Coal India Share Price Target From 2025 to 2030: Coal India Ltd. is the world’s largest coal-producing company, and it holds a great significance in India’s energy sector. Its massive reserve and government support, the Coal India Share Price between 2025 and 2030 attracts institutional as well as retail investors. The article encompasses the share price target, technical chart, fundamental statistics, company profiles, and some trends of that specific industry related to Coal India in brief.

Coal India Limited- Company Overview

Coal India Limited is a state-owned company and under the Ministry of Coal, India. It was established in 1975, with its headquarters at Kolkata, West Bengal. The company has different subsidiaries in India and produces over 80% of coal produced in India.

Key Indicators of Coal India Share Price

- Market Cap: ₹2.31 lakh crore

- P/E Ratio: 5.78; it is low since it is undervalued.

- Dividend Yield: 6.95% which is attractive to income investors.

- Debt to Equity Ratio: 0.19 (high indication of financial stability)

- ROE: 11.43%

Fundamental Analysis

- P/E Ratio (TTM): 5.78 way below the industry average of 21.55.

- P/B Ratio: 10.52

- EPS (TTM): ₹13.68

- Dividend Yield: 6.95%

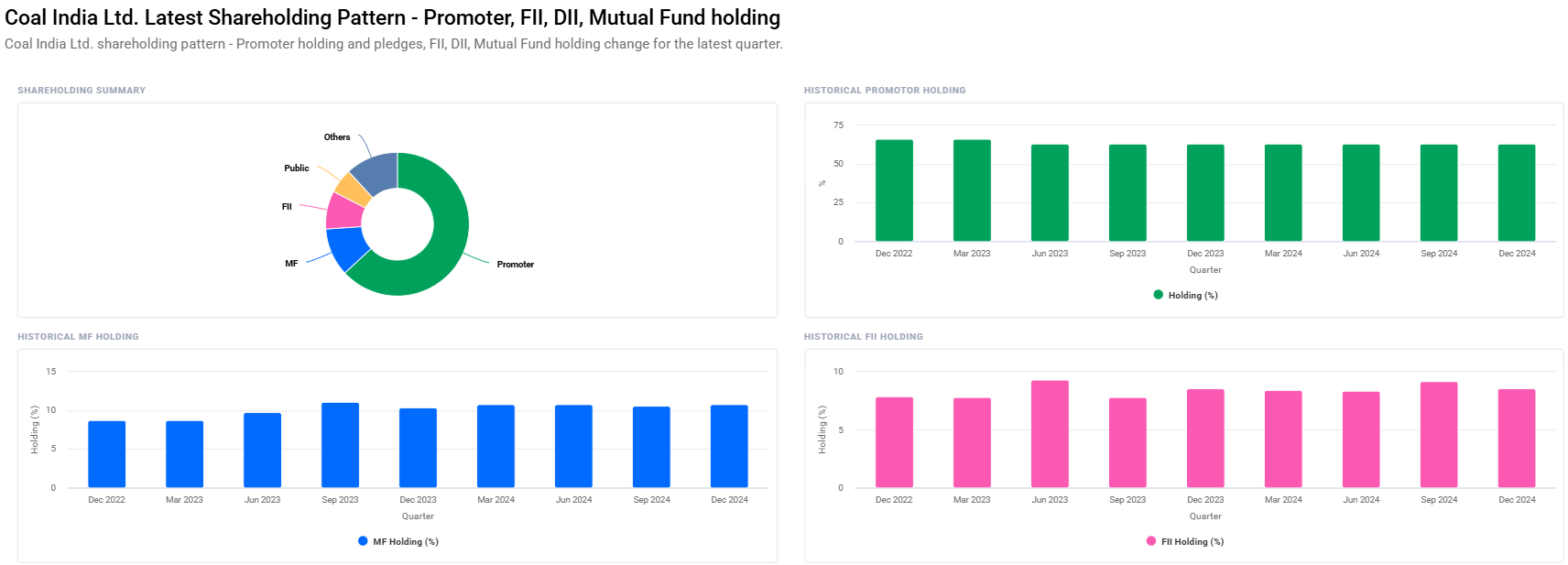

Shareholding Pattern For Coal India Share Price

- Promoters: 63.13%

- Domestic Institutions: 11.77%

- Mutual Funds: 10.81%

- Foreign Institutions: 8.58%

- Retail and Others: 5.70%

Coal India Share Price Targets (2025-2030)

The following table comprises Coal India’s projected share price targets for every year:

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹550 |

| 2026 | ₹730 |

| 2027 | ₹910 |

| 2028 | ₹1100 |

| 2029 | ₹1290 |

| 2030 | ₹1480 |

Technical Analysis For Coal India Share Price

- Score: 30.6 (technically weak as it is below 35)

- MACD (12, 26, 9)

- Value: -11.2 (Bearish sign since MACD is lower than its signal and centerline

- Day RSI: 33.4 (It is getting closer to the over-sold territory, if less than 30 is an over-sold one

- Value: 39.1 (Medium strength of trend is indicated)

- Value: 34.1 (Weakening the buying pressure)

- Value: 9.1 (The stock has average volatility)

According to the technical analysis, it has bearish momentum in the short term to Coal India Ltd. Hence, long-term investment buyers can take a buying cue.

Dividend Track Record

Coal India has provided the shareholder with adequate dividend distributions every time. Coal India is the holding with the highest income yields in the Indian market, which comes at around 7%, hence an attractive company for the income-oriented investor.

Driving Factors of Coal India Share Price

- Rising Energy Demand: Indian industrialization and urbanization increase the energy consumption demand. Being a coal producer, the increased coal-based power generation requirements shall help Coal India.

- Government Endorsement: As a state-owned entity, it enjoys governmental policy support; hence ensuring stable production and distribution.

- Export Diversification: Coal India is diversifying its sources of revenue with the objective of exporting to other countries in the region.

- Technological Upgradation: Installation of advanced mining technologies would further increase the efficiency along with reducing the operating costs.

- Renewable Integration: Coal India is also searching for diversification of renewable energy source, which will also improve its long-run revenue stability.

Risks Included For Coal India Share Price

- Regulatory Risks: Future production and consumption of coal will be impacted by environmental policies and regulations.

- Competition from Renewable Energy: In the long term, cleaner sources of energy will eventually decrease the consumption of coal.

- Volatility in Global Coal Prices: Revenue and profitability will be affected by volatile global coal prices.

Projected Financial Performance For Coal India Share Price (2025–2030)

Coal India is going to sustain its cash flow and profitability for the next year because demand has stabilized and operational efficiency maintained. Its low debt-to-equity ratio ensures financial soundness, and consistent dividend payouts make it an attractive long-term investment option.

FAQs About Coal India Share Price Target

Q1: What are the expected Coal India Share Price by 2030?

Coal India is likely to touch ₹1,480 by 2030. That is a lot of headroom it still has for the next six years.

Q2. Is Coal India a good stock to invest in for dividend yield?

Yes. Coal India at 6.95% dividend yield is a fantastic stock to invest in for regular dividend income.

Q3. What are the important factors that will influence Coal India share price in the near future?

Energies needed, government policies, international prices of coal, and competition coming from renewable energy sources are some of the key drivers.

Q4: How has Coal India stocks been valued in comparison with that of competitors?

The P/E for Coal India is at 5.78, which is way too lower in comparison with the industry average at 21.55, which makes the stock undervalued.

Q5: What are the risks coming along with investing in Coal India?

It faces regulatory challenges, competition of renewable energy, and volatile price fluctuations in the global coal market.

Q6: Long-Term Growth Strategy of Coal India

The long-term growth strategy of Coal India would be efficiency improvement, diversification into renewable energy sources, and greater exports to become sustainable.

One of the leaders of the energy segment in India is Coal India Limited, with excellent fundamental support as well as the benefits of a robust market position. Although short-term technical indicators continue to reflect some bearish momentum, the outlook for the stock remains pretty exciting over the medium term. Considering this, nearly four times price appreciation from existing levels can be expected for Coal India Share Price by 2030, so it will attract pretty good investors seeking long-term capital appreciation.

Conversely, the investors will also be tracking regulatory action and changes in the industry for better investment decisions. Its strong payout and undervaluation make Coal India even more attractive in the Indian equity market.