Bharat Electronics Share Price Target From 2025 to 2030: BEL is a Navratna PSU under the Ministry of Defence, one of the largest players in India’s defence electronics and in fact an undisputed leader in the electronics space. This company has always earned its name for innovation due to cutting-edge product development in markets for defense, civilian, and exports. Increasing investor interest is building on BEL with solid fundamentals and a growth story.

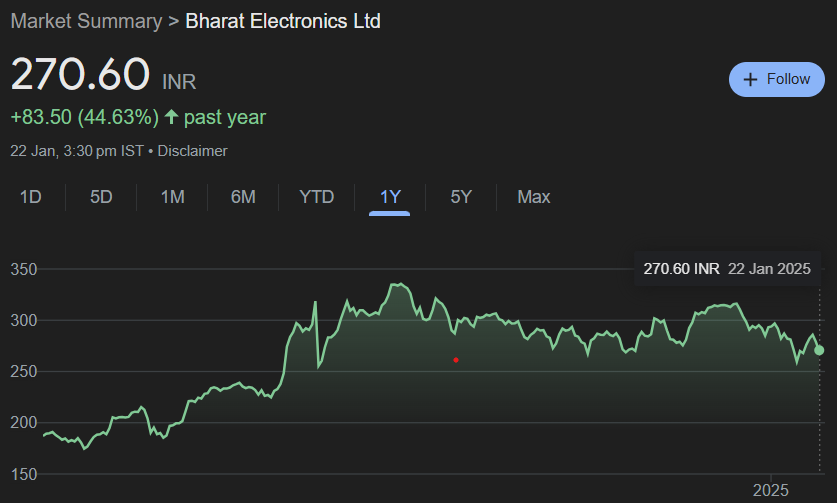

Stock Review Today For Bharat Electronics Share Price

- Open: ₹279.00

- High: ₹279.30

- Low: ₹266.30

- Market Cap: ₹1.98 Lakh Crore

- P/E Ratio: 43.54

- Dividend Yield: 0.81%

- 52-Week High: ₹340.50

- 52-Week Low: ₹171.75

Performance Bharat Electronics Share Price

- Previous Close: ₹279.00

- Volume: 2,12,72,549 shares

- Total Traded Value: ₹575 Crore

- Upper Circuit: ₹306.90

- Lower Circuit: ₹251.10

Analyst Ratings For Bharat Electronics Share Price

- Buy: 86%

- Hold: 5%

- Sell: 10% (Refinitiv Aggregated from 21 Analysts)

Fundamentals For Bharat Electronics Share Price

- Market Cap: ₹2,03,870 Crore

- P/E Ratio (TTM): 44.91

- P/B Ratio: 11.54

- Industry P/E: 42.99

- Debt to Equity: 0.00

- ROE: 25.71%

- EPS (TTM): ₹6.21

- Dividend Yield: 0.79%

- Book Value: ₹24.16

- Face Value: ₹1.00

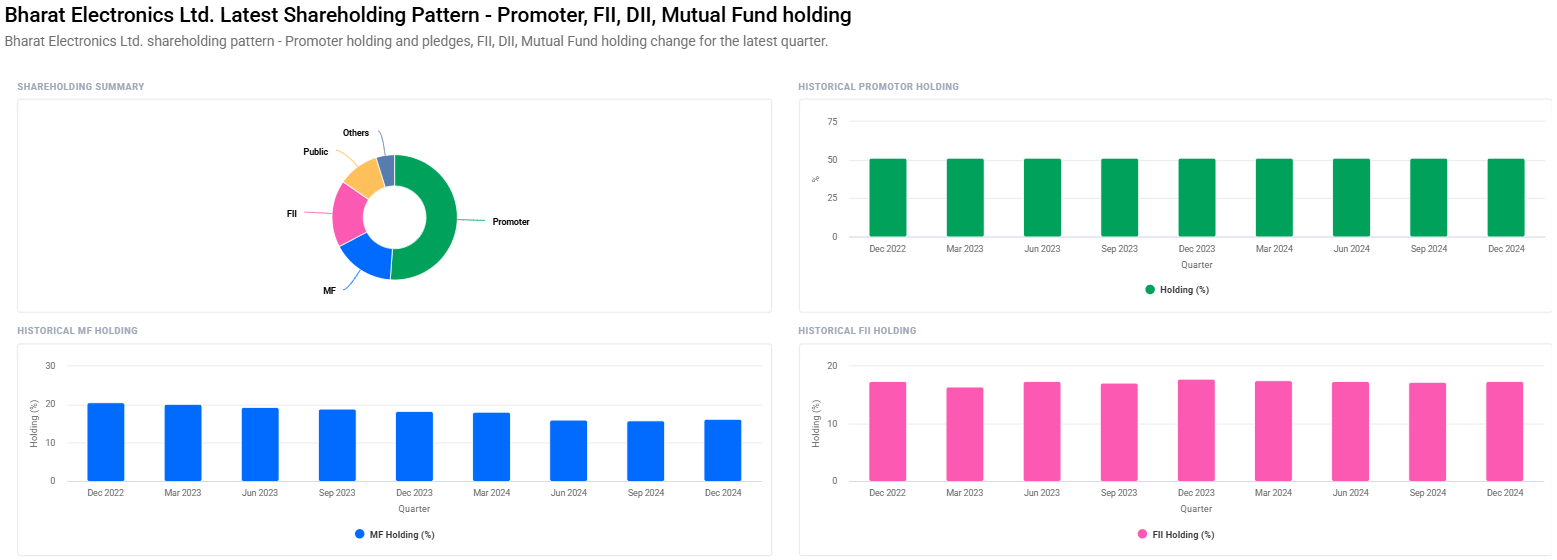

Promoter and Institutional Holdings

- Promoters: 51.14%

- Foreign Institutions (FII/FPI): 17.35%

- Mutual Funds: 16.17%

- Retail & Others: 10.58%

- Other Domestic Institutions: 4.77%

Recent Developments For Bharat Electronics Share Price

- FII/FPI holding is up from 17.27% to 17.35%.

- Mutual Fund holding is up from 15.81% to 16.17% with the MF schemes increased to 369 to 395.

- Institutional Investors holding is up from 37.49% to 38.28%

Technical Analysis (Day Performance) For Bharat Electronics Share Price

- Momentum Score: 48.5 (Technically Neutral)

- MACD (12, 26, 9): -5.8 (Bearish)

- ADX: 32.8 (Moderate Trend Strength)

- RSI (14): 40.4 (Neutral, trending towards Over Sold)

- ROC (21): -8.2

- MFI: 42.5 (Neutral)

- ATR: 8.5 (Moderate Volatility)

Bharat Electronics Share Price Targets (2025 to 2030)

| YEAR | TARGET PRICE (INR) | REMARKS |

| 2025 | 350 | Increasing defense contract and exports |

| 2026 | 520 | Entry into latest technologies |

| 2027 | 700 | Increased demand in defense system in global |

| 2028 | 880 |

Increased exports and tie-up |

| 2029 | 1060 | Increased demand in defense system in global |

| 2030 | 1240 | Strong Leadership in both defence and civilian sectors |

Innovations to continue profit margins For Bharat Electronics Share Price

BEL was established in 1954 to fulfill its effective role in the defense sector of India. The company has diversified over the years into different nondefense segments of homeland security, smart cities, and healthcare solutions. The excellent R&D infrastructure supports the leadership of innovation by the company.

Key Highlights/Performance Arenas For Bharat Electronics Share Price

- Multiple innovation and operational excellence awards won

- Market leader in supplying defense electronics to Indian Armed Forces.

- Increasing footprints in international markets through exports.

Growth Drivers For Bharat Electronics Share Price

- Increased Defense Budget Share: An upside for BEL.

- Export Opportunities: The Atmanirbhar Bharat initiative by the Government has opened export opportunities.

- Investment in R&D: Strengthens the product portfolio.

- Diversification: Foray into smart cities and healthcare solutions to avoid defense dependence.

FAQ Section For Bharat Electronics Share Price

1. Is Bharat Electronics a good long-term investment?

Yes, Bharat Electronics has good fundamentals, no debt, and good growth potential, hence making it a good long-term investment.

2. What are some of the key risks for BEL?

The key risks for BEL include geopolitical risk, competition, and dependency on government orders.

3. What are some of the differences that make BEL unique from its peers?

Focus on R&D, high-quality products, and government support make BEL different from its peers.

4. How does BEL contribute to the Make in India initiative?

BEL is a leader in indigenous defense production and has contributed significantly to the government’s Make in India vision.

5. Why is P/E ratio high?

The P/E of BEL reflects investor confidence and its growth prospects in both the defense and non-defense sectors.

Bharat Electronics Limited is one shining example of India’s self-reliance in defense production. Its robust financials, zero debt, and market leadership place it straight on the menu for long-term investors. Growth targets coupled with the government’s support make this company geared to explode with exponential growth in the coming decade.