Hindustan Zinc Share Price Target From 2025 to 2030: Hindustan Zinc Limited, HZL is India’s largest zinc and lead manufacturer. It is a subsidiary company of Vedanta Limited. Leaders in the non-ferrous metal market, HZL has registered very strong performances financially. Fundamentals are strong, and attractive dividend yields have made investors generally view the stock as very promising with strong growth initiatives from the company side.

This is the overall share price outlook for Hindustan Zinc in the range 2025-2030, determined through market trend lines, technical as well as specific company details.

Overview For Hindustan Zinc Share Price

- Market Capitalisation: ₹1.88 Lakh Crore

- Price-Earning Ratio: 20.00

- Dividend Yield: 7.88%

- 52-Week High: ₹807.70

- 52-Week Low: ₹284.60

- Debt to Equity ratio: 1.84

- Return on Capital (ROC): 114.87 %

- EPS(TTM): ₹22.22

- Book Value: ₹18.03

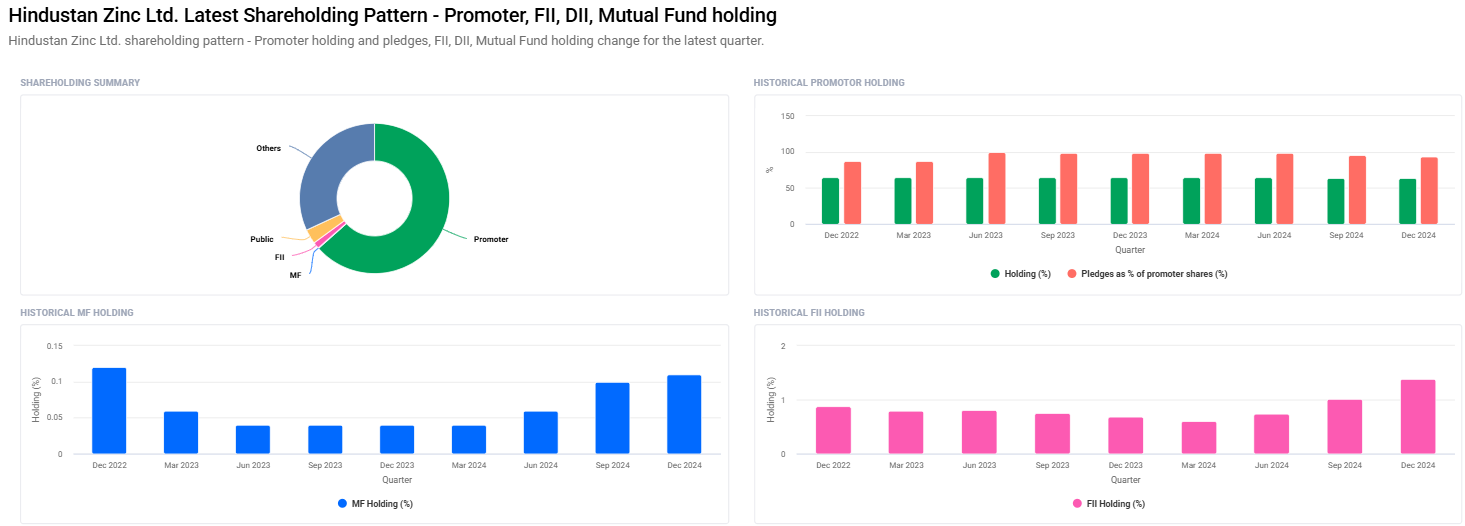

Shareholding Pattern For Hindustan Zinc Share Price

- Promoters: 63.42 % Unpledged, 1.92 % Qtrs

- Retail and Others : 31.07 %

- Other Domestic Institutions: 4.01 %

- Foreign Institutions: 1.39%

- Mutual Funds: 0.11 %

Current indicators are showing FII/FPI where FII/FPI is increasing, and mutual fund investment is also increasing, which means the stock is gaining confidence among investors.

Intraday Technical Indicators For Hindustan Zinc Share Price

- Momentum Score: 36.5 (Neutral)

- MACD (12, 26, 9): -4.4 (Bearish Signal)

- Intraday ADX: 18.1 (Neutral Trend Strength)

- Intraday RSI (14): 46.6 (Stable)

- Intraday ATR: 17.2

- Intraday ROC (21): 1.2 (Marginal Positive Movement)

- Intraday ROC (125): -25.4 (Long Term Negative Trend).

These signals show stock at short term stability but, other technical signs do point to change of strategy to be adopted long term.

Hindustan Zinc Share Price Target (2025 to 2030)

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹800 |

| 2026 | ₹1350 |

| 2027 | ₹1500 |

| 2028 | ₹2050 |

| 2029 | ₹2600 |

| 2030 | ₹3150 |

2025: Hindustan Zinc Share Price Target ₹800

Strong foundation along with steady payout of the dividend, so with that sort of thing Hindustan Zinc should be around earning around ₹800 by 2025. This will definitely try to upgrade cost-cutting along with a good production in volume reduction.

2026: Hindustan Zinc Share Price Target ₹1350

By 2026, this company Hindustan Zinc, with demand on zinc as well as on lead, globally it will prosper because of the fact that there is an increasing application of zinc as well as lead in renewable energy and automobiles. Therefore, share prices around ₹1350.

2027: Hindustan Zinc Share Price Target ₹1500

With the technological advancement made in 2027, Hindustan Zinc is going to be much more operationally efficient. Balance sheets would eventually usher in investor confidence as stock price will be able to push higher toward ₹1500.

2028: Hindustan Zinc Share Price Target ₹2050

More further market penetration. Since the industrial trend will start supporting the revenue growth, hence the target share price for the calendar year 2028 is kept at ₹2050.

2029: Hindustan Zinc Share Price Target ₹2600

Strategic investment, innovation, and consolidating market leadership will see the share price touch around ₹2600 by 2029 for Hindustan Zinc.

2030: Hindustan Zinc Share Price Target ₹3150

Hindustan Zinc long-term prospects look very bright. HZL will touch share price target ₹3150 by 2030 with continued growth, innovation, and strong financial performance.

Drivers for Hindustan Zinc Share Price Growth

- Strong Market Position: HZL is the largest producer of zinc, lead, and silver in India, with considerable market share.

- Dividend Policy: Despite the fact that the yield is 7.88%, it is highly attractive to income-seeking investors.

- Operational Efficiency: The return on capital being at 114.87% shows an efficient operating the company.

- Global Demand: There is a growing demand for zinc provided the sectors related to renewable energy, automobile industries, and infrastructures.

- Technological Advancements: Constant Investment in Technologies that Improve Production Efficiencies

Risks and Issues For Hindustan Zinc Share Price

- Market Volatility: This business is very sensitive to highly volatile global commodity prices, which may affect the margin of profit on this company.

- Stringent regulations on the Environment: It can alter its lines of operation based on stricter environmental regulations.

- Debt Levels: 1.84 debt/equity ratio will be managed very well.

- Geopolitical Risks: Global trade war will impact on demand and Supply chain.

FAQs For Hindustan Zinc Share Price

1. Is Hindustan Zinc a good long-term investment?

And Hindustan Zinc has proved to be a great long-term investment as well because it is the market leader and also has a huge dividend yield besides a strong show from its financials.

2. How high is the dividend yield for Hindustan Zinc?

Latest statistics reveal that this is indeed one of the very attractive dividend yields at 7.88% from Hindustan Zinc.

3. Growth drivers in Hindustan Zinc

Increasing demand of zinc due to renewable energy and other technological factors apart from the strong efficiencies of its operation.

4. Risks on an investment by Hindustan Zinc

Volatility in the markets, environmental issues, debt management and geotemporal ones.

5. What will be the share price target of Hindustan Zinc in 2030?

The share price target for Hindustan Zinc would be around ₹3150 in the year 2030.

6. What has been the trend of institutional investor interest in Hindustan Zinc over recent periods?

Institutional investors have mildly reduced their holding. FII/FPI has elevated from 1.01% to 1.38%. Mutual fund has also elevated mildly.

Hindustan Zinc Limited is one of the key players in the Indian non-ferrous metals industry. The company, with a sound financial base and strategic initiatives and a healthy market environment, would be well-positioned for long-term growth. Long-term capital appreciation and attractive dividend yields are what investors look for in such opportunities, and Hindustan Zinc is an excellent investment opportunity.