Cressanda Railway Solutions Share Price Target From 2025 to 2030: The name is huge as far as the Indian railway industry is concerned. Cressanda Railway Solutions Ltd provides one window service; a plethora of engineering, construction, and operation activities under its own umbrella, catering to the requirements of the railways. In the recent past, however, it has been witnessing stocks that appear to be undeniably in a volatile posture. In fact, value buildup for those wanting to understand further price movement from the Cressanda Railway Solution perspective will definitely require such analysis. This article discusses the Cressanda Railway Solutions Share Price target from 2025 to 2030, using technical indicators, market performance, and company aspects.

Present Market Scenario For Cressanda Railway Solutions Share Price

As a precursor to exploring the prices in the future, let us first see where the stock of Cressanda Railway Solutions stands as of today.

- Present Price: 7.48 INR

- 52-Week High: 24.90 INR

- 52-Week Low: 6.20 INR

- Market Cap: 316.94 Crores

- P/E Ratio: 51.39

- Dividend Yield: N/A

- Volume: 14,05,671

- Total Traded Value: 1.05 Cr

- Upper Circuit: 7.49 INR

- Lower Circuit: 6.79 INR

Technical Analysis For Cressanda Railway Solutions Share Price

There are many technical indicators used, which reflect the momentum, strength, and volatility of the stock. Now, let us look at the Cressanda Railway Solutions’ day-to-day technical analysis:

- Momentum Score: 34.2 (Technically weak)

- MACD (12, 26, 9): -0.6 (Bearish indicator)

- ADX (Average Directional Index): 26.8 (Weak trend indicator)

- RSI (Relative Strength Index): 41.6 (Neither oversold nor overbought but weak trend)

- ROC (Rate of Change) 21:-13.0 Indicates a negative momentum.

- MFI (Money Flow Index): 18.7 Identifying a rebounding stock.

- ATR (Average True Range): 0.44 Indicates lower volatility.

- ROC (125): -46.5 Indicates long-term bearish trend.

These technical indicators depict that the stock is technically weak, and for Cressanda Railway Solutions, the market sentiment seems bearish in the short term. But in any case, with the low MFI, there’s every possibility it might rebound and investors should cautiously watch out for this.

Predictions for Cressanda Railway Solutions Share Price 2025 to 2030:

With current market trends, fundamentals of the company, and history price volatility, we can project the future Cressanda Railway Solutions Share Price like the following.

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹25 |

| 2026 | ₹45 |

| 2027 | ₹65 |

| 2028 | ₹85 |

| 2029 | ₹105 |

| 2030 | ₹125 |

Critical factors which would support future growth in the company:

- Industry Growth: The Indian railway sector is experiencing massive modernization with ambitious government initiatives like Dedicated.

- Freight Corridor and high-speed rail projects: Cressanda Railway Solutions will significantly benefit from these projects, as the completion of these projects will increase demand for rail engineering and construction services.

- Infrastructure investments: India invests much on infrastructure growth, including transport, urban development, and logistics. With Cressanda Railway Solutions implementing several railway projects in the country, it places the company at the frontline of developing its infrastructure investment.

- Technological Advancement: Cressanda Railway Solutions is increasingly investing in technology to streamline its operations. The advancements of technology such as AI in railway operations and automation in railway maintenance may turn out to be game-changers for the company, which can increase efficiency and cost-effectiveness.

- Financial Stability: Its ROE stands at 4.07%, and Debt to Equity ratio of 0.01, showing a financially stable company. That is reflected in the P/B Ratio of 1.82, which appears promising by sending an undervalued message with respect to its book value.

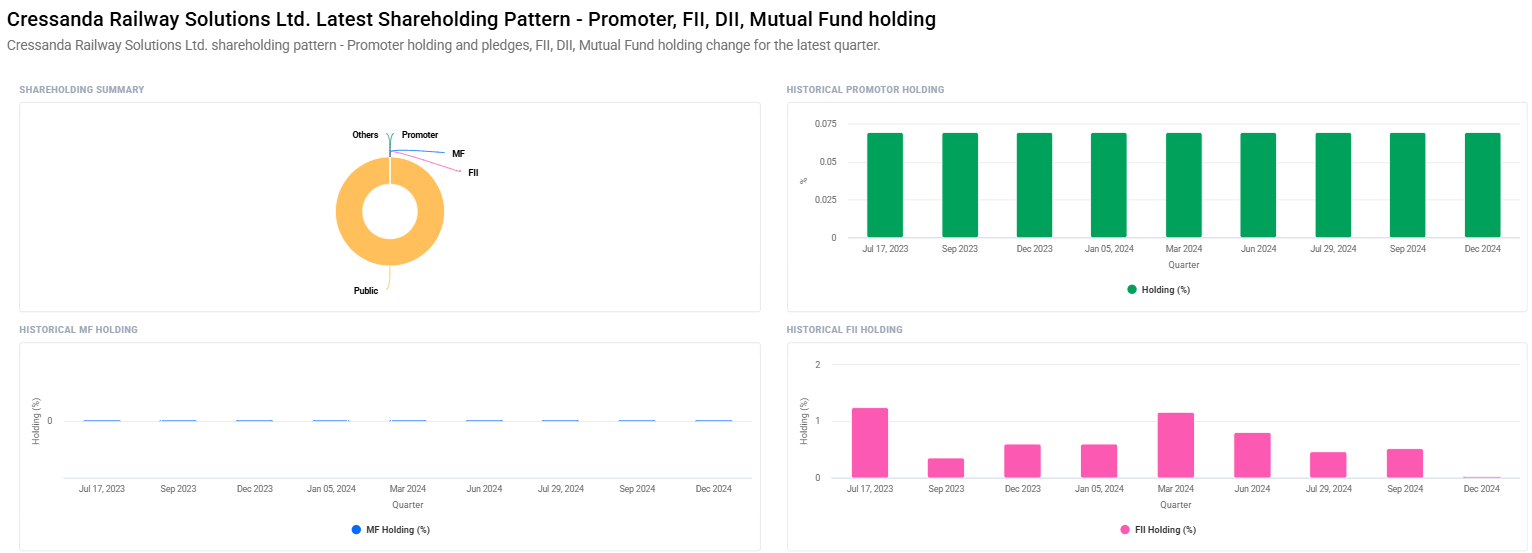

- Promoter And Institutional Holdings: The percentage of promoters has been shown by the available latest data as being 0.07%. Similarly, the holding of institutional investors has reduced its shareholding to 0.02% from 0.54%. So, a weakness in terms of minimal institutional interest can be turned into a strong opportunity for the long-term investors to get the entry at reduced prices.

Risk of Investments For Cressanda Railway Solutions Share Price

While Cressanda Railway Solutions looks promising, there are risks involved in investing in the company:

- Market Fluctuation: The stock is highly volatile with wide-open gaps and near a significant gap between 52-week high and low; this leads to a volatile price.

- Technically Weaker Position: It is technically weaker at this point of time with negative pointers from all the three MACD, ROC, and RSI. A lot of care needs to be exercised and short-term variations need to be tracked closely.

- Low Institutional Participation: This might imply a less stable stock price due to the reason that it will take more time for the stock to recover its potential highs.

FAQs For Cressanda Railway Solutions Share Price

1. What is the current trend in the market for Cressanda Railway Solutions stock?

Technically, it is weak as of now and indicators are bearish. The MACD, RSI, and ROC have negative momentum; however, it can rebound at any time since the MFI is low.

2. What is the price target of Cressanda Railway Solutions for the period from 2025 to 2030?

On the basis of current data, the expected Cressanda Railway Solutions Share Price target is as under:

- 2025: ₹25

- 2026: ₹45

- 2027: ₹65

- 2028: ₹85

- 2029: ₹105

- 2030: ₹125

3. What are the growth drivers of Cressanda Railway Solutions?

Growth drivers for Cressanda Railway Solutions Share Price include ongoing infrastructure investments in India’s railway sector, the government’s focus on modernization, and self-developed technology in rail operations and maintenance.

4. What are risks of investment in Cressanda Railway Solutions?

The volatility of the stock combined with poor technical conditions has investors looking, but the diminishing interest from the institutions leaves its price prone to fluctuations, and since its financial health is stable it cannot be strong enough in the short term.

5. Is Cressanda Railway Solutions a good investment?

The stock is a long-term play, but the current technical indicators are weak. The investor should closely monitor the stock, especially if there is a sign of a technical rebound.

Cressanda Railway Solutions is a stock that will interest long-term investors who would like to invest in the growth of India’s railway and infrastructure sectors. Although technical indicators might be warning against this stock in the short term, fundamentals of the company are very impressive, which includes its debt-to-equity ratio and stability of financial position. The market share of Cressanda Railway Solutions may increase as the railway sector keeps on modernizing and expanding that increases the chance of stock to go up.

With a Cressanda Railway Solutions Share Price target of ₹25 in 2025, and with a steady climb towards ₹125 by 2030, the case presented by Cressanda Railway Solutions for investors willing to ride out short-term volatility and still reap its long-term rewards is compelling indeed.