Coforge Share Price Target From 2025 to 2030: Indeed, the increasing momentum of Coforge Limited, one of the prominent global IT solutions companies, is indeed a result of solid service offerings and novel solutions. In other words, in the digital transformation push that the company continues to uphold, such services in banking and insurance or even otherwise are attractive in the tech space. It will give an elaborate analysis of Coforge to get share price targets from 2025 until 2030 using market trends, financial performance and technical analysis.

Current Market Data For Coforge Share Price

- Open: ₹8,415.00

- High: ₹8,469.05

- Low: ₹8,071.00

- Market Cap: ₹50,060 Crore

- P/E Ratio: 67.92

- Dividend Yield: 0.94%

- 52-Week High: ₹10,026.80

- 52-Week Low: ₹4,287.25

- Previous Close: ₹8,414.45

- Volume: 2,55,975 shares

- Total Traded Value: ₹207 Crore

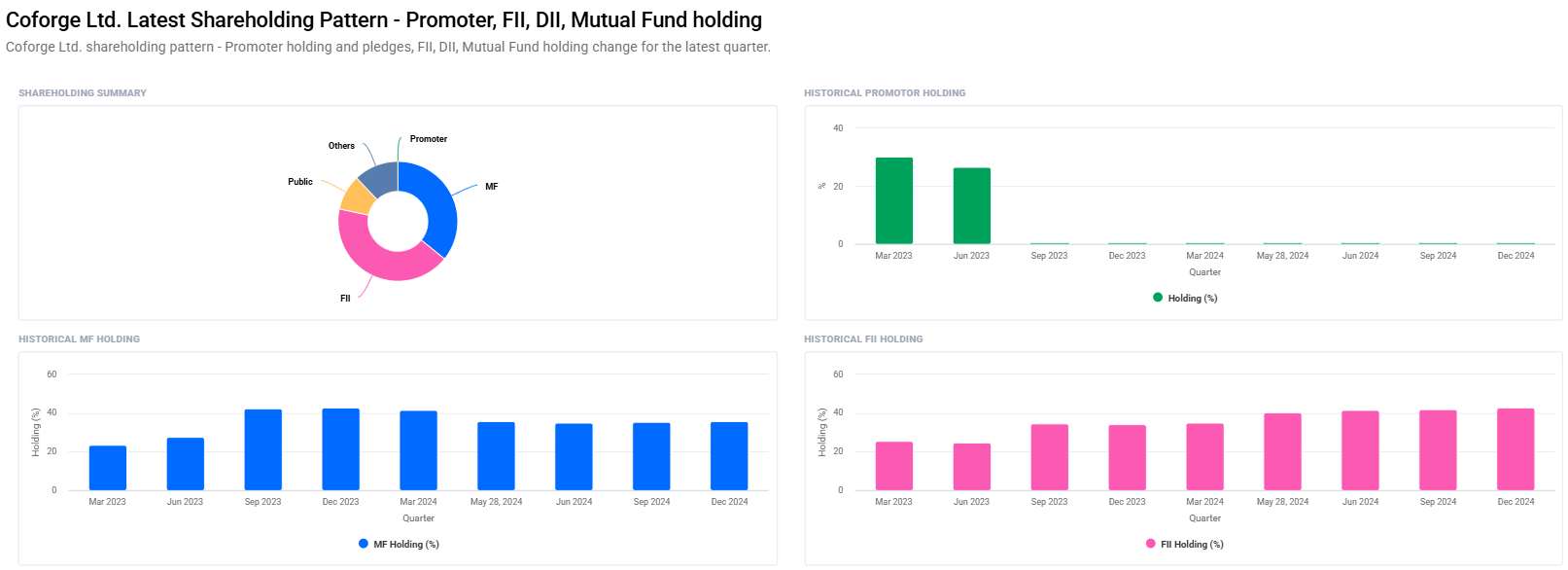

Shareholding Patterns For Coforge Share Price

- Foreign Institutional Investors: 42.55%

- Mutual Funds: 35.80%

- Other Domestic Institutional Investors: 12.06%

- Retail and Others: 9.59%

Latest figures depict foreign inflows, where FII/FPI has gained to 42.55%. The mutual fund houses have now increased entry to this investment mode by 35.80%.

Coforge Share Price Day Technical Analysis

- Day Momentum Score: 50.6 (Neutral)

- RSI (14): 38.6 (Neutral turning OVER sold)

- MFI: 44.4 (Neutral)

- MACD (12, 26, 9): -176.4 (Extremely Bearish)

- ATR: 310.3 (Extremely Volatile)

- ADX: 25.1 (Weak Trend)

- ROC (21): -5.8 (Negative momentum in the short term.)

- ROCs (125): 37.9 (Positive momentum in the long term.)

Financial Fundamentals For Coforge Share Price

- Market Cap: ₹56,264 Crore

- P/E Ratio (TTM): 72.64

- P/B Ratio: 9.41

- Industry P/E: 31.84

- Debt to Equity: 0.18

- ROE: 13.33%

- EPS (TTM): ₹115.83

- Book Value: ₹894.03

- Dividend Yield: 0.83%

Coforge Share Price Targets (2025 to 2030)

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹10000 |

| 2026 | ₹16000 |

| 2027 | ₹22000 |

| 2028 | ₹28000 |

| 2029 | ₹34000 |

| 2030 | ₹40000 |

2025 Coforge Share Price Target: ₹10,000

Coforge will continue its efforts to scale up digital services and improve its cloud-based products. The collaborations and AI, automation innovation that the company makes will help the company achieve the target.

2026 Coforge Share Price Target: ₹16,000

With ongoing adoption of digital transformation services in global corporations, Coforge can expect substantial benefits. Strategic investments and R&D would enhance its market position.

2027 Coforge Share Price Target: ₹22,000

The next-gen IT solution has a much better prospect in the hand of technological advances related changes in the industry. All vertical expansion and international markets will help to get the share price to increase further.

2028 Coforge Share Price Target: ₹28,000

Coforge would have concluded 2028 as seen as a market leader for the cloud computing, automation, and cybersecurity services owing to its solid financials and growing investor confidence will propel that growth.

2029 Coforge Share Price Target: ₹34,000

Rigorous client relationships coupled with leadership of digital innovations by Coforge. The company will continue its upward march in the market demand for digital and IT services.

Coforge Share Price Target 2030: ₹40,000

Being an innovator in the technological world, share price of Coforge may shoot up with a continuous growth strategy and sound fundamentals. There are high chances for the company to lead in the IT sector.

Determinants of Coforge Share Price

- Global Digital Transformation: A sharp increase in demand for IT services and digital transformation would drive the growth of Coforge.

- Technological Innovation: Continued investments in AI, automation, and cybersecurity would make Coforge competitively superior.

- Strategic Partnerships: Strategic partnerships with world-leading technology brands would elevate the service portfolio and expand the client base.

- Financial Stability: a low debt-to-equity ratio and healthy ROE points towards sustained financial strength.

- Market Sentiment: Increasing FII and mutual fund investments have a positive indication about investor confidence.

Frequently Asked Questions For Coforge Share Price

Q1: Is it a good long-term investment?

A: Of course, Coforge has been showing fairly healthy financial growth by focusing on innovation, and hence, this is a promising long-term investment.

Q2: What can possibly decline Coforge Share Price over next several years?

A: Technological breakthroughs or worldwide markets’ trends might decline its stock price. Also, a decline in its profitability and financial performance.

Q3: What will be the Share Price of Coforge 2030?

From the given current trends and analysis, by the end of 2030, Coforge’s share price is going to reach almost around ₹ 40,000.

Q4: Coforge compared to peers?

As its P/E ratio is very much higher in contrast to an average of that particular industry so valuation premium through good growth has to be shown for this reason.

Q5: What is the company’s dividend policy?

A: Coforge has a dividend yield of 0.83%, reflecting its commitment to rewarding shareholders.

Company Information

Coforge Limited, formerly NIIT Technologies, is a global IT solutions company that provides transformational services to all sectors across the globe, including banking, insurance, travel, and healthcare. The company has a large footprint in North America, Europe, Asia, and Australia. It is customer-centric, providing innovative solutions with business outcome drivers.

Key Highlights:

- Founded: 1981

- Headquarters: Noida, India

- Key Services: Cloud computing, digital transformation, automation, artificial intelligence, and cybersecurity

- Global Presence: Operations in more than 20 countries

Coforge Limited offers a good investment prospect for long-term investors. This company is serious about digital transformation through technological innovation and financial stability, and so will exhibit high growth in the coming years. Investors can expect strong returns, with share price targets projected to reach about ₹40,000 by 2030.