Dabur India Share Price Target From 2025 to 2030: Dabur India Ltd. is a word synonymous with the concepts of trust, Ayurveda, and health. The company is far more than just a brand; it is a legacy. More than 140 years of innovation and excellence have shaped a significant portion for Dabur in the FMCG industry. The question from an investor perspective would be how far Dabur can reach. Let us analyze possible Dabur India share price targets ranging from 2025 to 2030 by data, analysis, and the growth story behind it.

Present Stock Summary For Dabur India Share Price

| Parameter | Value |

| Open Price | ₹528.65 |

| 52-Week High | ₹672.00 |

| 52-Week Low | ₹489.20 |

| Market Cap | ₹91,780 Cr |

| P/E Ratio | 52.13 |

| Dividend Yield | 1.05% |

| Debt-to-Equity Ratio | 0.17 |

| Return on Equity (ROE) | 17.26% |

All of these numbers represent the good underlying of Dabur and provide strong potential for sustained growth.

Dabur India Share Price Target Estimates for the Year 2025-2030

This is how the Dabur India future share price trend will appear like:

| Year | Target Price | Growth Drivers |

| 2025 | ₹700 | Demand of the product increased in Ayurvedic, increased sales through home routes. |

| 2026 | ₹900 | International business. Introduction of a new product range |

| 2027 | ₹1100 | The enhanced access in the rural market as well as the diversification in revenue streams. |

| 2028 | ₹1300 | Investment in Research and Development. Increased spending through digital marketing channels. |

| 2029 | ₹1500 | Enhanced worldwide trend, continued rise in brand loyalty amongst consumers |

| 2030 | ₹1700 | Long term market leadership by jump in environmental product demand |

Drivers for Dabur India Share Price Growth

1. Branding through heritage: It has gained more than 140 years of trust. In return, it boasts extremely strong consistent demand across generations. An Ayurvedic-based company encounters the increasingly trendy preference in customer for a natural and organic product.

2. Rural Growth: The opening up of tremendous target customers helps in penetrating into the rural market of Dabur and helping to increase its revenue.

3. Innovation and Product Portfolio: Dabur’s innovation and diversification of markets from healthcare to beauty ensures markets remain relevant.

4. International Market: Dabur is represented in more than 120 countries. This is an enormous international player and, therefore, ensures revenue stability and growth.

5. Operating Efficiency: A low debt-to-equity ratio at 0.17 and high ROE at 17.26% show the financial muscle and operating efficiency of Dabur.

Technical Analysis: Dabur India Share Price Momentum in 2025

| Indicator | Value | Analysis |

| RSI (14) | 58.5 | Neutral zone, scope for a rise. |

| MACD | 0.9 | MACD is positive and above the signal line. |

| ADX | 23.6 | Steady trend; scope for further strengthening. |

| MFI | 60.0 | Healthy trading range; not overbought and not oversold. |

All technical indicators suggest Dabur to go steady with limited downside risk.

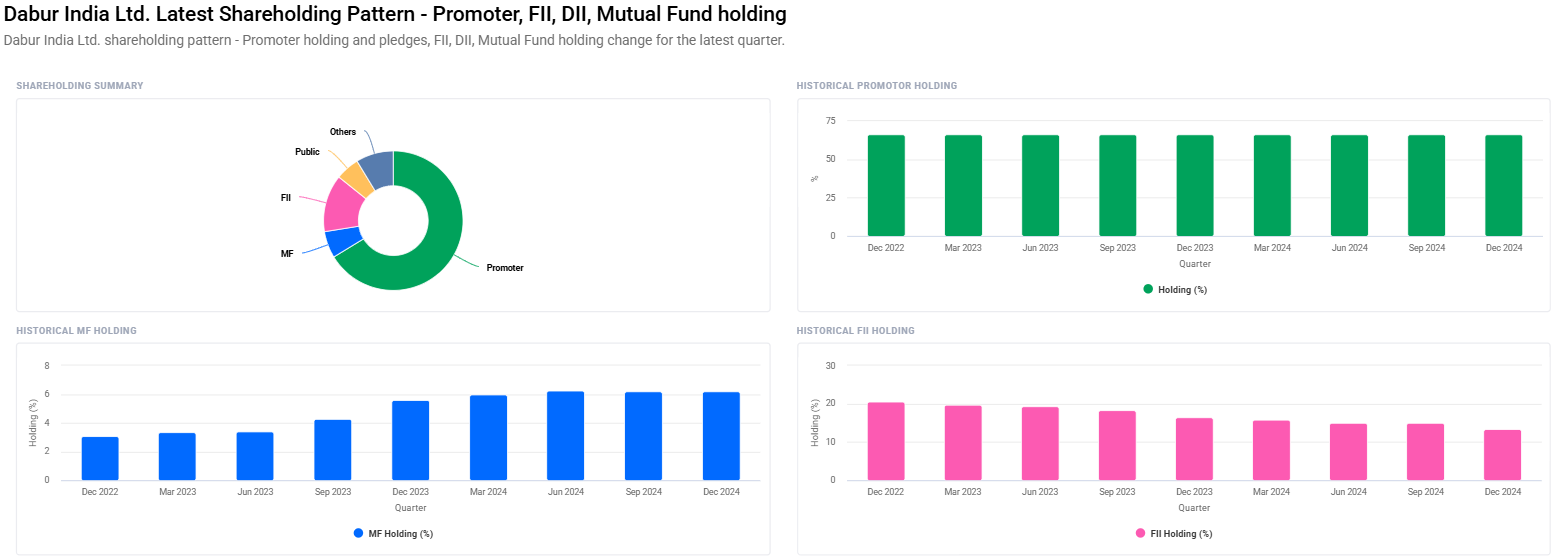

Ownership and Shareholding Pattern For Dabur India Share Price

- Promoters: 66.26% (rose marginally in last quarters).

- FII/FPI: 13.27% (dropped marginally).

- Mutual Funds: 6.20% (stable).

- Retail and Others: 5.54%.

This ownership structure speaks of a high level of confidence from both promoters and institutional investors, making the growth story of Dabur even more believable.

Why Dabur is a Long-Term Winner?

- Ayurveda Legacy: Natural wellness product leader.

- Brand Recall: Healthy sales via robust brand recall.

- FMCG Sector Growth: Health and wellness products are in higher demand.

- Financial Soundness: Low debt, regular dividend pay-out, and high ROE.

Concerns to be Addressed For Dabur India Share Price

- Market Competition: It will be hit as the firm belongs to FMCG sector where it is too competitive.

- Cost of Natural Ingredients: It is quite sensitive towards its margin due to high cost of raw materials

- Global Risks: These are mostly of regulatory and political types

However, diversified portfolio along with robust fundamentals make it Dabur India an investment which shows resilience.

FAQs: Dabur India Share Price Insights

1. Dabur India, is a good long term investment?

Yes, Dabur India’s strong balance sheet, brand image that people believe in, and growth prospects are excellent for long-term investment.

2. What will be the share price of Dabur India in the year 2030?

If growth continues without much interruption, Dabur India share price will be around ₹1,700 in 2030.

3. Why do investors like Dabur’s dividend policy?

If one takes the dividend yield as 1.05%, then Dabur promises a guaranteed returns to its shareholders, that too in steady hands, which means predictable and a sure source of income.

4. How dangerous is investment in Dabur India?

Even though the growth curve of Dabur India has been optimistic, competition, the volatile cost factor due to fluctuating raw material, and globalization bringing regulatory risk remains.

5. How International does Dabur stands?

More than 120 countries’ reach and the Ayurveda-based product portfolio makes Dabur’s scope of growth tremendous.

Conclusion: How to Reach 2030 with Dabur India

A name synonymous with dependability in terms of stability and growth within the FMCG space, Dabur India Ltd comes with a fine print of success. The innovation, expansion of the rural sectors, and sustainability speak volumes of making it well enough for long-term investors.

It goes out to any stock that delivers consistent growth without exposing too much risk; and therefore, Dabur India turns out to be the best choice for any portfolio. So don’t miss this ride with one of India’s most trusted brands!