Exicom Share Price Target From 2025 to 2030: Exicom Tele-Systems Ltd. is the name to reckon with the era of telecommunications and electronics. It is very well-positioned for complicated communication solutions in power systems, electric vehicle chargers, and much more. Due to its portfolio of innovative products and strategic partnerships, Exicom Tele-Systems Ltd. finds itself at the pivot of the ever-changing nature of technology.

This article consists of the specific share price predictions for Exicom Tele-Systems for periods stretching from 2025 to 2030 in favor of prevalent market movement, technical movement, and specific financial key performances.

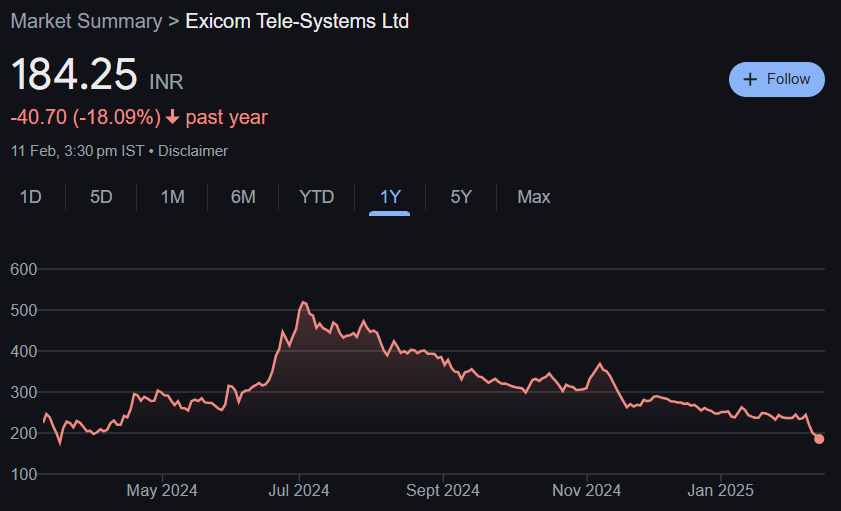

Exicom Share Price Performance

- Opening: ₹ 195.50

- Day’s High: ₹ 195.50

- Day’s Low: ₹ 184.25

- Market Capitalisation: ₹ 2,345 Crores

- P/E Ratio (TTM): -115.51

- EPS (TTM): -1.68

- Book Value: ₹ 60.36

- Debt to Equity: 0.85

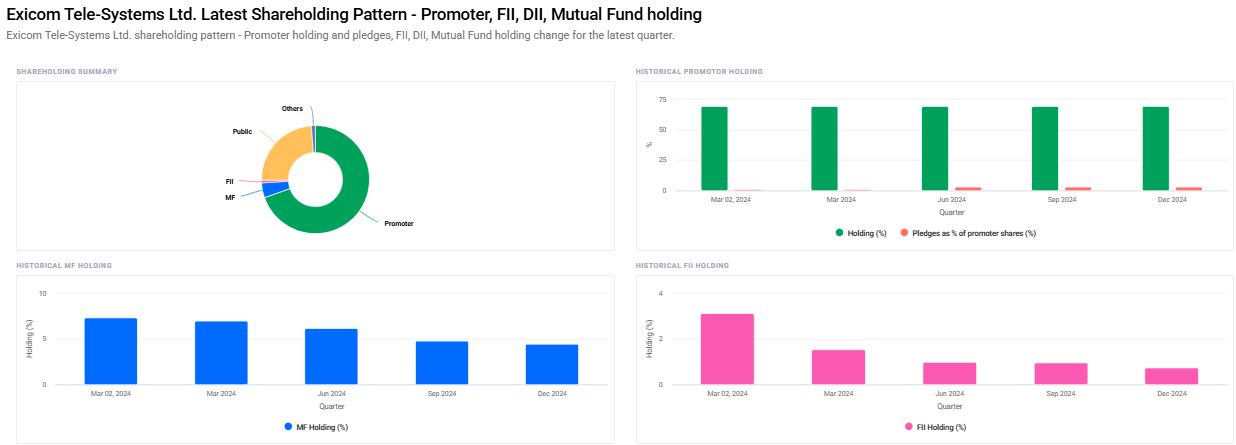

- Promoter Holding: 69.57%

- 52 Week High: ₹ 530.00

- 52 Week Low: ₹ 169.40

Exicom Share Price Target From 2025 to 2030

Technical indicators point that the stock is still moving in a bearish trend. Since the RSI stands at 27.3, this indicates an oversold condition; thus, it might be observed that bouncing stocks would take place in the coming period. Share Price Prediction for 2025-2030 In the coming period, Exicom Share Price would range about INR 550.

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹550 |

| 2026 | ₹900 |

| 2027 | ₹1250 |

| 2028 | ₹1600 |

| 2029 | ₹1950 |

| 2030 | ₹2300 |

2025: Exicom Share Price Target INR 550

It is expected that in 2025, the company would see an expansion of EV charging and communication solutions infrastructure. The stock should touch the INR 550 mark with the improvement in the market feeling and strategic business upgradations.

Exicom Share Price Target in 2026: INR 900

This will be so through growth that is marked because of an increased telecom infrastructure with government support in high-tech companies. This will be so by targeting at reaching INR 900 of Exicom’s price. It will have improvement regarding new products added to the financial results to target that.

2027: Exicom Share Price Target at INR 1,250

Exicom Tele-Systems will be the market leader through innovation and international collaboration by 2027. The Company will also benefit from the faster adoption of 5G technologies and other communications solutions, as long-term price is expected at INR 1,250.

2028: Exicom Share Price Target INR 1,600

It. It would be in the year 2028, when the results of investments in research and development by the company would be fruitful. As Exicom would come out to be a leader in the telecommunication sector, therefore, it could be assumed that the share price will be achieved up to INR 1,600.

2029: Exicom Share Price Target INR 1,950

The company is going to observe aggressive growth in 2029 with the latest requirements of the upgraded form of communication systems with charging infrastructure for electric vehicles all around the world. As per the estimates, the target price for the year is INR 1,950.

2030: Exicom Share Price Target INR 2,300

By 2030, Exicom Tele-Systems shall remain a market enabler for telcom as also for the power market. Sustainability along with Innovative thoughts shall carry the shares higher up to levels of INR 2,300.

Company Background

The Company is also known for rendering technological innovation within its solutions and offers

- Telcom: It deals in telecom power solutions offered to the Telecom Network.

- EVs: Develops the EV Chaser for promoting green movement of mobility.

- Energy Management: Smart Energy Solutions for better usage of energy.

- Strong owners with high promoter holding: 69.57% reflects the management is largely optimistic about future prospects of the company.

- New technology investments: Infra to charge Electric Vehicle and Customer-Friendly innovative product focus.

Issues: For Exicom Share Price

- EPS has been in the red at -1.68 and P/E also in red at -115.51 loss.

- Technical Indicators: MACD as well as ADX are showing falling pattern.

Technical Analysis Findings For Exicom Share Price

- Day RSI(14) : 27.3(In the over sold zone; All ready to bounce)

- MACD(12,26,9): -11.0

- Day ADX : 19.6 (Strength of trend is soft)

- ROC (125) : -51.0 (Negative momentum in the last long period)

These indicators mention that although the stock is going bad at the present time, the prospects for such recovery and growth are excellent in the short term.

FAQs For Exicom Share Price

1. Is Exicom Tele-Systems a good investment for the long term?

The near future holds a bright color for Exicom Tele-Systems, as they are targeting those emerging technologies on the market to be known better for their brand name. Being in a crunching financial spot currently, owing to its very strong hold and innovative business style, the firm has come forth as a phenomenal long-term investment opportunity.

2. What risk is there for investing in Exicom Tele-Systems?

The main risk here is that it is losing its current financials, debt-to-equity is alarmingly high, and it shows negative EPS. Other risks could be market fluctuation in the tech space and of course, competition.

3. Why is the stock underperforming right now?

The technical analysis is bearish trends as indicated by MACD and RSI, besides this, financial metrics indicates a negative EPS.

4. What can be the growth drivers for Exicom Tele-Systems in the next couple of years?

The key growth drivers would be government support for technology and green mobility, increased demand for telecom infrastructure, and investments of the company in innovation.

5. What does promoter holding mean for Exicom Tele-Systems?

69.57% promoter holding reflects confidence in the future prospects of the company and stability in the stock.

6. What, in the near term, would an investor want to watch for?

The investors need to observe the company’s financials, technological innovativeness, and the current market trends in telecom and EV space.

There are sound growth prospects for Exicom Tele-Systems Ltd. as the current issues relating to its financials should not be a stumbling block for the company. Investments in strategic locations, targeting burgeoning technologies, will well fetch lots of value for the shareholders. Share price target for the period 2025 through 2030 would work as a blueprint whereby one could evaluate future scope.