Federal Bank Share Price Target From 2025 to 2030: Federal Bank is one of the largest private sector banks from India, which is promoted with stability and good fundamentals. Presently, this bank has emerged to be a very popular investment favorite, hence the market analysts as well as shareholders keep a close eye on the stock price movement. Good business strategy, technological advancement, and large customer base make Federal Bank a hope investment opportunity.

This article will analyze deeply Federal Bank share price targets in 2025-2030 based on technical trends and keen financial insights and from expert opinions.

Current Market Snapshot For Federal Bank Share Price

- Open: 185.35 INR

- High: 186.00 INR

- Low: 182.81 INR

- Market Capitalization: 45,140 Cr

- P/E Ratio: 11.25

- Dividend Yield: 0.65%

- 52-week High: 217.00 INR

- 52-week Low: 139.65 INR

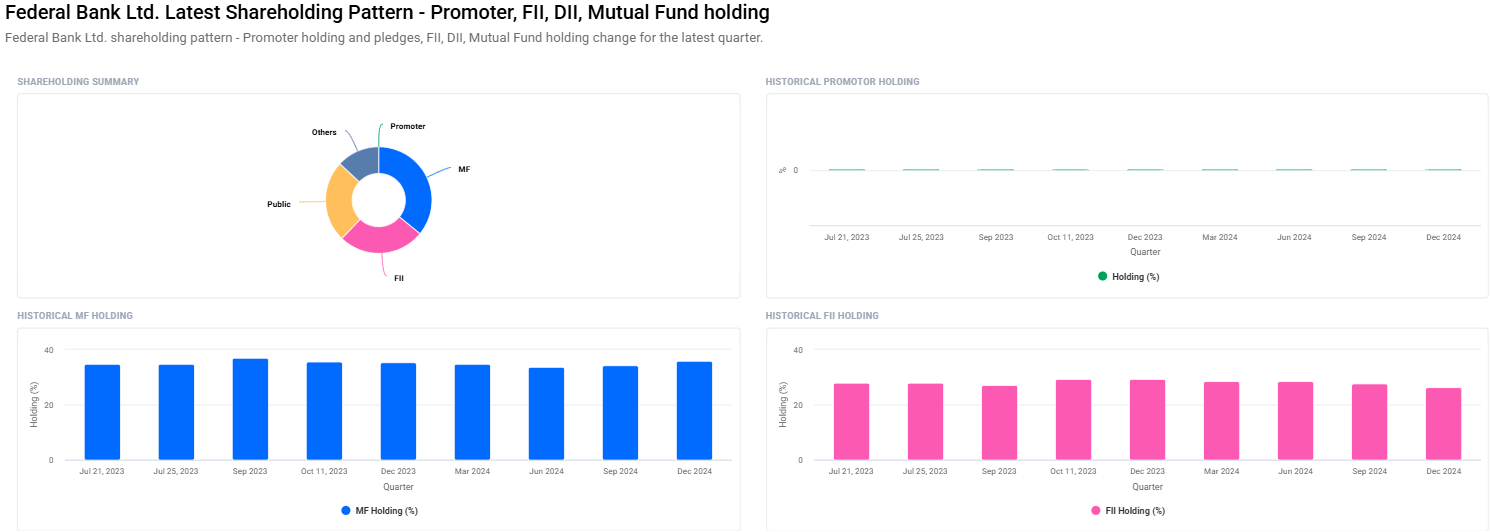

Institutional and Retail Investor Holding For Federal Bank Share Price

- Mutual Funds: 35.89%

- Foreign Institutions: 26.32%

- Retail and Others: 24.78%

- Other Domestic Institutions: 13.01%

Projections of the Federal Bank Share Prices (2025 to 2030)

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹220 |

| 2026 | ₹300 |

| 2027 | ₹380 |

| 2028 | ₹460 |

| 2029 | ₹540 |

| 2030 | ₹620 |

The above projections are done on the grounds of strong financials by Federal Bank, the improvement in technology, and rising institutional investment.

Key Financial Take-outs For Federal Bank Share Price

- EPS (TTM): 16.45 INR

- Debt-to-Equity Ratio: 1.39

- Book Value: 132.49 INR

- Return on Equity: 12.42%

- Return on Capital: 12.53%

Federal Bank has had a smooth-profitability growth history, and also offers good enough prospects that it will serve investors to return good value for investors.

Technical Takeaways For Federal Bank Share Price

- Momentum Score: 42.5 (Technically neutral)

- MACD (12, 26, 9): -4.1 (Bearish Signal)

- RSI (14): 39.8 (Neutral Zone)

- ADX: 33.7 (Moderate Strength Trend)

- MFI: 45.8 (Equilibrium Flow of Money)

All this shows a neutral to middle trend in the moving Federal Bank’s share, with a lot of scope for its growth.

Pain Factors For Federal Bank Share Price

- Technological Innovation: Digitalization and use of technology will improve customer satisfaction along with increasing operational efficiency of Federal bank.

- Growth Strategies: Growth strategy will reflect in an increase in the retail and corporate loans that will fortify the revenue lines.

- Slow Rise of Institutional Investments: Long-term mutual funds and institutional ownership are rising as investor confidence in the improved performance of Federal Bank increases.

- Economic Growth: Recovery and Sustainable Growth of the Indian Economy Will Benefit the Banking Segment.

- Policies and Procedures: The regulatory policies and the rules and regulations will continue to be aligned with long term growth lines for Federal Bank.

Investment Opinion about Federal Bank

There is a sound base, and initiatives well in place. Federal Bank will continue to generate value for its shareholders. More or less an innovative bank focusing on customer-centric solutions, the bank’s ability to continue delivering growth.

FAQs For Federal Bank Share Price

1. Will Federal Bank go up in the long term?

Yes, because the Federal Bank is one of the stable long-term investments because of its strong financial fundamentals with a remarkable growth track, and its advancement in the technology department is also strong enough.

2. What would be your estimated share price of Federal Bank for the year 2025?

The estimated share price for the year 2025 by Federal Bank should be around about 220 INR.

3. How has Federal Bank performed in the last few years?

Federal Bank follows a positive trend of growth with a 25.11% growth over the last one year.

4. What factors would cause the Federal Bank Share Price to rise?

The constituent elements would be related to technological improvement, expansion programmes, changes in the regulatory conditions, and, generally, changes in the wider economic environment.

5. What is the dividend yield of Federal Bank Share Price?

The dividend yield for Federal Bank shares is 0.65%.

6. What is the long-term share price target for Federal Bank by 2030?

The long-term share price target for Federal Bank by 2030 will be 620 INR.

7. What is the debt-to-equity ratio of Federal Bank?

Federal Bank has maintained a debt-to-equity ratio of 1.39, indicating that the company has been using debt very judiciously to create growth.

Company Information

Federal Bank was established in the year 1931 at Aluva, Kerala and has grown to be one of the leading private sector banks in India. This bank provides a wide range of products and services through a well-spaced branch network and an extensive ATM system throughout India.

As truly this is a digital-innovative bank, it looks forward to welcoming new technologies to its customers. As it boasts of an impressive customer base and strategic moves at the location, it’s quite a viable candidate in the bank sector of India and, thus, a head start from rest in the upcoming times. The Federal Bank Share Price is moving upward between 2025 and 2030, thus it can be a long-term investment opportunity for long-term investors. Being strategically focused on technological innovation, customer-centric solutions, and operational efficiency, Federal Bank will grow on sustainable grounds and should deliver value to the shareholders.