Dam Capital Share Price Target From 2024 To 2030: DAM Capital Advisors Ltd is a leadership company in the financial service industry. The primary focus of this company is upon investment banking as well as advisory services. Its expertise in mergers and acquisitions, equity, and debt capital markets along with corporate finance solutions has placed this company well above the rest of the competitors in the market. This kind of strength in the market and powerful leadership attracts an investor to put money into such companies, that seek growth into the financial service sector.

Key Market Statistics For Dam Capital Share Price

- Market Price Current: 304.10 INR

- Open: 303.65 INR

- High: 311.30 INR

- Low: 301.35 INR

- Market Cap: 2,141 Crore INR

- P/E Ratio (TTM): 16.75

- 52 Week High: 456.90 INR

- 52 Week Low: 274.50 INR

- Dividend Yield: 0.17%

- Book Value: 23.00 INR

- Debt to Equity: 0.00

- EPS (TTM): 9.98

DAM Capital Share Price Forecast Predictions

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹500 |

| 2026 | ₹670 |

| 2027 | ₹840 |

| 2028 | ₹1010 |

| 2029 | ₹1180 |

| 2030 | ₹1350 |

2025: Dam Capital Share Price Target 500 INR

The market will recover soon. In this respect, increasing demand for investment advisory services would shift the stock of DAM Capital toward 500 INR. Thereby focusing on acquiring more clients and consequent strategic deals would lead to the growth reflected above.

2026: Dam Capital Share Price Target 670 INR

Perhaps, by 2026, strategic investment made by the company and market expansion will be rewarding. Along with sectoral growth, the stock might witness the surge of around 670 INR.

2027: Dam Capital Share Price Target 840 INR

DAM Capital’s strong market share gain in investment banking and the successive completion of such high-profile deals may take this stock to an approximate level of 840 INR.

2028: Dam Capital Share Price Target 1010 INR

Above all, the healthy growth along with adding services, the price of DAM Capital will surpass 1000 INR. With change in finance sector towards high advisory services, the share price will be going to spike high.

2029: Dam Capital Share Price Target 1180 INR

Through strategic alliances in finance and highly technological synergy, the value of stock will increase as much as approximately 1180 INR.

2030: Dam Capital Share Price Target 1350 INR

If the stable revenue growth continues, the steady market, and the growing customers, then, by 2030, DAM Capital stock will reach 1350 INR.

Technical View of Dam Capital Share Price

- Day Momentum Score: 11.5 (Technically week; stocks that score below 35 are taken as week)

- RSI (14): 36.5 (Closing at the oversold level)

- ATR (Average True Range): 22.6

- ADX: 50.1 (At a very high degree which indicates strong trends)

- MFI (Money Flow Index): 50.8

- ROC (21-Day): -24.7

With these technical steps, one can summarize that even though DAM Capital has technical weakening currently, it has a bright long-term growth ahead because of market inclination and proper operating systems.

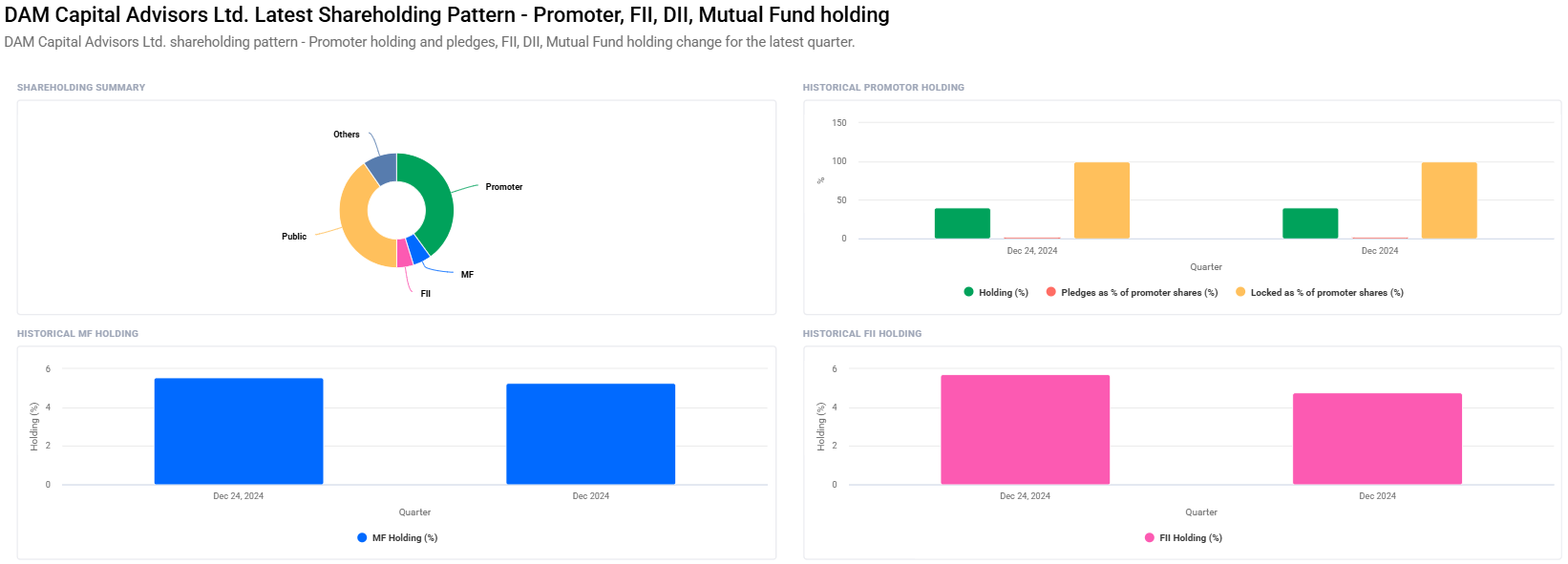

Fundamental Information For Dam Capital Share Price

- Promoter Holding: 40.00%

- Retail and Others: 40.45%

- Other Domestic Institutions: 9.56%

- Mutual Funds: 5.25%

- Foreign Institutions: 4.74%

Balanced Shareholding Pattern There is an extremely healthy mix of promoter control and institutional investment which reflects long-term growth potential.

Frequently Asked Questions For Dam Capital Share Price

Q1: Is DAM Capital a good long-term investment?

A: Yes, due to its solid fundamentals, no debt outstanding, and increasing market share. This compels expectations for considerable long-term growth of DAM Capital.

Q2. What should one consider as a risk associated with investing in the DAM Capital

A: Market fluctuations, financial crises, and alterations in the finance sector policy have a bearing over the trend followed by the trend of the respective stock prices

Q3. Enumerate the recent technical reasons wherein one can prove that DAM is technically weak

A The Momentum score shows 11.5, as the ROC carries a negative sign, the companys stock will be at its technical short run weak.

Q4: What will propel the growth of DAM Capital in years to come?

A: Expansion of investment advisory services, strategic acquisitions, and technological innovation in financial services.

Q5: Is having zero debt an advantage for the company?

A: Absolutely. Zero debt provides the company with higher financial flexibility and more immunity to economic difficulties.

It remains one of the fine investment among stocks in financial service for the investor, DAM Capital Advisors Ltd. Technically remains weak but from a fundamental level, it seems strong and even plans for further growth are impressive, and for that matter is debt-free; it would perfectly fall into that category of enticing stock holdings amongst stable and with high yields-oriented investors seeking investment in stable yield and high can find extremely seductive in these portfolios between the years 2025 and 2030.