve.

2030: Bharat Dynamics Share Price Target ₹6,800

It shall be one of the more powerful players in the defense sector with consistent profitability and order inflows by 2030.

The stock will continue to be a darling for investors who want to bet on India’s defence sector.

Technical Analysis Insights For Bharat Dynamics Share Price

- Day Momentum Score: 42.8 (Technically neutral)

- Day MACD (12, 26, 9): 5.4 (Above the center line but below the signal line)

- Day RSI (14): 48.4 (Neutral)

- Day MFI: 47.1 (Neutral)

- Day ADX: 15.0 (Weak trend)

- Day ATR: 68.8 (The day had a middle range of price fluctuation).

- Day ROC (21): 0.0 (Neutral)

- Day ROC (125): -10.7 (Fall for relatively longer durations

Fundamental Analysis For Bharat Dynamics Share Price

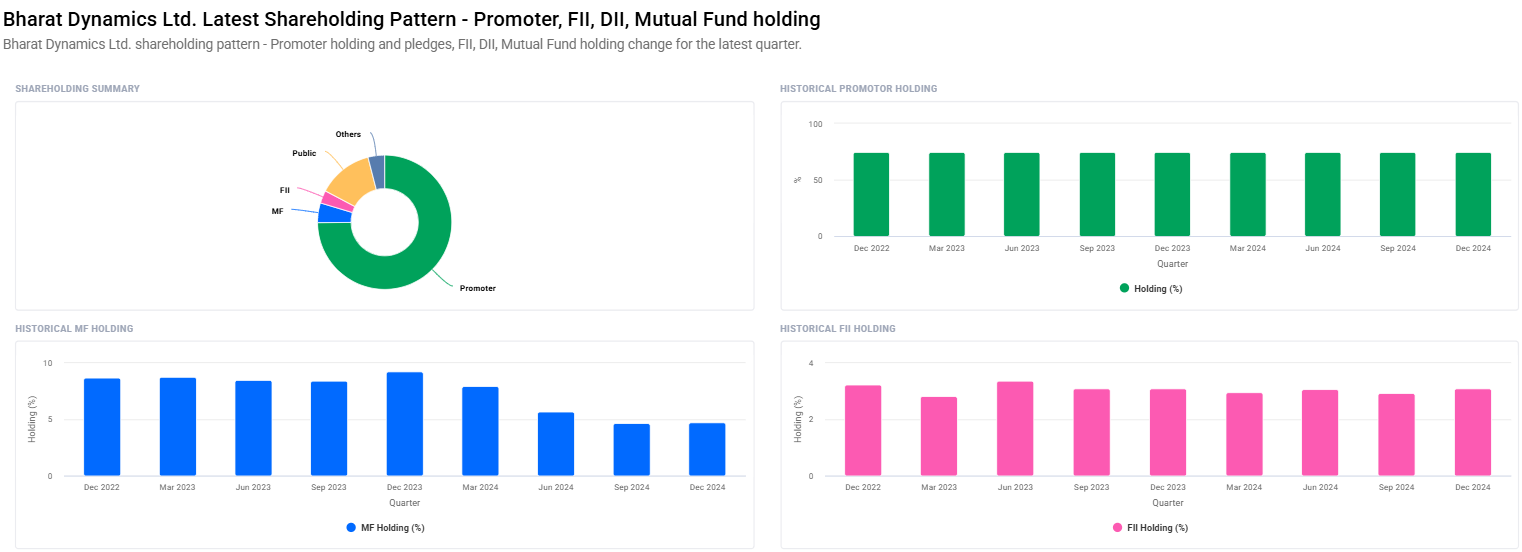

- Promoter Holding: 74.93% (No change)

- FII/FPI Holding: Increased from 2.94% to 3.09%

- Mutual Fund Holding: Increased from 4.64% to 4.74%

- Debt-to-Equity Ratio: 0.00 (Debt-free)

BDL’s strong foundation is armed with zero debt and growing institutional buying, which are two of the largest stability drivers of growth for long term.

Growth Factors Behind Bharat Dynamics Share Price

- Government Policies: Increase domestic defense production and a rise in government defence spending

- Technological Progress: R&D continues without a break and yields better defense products

- Export Opportunity: International markets open up

- Operational Efficiency: Better manufacturing capacity, cost reduction and cutting

Investment Risk For Bharat Dynamics Share Price

- Geopolitical Risks: International relations are unstable

- Dependence on Government Defence Spending: The growth would slow down if government defence spending declined.

- Technological Competitors: The improvement in technology might be a threat to the company by its competitors.

FAQs For Bharat Dynamics Share Price

Q1: Is Bharat Dynamics Limited a debt-free company?

A: Yes, BDL has a debt-to-equity ratio of 0.00, meaning it is completely debt-free.

Q2: What was the latest trend on institutional investments in BDL?

A: FII/FPI holdings were up from 2.94% to 3.09%, and mutual fund holdings rose from 4.64% to 4.74% in the last quarter.

Q3: What will be Bharat Dynamics Share Price in 2025?

A: ₹1,800 for the year 2025.

Q4: Why BDL is good investment in Defense space?

A: BDL is good investment in Defense space because BDL is good on Govt front. BDL is carrying good technology and also debt free.

Q5: In what way is the Make in India initiative an impetus to BDL’s growth?

A: The Make in India initiative is a platform for the upliftment of indigenous manufacturing of defense equipment. Hence, it is a positive factor for any such companies, and BDL is one amongst them.

Q6: How does BDL’s dividend yield compare with that of the industry?

A: BDL’s dividend yield is at 0.44% modestly placed in comparison with that of the industry.

This shows that Bharat Dynamics Limited remains an attractive Indian defense sector play, having healthy financials and technology, now being supported with increasing institutional interests. The Bharat Dynamics Share Price target presented from 2025 until 2030 reveal a performance that is just very impressive to investors in large. Based on the defense modernization and increase in self-reliance policies of India, this company has been one of the major contributors in determining the future direction of the Indian defense system.