HCC Share Price Target From 2025 to 2030: Hindustan Construction Company Ltd. is one of the leading infrastructure development companies in India, with a legacy of completing large engineering projects. Its shares have had swings as the construction environment gets tougher. Here, an analysis for HCC has been done based on forecasting share prices between 2025 and 2030 through fundamental, technical analysis, and its growth.

Company Overview: Hindustan Construction Company Ltd.

HCC has always been at the forefront of mega-infrastructure and civil engineering projects. From highways to dam constructions and now to urban infrastructure, HCC has been the leader for decades.

- Industry: Infrastructure and Construction

- Market Cap.: ₹6,342 Crore

- Debt-to-Equity Ratio: 8.47 HLB is not abnormal for this kind of very capital-intensive business

- P/E (TTM): 12.96 That makes the stock reasonably undervalued vis-a-vis peers

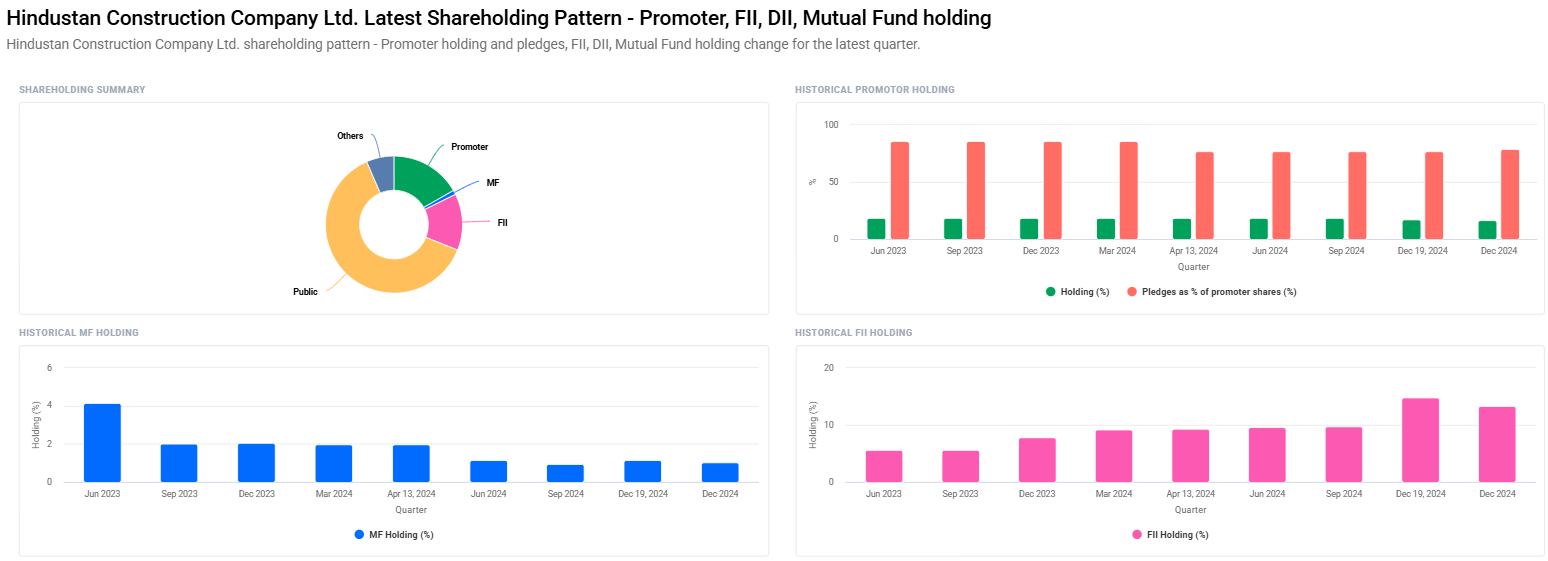

- Promoter Holding: 16.72% of which is pledged at 78.89%.

HCC has been linked to Bandra-Worli Sea Link, nuclear power plants and hydropower ventures. Nonetheless, high debt along with promoter pledging has seen as a hurdle in the growth curve for HCC.

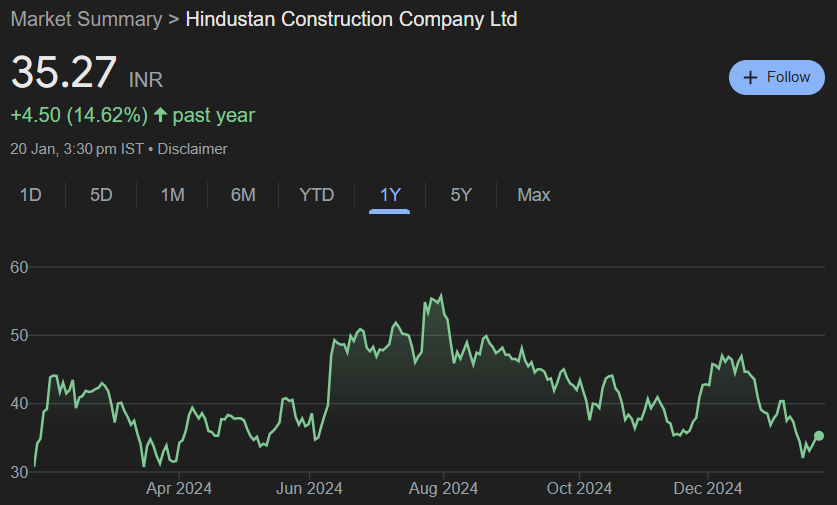

HCC: Technical Analysis For HCC Share Price

| Parameter | Value | Explanation |

| Market Cap | ₹6,342 Crore | Not very large in the infra segment |

| Debt-to-Equity Ratio | 8.47 | Very high leverage similar to most of the construction entities |

| P/B Ratio | 7.34 | Stating premium valuation versus book value |

| ROE | -35.85% | Net Loss with Negative Return on Equity, stating some level of financial distress |

| EPS (TTM) | ₹2.69 | Noting profitability per equity |

Technical Analysis of HCC

Daily technicals hold mixed views of HCC stock and the corporate prospects need to be grasped before investing in it.

- Daily RSI (14): 40.6 (Neutral area; not oversold and nor overbought)

- Day MACD (12, 26, 9): -2.1 (Bearish signal in that the MACD is below its signal line)

- Day ROC (21): -21.9 (Momentum loss has been humongous)

- Momentum Score: 29.4 (Technically weak; anything below 35 is weak)

- ATR (Average True Range): ₹2.1 (High volatility in the stock price)

HCC Share Price Predictions: Year-Wise Target from 2025 to 2030

The hope for the company depends on the infra boom in India along with its government initiatives on urbanization, highways, and smart cities. Above is the detail year-wise target price of the HCC share.

| Year | Expected Share Price (₹) | Key Drivers |

| 2025 | ₹60 | Riding on infra projects announced by the government |

| 2026 | ₹90 | Support by way of new debt reduction, enhanced ability to deliver |

| 2027 | ₹120 | Revenue pickup from the following new high-value contracts |

| 2028 | ₹150 | More profitability as leverage falls |

| 2029 | ₹180 | More ROE with investor comfort increasing |

| 2030 | ₹210 | Stable as Indian infra demand sustains |

HCC Share Price Growth Drivers

- Infrastructure Spend by Government: The company will gain a lot from public projects with tremendous government spends in this area.

- Urbanization: Infrastructure expenditure in the Indian urban centers will demand spends on smart cities, metro rail, and housing infrastructure.

- Strategic Projects: HCC is poised to take on high-value projects like the nuclear power plant and hydropower. Therefore, the high-value projects will favor this company.

- Debt Reducing Trend: It is debt management trend improved healthy finances. That, to some eye, means ever good to investors.

Red Flag For HCC Share Price

- Debt: High levels of debts and EQ of Debtor of 8.47% meant to strangle cash inflow.

- Promoter Equities Pledged : Approximately 78.89 % shares of the promoter are pledged with the consequence, in turn likely to affect the perception of the investors of the company.

- Competitive Market: The construction and infra space is competitive with players like L&T and NCC vieing for projects.

- Economic Uncertainty: Any economic slowdown leads to the delay in completion of project and then affects the revenues accordingly.

HCC Share Price Shareholding Pattern

| Segment | %Holding | Key Insights |

| Retail And Others | 62.43% | Retail investors are leading |

| Promoters | 16.72% | From 18.59% |

| Foreign Institutions | 13.35% | From 9.73% |

| Mutual Funds | 1.02% | Up from 0.95% |

FAQ: HCC Share Price

1. Is HCC a good long-term investment?

HCC is a good long-term investing opportunity for the ones looking at pure exposure of Indian infrastructure sector, though against it is high debt and promoter pledges.

2. What will be the future driving factor for HCC’s share price?

The main driving factors are infrastructural spending by government, urban development projects, debt reduction, and profit improvement through cost control.

3. Why HCC is technically weak?

Technically, MACD, ROC, and Momentum Score of the HCC company are based that indicate short term laggings showing bearish signs.

4. Hazards of the stock of HCC

Financial Leverage of high amount; the pressure due to competition, execution delay on various projects caused due to uncertain economies.

5. Does HCC reach ₹200 by 2030?

With the growth trajectories, improved financial metrics and infrastructure demand, HCC may well reach ₹200 by 2030 if it can see past its debt challenges.

Conclusion: A Promising but Risky Journey Ahead

The Hindustan Construction Company Ltd has a more-required infra boom in India; its share price is expected to be around ₹ 210 by 2030. So, there is a lot in the lines of prospects, but at the same time, investors are cautioned to remain on their guard of very high leverage as well as some promoter pledges; so it can certainly find a space for those having very high-risk and long investment period, keep up with close observations of the company’s financial performance as well as changes in market situations.