Gujarat Toolroom Share Price Target From 2025 to 2030: This stock attracted both retail as well as institutional investors only in the last couple of years as a share. The firm is fundamentally stable, but growth being very appealing; actually, it is more talked about in conversations on long-term investments. So let’s move ahead and determine the share price target till 2025 through to 2030, considering the performances of the firm along with the technical indicators, the trend that follows the whole market.

Key Points For Gujarat Toolroom Share Price

- Price Incorporation: ₹14.61

- Previous Closing price: ₹15.37

- Traded Quantity: 12,44,328

- Traded Value: ₹1.82 Cr

- Market Cap: ₹357 Cr

- P/E Ratio (TTM): 20.77

- P/B Ratio: 1.65

- ROE: 24.14%

- Debt to Equity: 0.00(Debt-free Company)

- EPS (TTM): ₹0.74

- Book Value: ₹9.34

Gujarat Toolroom Share Price Predictions for 2025-2030

| Year | Predicted Share Price (₹) | Major Growth Drivers |

| 2025 | ₹50 | Due to a better underlying environment and increasing engineering equipment demand |

| 2026 | ₹85 | With growing operation and introduction of more productive manufacturing practices. |

| 2027 | ₹120 | Owing to the associations and entering the new geographies. |

| 2028 | ₹155 | Sustained through increasing institutional flows. |

| 2029 | ₹180 | A leader in the niche market with a take away for the exporter. |

| 2030 | ₹225 | Profit would increase linearly. Working towards more and more greening activity. |

Gujarat Toolroom Ltd.: Technical Analysis

Technical Day Indicators For Gujarat Toolroom Share Price

- Momentum Score: 44.9 (Neutral, in stable short period).

- RSI (14): 47.8 (Within balanced zone. No over sold/overbought signal).

- MACD: Crossover over center line though it is below signal line. Ready to break on a positive footing.

- ADX: 23.3 (This level indicates very weak trend strength; the stock can break sharply after a catalyst).

- MFI: 70.2 (At overbought zones; look for short-term correction).

- ATR: 0.8 (Volatility is low, hence, smooth price action).

Investor Insight For Gujarat Toolroom Share Price

Technical Indicators are neutral-to-slightly positive on Gujarat Toolroom Ltd. The long-term investor must seek fundamentals rather than short-term fluctuation.

About Gujarat Toolroom Ltd.

Company Overview

Gujarat Toolroom Ltd. is one of the leading companies of the engineering and manufacturing sector in India, i.e., that produces precision tools and components. The years of operations have made a niche in delivering quality engineering solutions which have gradually resulted in providing a client base over time.

Major Strengths For Gujarat Toolroom Share Price

- Debt Free Structure: The company stands at an economically sound and operational efficient position.

RoE is High at 24.14% by Gujarat Toolroom; it has left many other competitors in the league behind. - Institutional Confidence: Foreign institutions increased their holding from 0.13 per cent to as high as 28.62 per cent while displaying growing confidence in the overall growth prospects

- Innovation-Oriented: The company would continue to invest a significant portion of its spend on R&D keeping pace with changing technology and expanding its product portfolio.

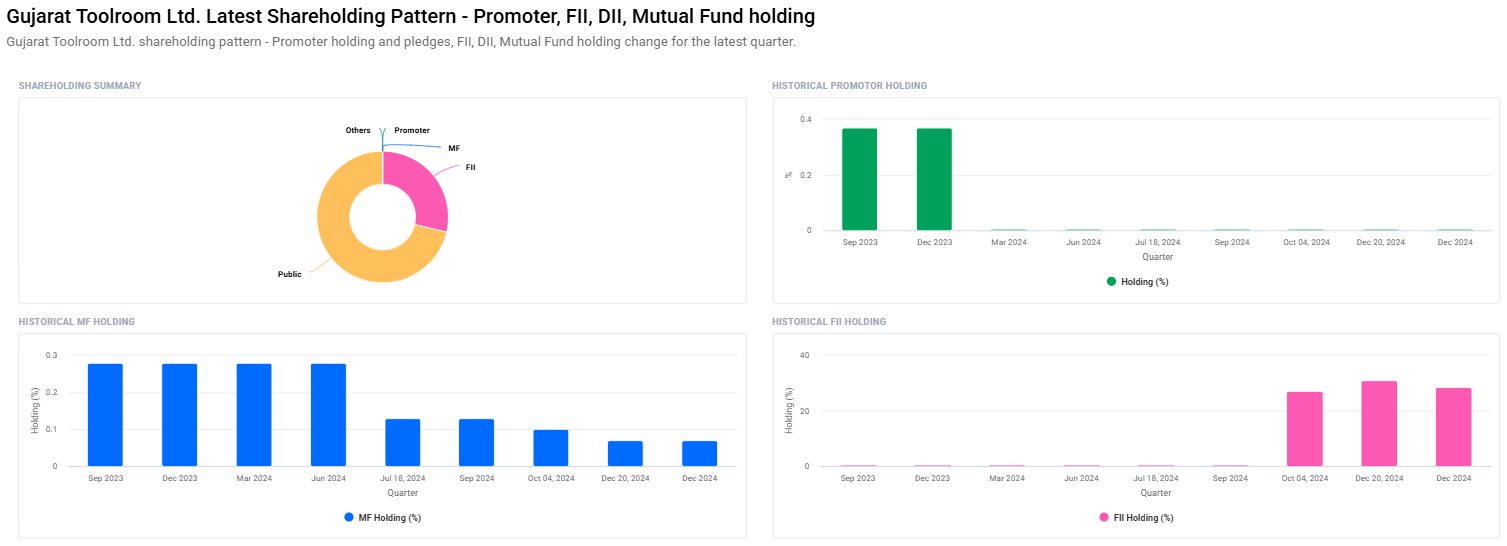

Share Holding Pattern For Gujarat Toolroom Share Price

- Retail & Other: 71.31%

- Foreign Institutions: 28.62% (Highest ever so far)

- MF: 0.07% (down from 0.13 %)

Institutional Trends For Gujarat Toolroom Share Price

- Gujarat Toolroom held by mutual fund schemes has remained constant at one.

- Foreign institutions have shown significant interest and their holding has gone up significantly.

Fundamental Analysis For Gujarat Toolroom Share Price

Strengths For Gujarat Toolroom Share Price

- Fundamentals: A P/E ratio of 20.77 indicates that the stock is comparatively more fairly valued against its industry peers.

- Industry P/E Comparison: The industry P/E stands at 50.91 which depicts that Gujarat Toolroom is slightly to fairly priced

- Sustainable Performance: The Book value of the Company Gujarat Toolroom has stood at ₹9.34 and the EPS at ₹0.74 depicting that growth had been consecutively seen

Weakening For Gujarat Toolroom Share Price

- Low Dividend Yield: The company does not declare dividends in the existing books of accounts hence does not appeal towards income seeking investors.

- Technically Neutral: The momentum as well as technical indicators reflect a strong growth trigger to propel the stock upwards

What are Growth Catalysts for 2025-2030?

- Increased capacity in manufacturing: Increased demand for precision tools would lead to increasing capacities.

- Focus on Export Markets: Gujarat Toolroom can be going global and recording significant revenue building.

- Technological Up-gradation: AI and automation introduction in the manufacturing sectors

- Institutional Support: An institutional building confidence for the future.

- Economically Positive Policies: The manufacturing sector is gaining importance because of the Make in India policy of the government.

Frequently Asked Questions About Gujarat Toolroom Share Price

1. Is Gujarat Toolroom a good long-term investment?

Yes, it is because of the strong fundamentals of the company, a debt-free structure, and rising institutional interest.

2. What are the risks involved in investing in Gujarat Toolroom?

The major risks are low dividend yield, dependence on a particular niche market, and the necessity for continuous technological advancements to maintain competitive advantage.

3. Why institutional holding has increased sharply?

Gujarat Toolroom has strong long-term growth potential with the company having good fundamentals and proper market positioning from foreign institutions.

4. What does zero debt status of the company indicate?

Zero debt would ensure that the firm is stable, and hence, is at lower risk of liquidity and shall be more sound during an economic slowdown.

5. Would Gujarat Toolroom Share Price touch ₹225 by 2030?

Yes, with such a growth pattern coupled with market growth going hand-in-hand with the operational efficiency of the firm touching the mark of ₹225 by 2030 is definitely probable.

Conclusion: Gujarat Toolroom-The steady growth story

Rare stable fundamentals and long term growth prospects are provided by Gujarat Toolroom Ltd. Though the short term trend does look neutral in the stock, the long-term trend looks extremely promising.

Investor Tip: Do consider this Gujarat Toolroom Ltd. to diversify portfolios so that this steady growth in the next 5 or 6 years would give nice and steady growth at around ₹ 225 for the year 2030 End.