Delhivery Share Price Target From 2025 to 2030: This logistics and supply chain company, Delhivery Limited, has been a flag-bearer for India because of the pan-India outreach and innovation in technology. The prospects for this growth shall continue in future years also, just because the evolution in the e-commerce ecosystem and tremendous emphasis on efficiency and automation help increase the rate of growth. An article is prepared to present company fundamentals, technical analysis, prospects, and share price forecasted for the years 2025 to 2030.

About Company

Logistics company founded in 2011, Delhivery, has been altering the contours of logistics services with its parcel transport, warehouse management, cross-border logistics, and supply chain analytics services. By means of an advanced technology platform, it services all e-commerce majors, SMEs, and enterprise clients all over India, and therefore stands as one of the leaders in India’s logistics sector.

Key Facts For Delhivery Share Price

- Market Cap: ₹24,304 Crores

- P/E Ratio (TTM): 3,268.50

- Book Value: ₹124.62

- Debt to Equity Ratio: 0.15 (it is the statement showing it possesses minimal degree of leverage.

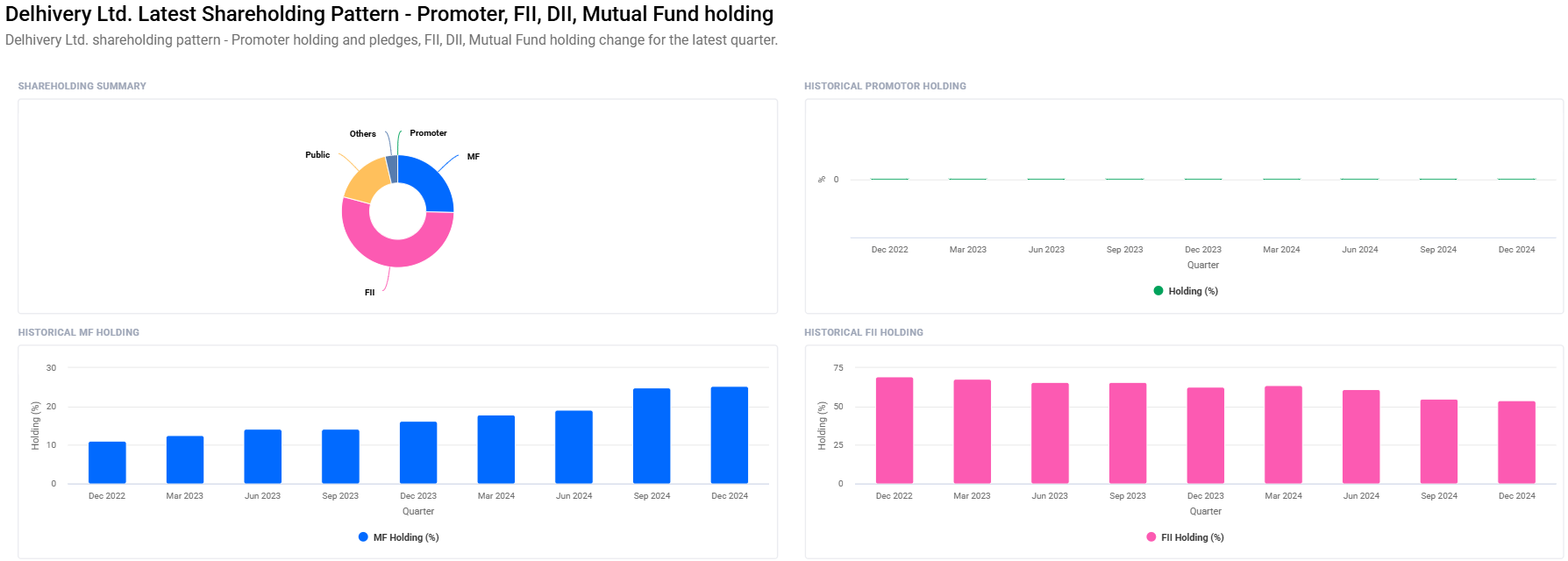

- Holding by Foreign Institutions: 53.74%

- Holding by Mutual Fund: 25.37%

The company has high reliability because it reflects improved confidence in its share of this stock during these periods whereas its dealing with short-term technical hassles when this had very low debt equity ratio along with higher mutual funds holding.

Market Summary

| Metric | Value |

| Opening Price | ₹327.00 |

| Last Closing Price | ₹326.95 |

| Highest | ₹331.25 |

| Lows | ₹319.05 |

| 52 week High | ₹488.00 |

| 52 week Low | ₹312.35 |

| Turnover | 10,97,225 shares |

| Total Turnover Value | ₹35.30 Crores |

| Technical Trend Score | 30.6 (Weak) |

Technical Analysis Summary

Daily Indicators

- Momentum Score: 30.6 (Technically weak)

- RSI (14): 38.8 (Approaching oversold territory)

- MACD: -7.3 (Strong bearish signal)

- ADX: 16.7 (Weak trend strength)

- ROC (21): -8.3 (Negative momentum)

Notes For Delhivery Share Price Target From 2025 to 2030

Delhivery shows fairly weak short-term technical indicators, but it exhibits bearish tendencies in the momentum indicators, but such ripples are normal for growth companies in the phase of fast growth and reinvestment.

Delhivery Share Price Projections From 2025 to 2030

Here are the share price targets according to the growth strategies of Delhivery, market analysis, and projected expansion in the industry.

| YEAR | EXPECTED SHARE PRICE (₹) | GROWTH CATALYSTS |

| 2025 | ₹500 | Better e-commerce deliveries and cost efficiency |

| 2026 | ₹670 | AI incorporations for logistics improvement |

| 2027 | ₹840 | Expansion in the tier 2 and tier 3 cities |

| 2028 | ₹1010 | Improved cross-border logistics and warehousing |

| 2029 | ₹1180 | Enhancement through supply chain analytics as well as value-added services |

| 2030 | ₹1350 | Positioning as a logistic tech leader along with strategic partnerships |

Growth Drivers of Delhivery Share Price

- Boom in E-commerce: E-commerce in India will grow at an exponential rate, and thus, Delhivery will become a key player for most e-commerce companies in India.

- Technology-Driven Operations: Investment in AI, machine learning, and robotics will enhance the operational efficiency and scalability.

- Tier 2 and Tier 3 markets: The robust strategy of Delhivery will open up vast growing markets.

- Cross Border: Cross border services takes the company to international boundaries that makes Delhivery the leader in overseas trade.

- Asset-light model: Having a very low debt-to-equity ratio with no heavy obligation to debt gives the company financial stability while always keeping the operational agility.

Risks and Challenges for Delhivery Share Price

- Competition : Extremely competitive pressure on margins, as the competitors are logistics biggies like Blue Dart, Ecom Express and Amazon Logistics.

- Market Volatility: The stock market is unpredictable, and this factor can affect investor sentiments

- Economic Slowdowns: If the e-commerce and trade pace is slow, revenue growth would decline

- Regulatory Changes: Strict policies and regulations regarding logistics can shoot up the compliance cost

FAQs About Delhivery Share Price

1. Is Delhivery a good long-term investment option?

Yes, with such strong fundamental back-up, low debt servicing, and focused growth, the company is the right long-term bet. The position of leadership in logistics technology by Delhivery adds more layers to its future prospect.

2. Delhivery Share Price Target till 2030 can be?

Share price of Delhivery will reach up to ₹1,350 in 2030. This will be because of strategic expansions, technological revolutions, and strong market demands.

3. Why the P/E ratio of Delhivery is so high?

High P/E ratio reflects that investors are ready to pay a premium for Delhivery’s growth prospect. It is common in the expansion phase companies.

4. What are the major strengths of Delhivery?

Delhivery has an advantage with advanced technology platforms, a massive network of logistics, low debt to equity, and increasing interest from the institutional side.

5. What are the recent changes in the holdings of the mutual fund?

Mutual fund holding has increased from 24.91% to 25.37%. There is an increasing interest of mutual funds in the growth prospects of Delhivery.

It is very well placed to capitalize on the booming logistics and e-commerce businesses in India, with innovative technology, strategic investments, and a customer-centric approach. The short-term technical indicators being cautious clearly show a longer term stable prospect. Projected targets for the Delhivery Share Price range from ₹500 in 2025 to ₹1,350 in 2030, and therefore, it is an excellent long-term growth story for investors.

This investment in Delhivery is part of a larger story regarding digital and e-commerce growth in India, and therefore the investment is highly promising for investors who are looking to make some money off the evolution of logistics.