Davangere Sugar Share Price Target From 2025 to 2030: Davangere Sugar Company Limited is one of the major companies in the sugar industry in India, which has a history of agrarian traditions and sustainability. As such, it is always an investment preference due to the growth opportunities that exist in any developing industry associated with rural development and central policies. This article aims to provide a broad overview of the targets of Davangere Sugar Share Price from the year 2025 to 2030, supported by financial insights, technical analysis, and market trends.

About Davangere Sugar Company Ltd.

Davangere Sugar Company Ltd. is one of the big sugar mills which also enjoys a good experience the company has about agro-processing and sugarcane cultivation activities. The Company also produces some by-products, namely molasses, as well as bagasse which makes good utilization of the resources available; which ensures sustainability in its operations, which is a healthy environmental reason.

Principal Ratios For Davangere Sugar Share Price

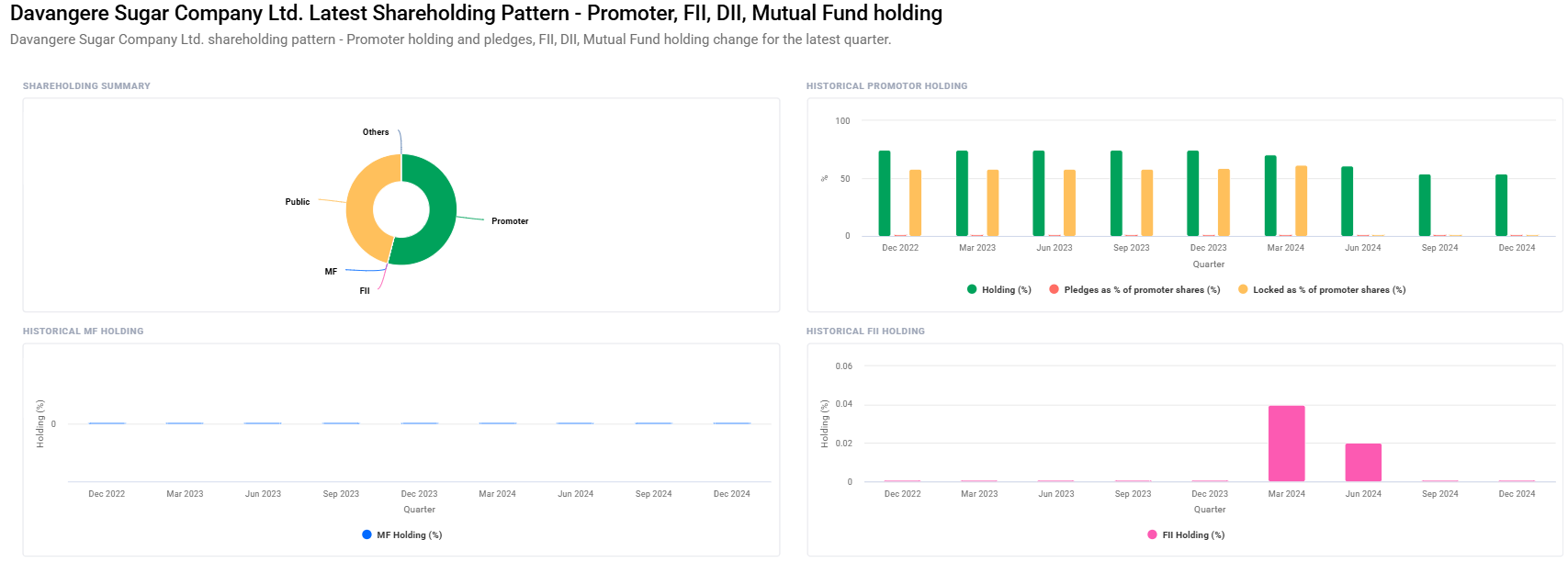

- Promoter Holding 54.04% shows excellent holding.

Industry Influence: The company operates in an industry where the government supports it via incentives and policies, including sugar export, ethanol blending program, and rural employment.

Current Events: The company has always tried to reduce its cost base and maximize its efficiency; hence, it is very well prepared for future growth.

Fundamental and Technical Analysis For Davangere Sugar Share Price

- Market Cap: ₹568 Cr

- P/E Ratio (TTM): 43.14 Industry Average: Very High

- Debt-to-Equity Ratio: 27.36 A high debt level reflects bad financial discipline level.

- Book Value: ₹1.99

- ROE (Return on Equity): 3.62%

Technical Indicators (Day Analysis) For Davangere Sugar Share Price

- RSI (Relative Strength Index): 55.8 Neutral Region

- ADX: 26.4. The trend is showing it is of average strength.

- MACD Line: Bullish signal since the line is above the signal line.

- Momentum Score: 46.62. The stock doesn’t seem to be on any trend currently.

It may claim to have a relatively higher debt-to-equity ratio, stable fundamentals, and increasing interest from investors, but it is one of those stocks that will face long-term growth.

Davangere Sugar Share Price Target (2025 to 2030)

The above historical performance, industry outlook, and market trends can be used to justify the share price graphs for the coming years:

| YAER | TARGET PRICE (₹) | ANALYSIS |

| 2025 | ₹12 | It will grow due to rising sugar demand and government sops. |

| 2026 | ₹19 | Revenue will increase due to higher ethanol. |

| 2027 | ₹26 | The process of debt reduction and operational efficiency will begin |

| 2028 | ₹33 | Stable market position; exports are expected to some geographies. |

| 2029 | ₹40 | Growth is expected as ethanol blending mandates will increase, largely during those periods when sugar shortages are reported in the world. |

| 2030 | ₹47 | Diversification with sustainability-oriented growth |

Determine Davangere Sugar Share Price Growth

1. Government Policies: The ethanol-blending policy of the Indian Government is also supporting the sugar exports that are helping the sugar companies like Davangere Sugar build a strong platform for growth.

2. Growth in Ethanol Production: Ethanol production as revenue source to produce sustainable renewable source of energy.

3. Exportability: International as well as conducive regulations towards exportation of the product are expected to generate exemplary revenue streams.

4. Operational Improvements: Debt reduction and improvement in operational efficiency to help sustain profit margins with investors’ confidence.

Threats and Risk Factors For Davangere Sugar Share Price

1. Higher debt: A debt-to-equity ratio of 27.36 reveals that the company has a very high leverage position and, at lower revenue periods, is prone to financial risk.

2. Price Volatility: It varies directly with the profitability of the company as well.

3. Climate Change Sensitivity: It is climate change-sensitive as it depends on the harvesting of sugarcane based on weather.

Frequently Asked Questions (FAQs) For Davangere Sugar Share Price

Q1: Good long-term investment for Davangere Sugar?

A: Davangere Sugar is promising in the long-term investment sense since it grows with both sugar as well as the ethanol market, but carries debt levels high, so the improvements on the operating side will attract investors.

Q2: What are the growth triggers for this business?

A: Government policies that allow it to produce more on ethanol, export sugar and renewable energies are growth triggers for Davangere Sugar.

Q3: Why the debt-equity ratio is so high for this company?

A: High debt-equity ratio reflects that there has been much borrowing perhaps for capacity expansion. It will bring revenue obviously but financial risk increases as well.

Q4: What will be the expected Davangere Sugar Share Price in 2030?

A: As per the current trend and market study, ₹47 will be reached in 2030.

Q5: Future Role of Ethanol Production?

A: Ethanol production is going to be a huge growth opportunity since that actually fits the renewable energy ambitions of India and, more importantly, can drive a higher-margin revenue stream.

One of the best-positioned firms in the Indian sugar industry is Davangere Sugar Company Ltd., with massive growth potential for the company supported by government incentives offered, increased ethanol production, and international demand for sugar. Firm operational improvements and expansion efforts in the market are likely to yield positive long-term results, considering the high debt level presently.

Investors should be extremely cautious and keep an eye on the fiscal health of this company as well as the general market conditions. Assuming a value estimate of Davangere Sugar Share Price of ₹47 by 2030, one with a high risk appetite and investment horizon might find investments in Davangere Sugar promising.