IDBI Bank Share Price Target From 2025 to 2030: IDBI Bank is one of the major banking and financial players in India that have an entrenched heritage, established themselves with a robust market presence, and investors are knocking at the door to know the precise growth graph of IDBI Bank share price from 2025 to 2030. With diversified portfolios, improved financials, and an enhanced focus on digital transformation, the prospects for IDBI Bank remain promising. We shall be seeing the IDBI Bank share price targets from 2025 to 2030, along with support from the key data, financial insights, and market trends in this article.

Current Market Overview For IDBI Bank Share Price

- Open: 83.00

- High: 83.39

- Low: 78.25

- Market Cap: ₹85.69K Cr

- P/E Ratio: 12.62

- Dividend Yield: 1.89%

- 52-Week High: 107.90

- 52-Week Low: 65.89

Fundamental Metrics For IDBI Bank Share Price

- Market Cap: ₹88,944 Cr

- P/E Ratio (TTM): 12.35

- P/B Ratio: 1.83

- Industry P/E: 12.61

- Debt-to-Equity Ratio: –

- Return on Equity (ROE): 14.82%

- Earnings Per Share (EPS): 6.70

- Dividend Yield: 1.81%

- Book Value: 45.24

- Face Value: 10

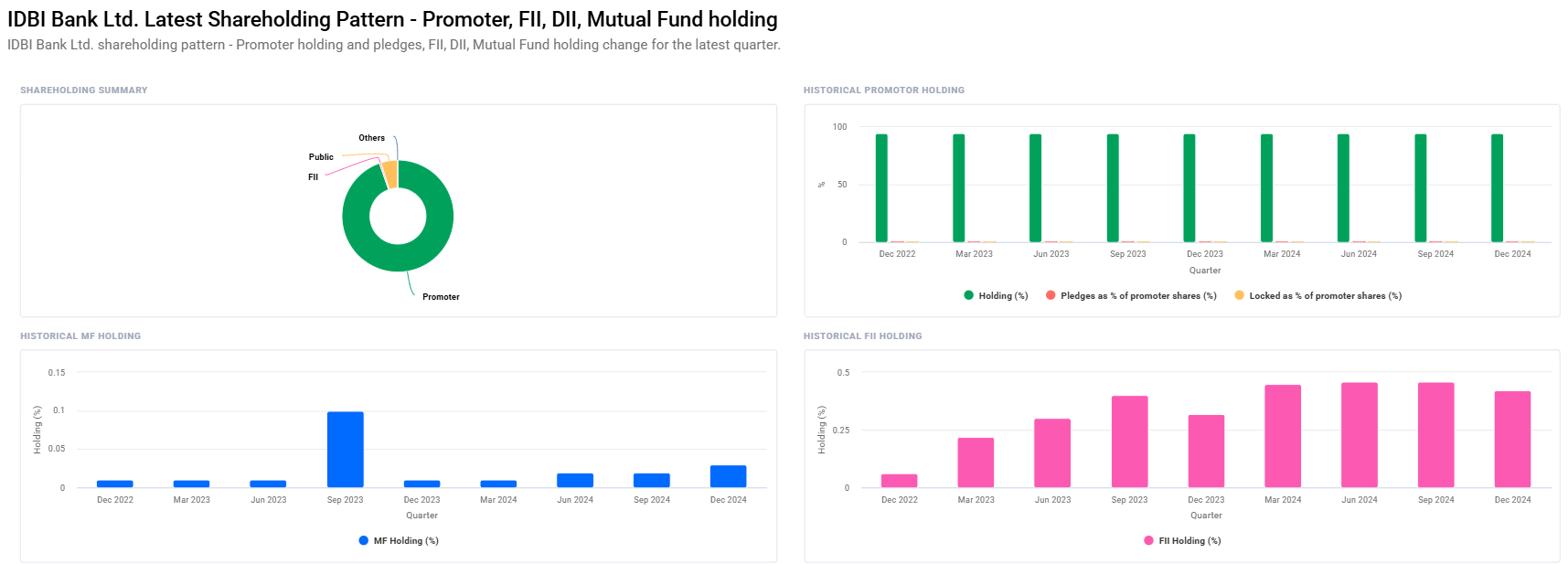

Shareholding Pattern For IDBI Bank Share Price

- Promoters: 94.71% No change quarter on quarter)

- Retail and others: 4.69%

- FII: 0.42% QoQ compared with 0.46%

- Domestic Institutions other than FIIs: 0.15%

- Mutual Fund: 0.03% Compared to last qtr 0.02%

Technical Analysis For IDBI Bank Share Price

- Momentum Index : 47.22, Neutral

- MACD(12,26,9):0.6, Positive and Bullish in nature

- ADX: 25.3, Neutral trend in strength

- RSI (14): 51.9, Neutral

- MFI: 67.0, Near the overbought region

- ROC (21): 4.5, Positive in momentum

- ATR: 4.2, Normal

- ROC 125: -18.4, Long term negative momentum

Growth Drivers of IDBI Bank Share Price

- Privatization Prospects: Privatization moves by the Indian government would be much more than a sweet move for strategic investors to achieve operational efficiency and an improved return on shareholders’ investments.

- Digital Transformation: IDBI Bank’s push on digital banking solutions and the adoption of financial technology will place the bank well for growth in the future.

- Strong Promoter Holding: 94.71% holding by promoters assures stability and long-term strategic direction.

- Improved Asset Quality: Continuous decline in NPAs and emphasis on retail lending enhance the confidence of the investors.

- Macroeconomic Tailwinds: With an ever-rising economy of India and with ever-increasing demand for financial services, IDBI Bank stands favorably.

IDBI Bank Share Price Target From 2025 to 2030

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹110 |

| 2026 | ₹150 |

| 2027 | ₹190 |

| 2028 | ₹230 |

| 2029 | ₹270 |

| 2030 | ₹310 |

2025: IDBI Bank Share Price Target ₹110

IDBI Bank would have a better financial performance and strategic investments in the pipeline for the year 2025. The share price will touch ₹110 with continuous growth in its loan book and cost optimization measures.

2026: IDBI Bank Share Price Target ₹150

Privatization and improved operational efficiency together with the robust digital ecosystem will enable IDBI Bank to benefit by 2026. These would propel the share price to around ₹150 and hence reflect a steady growth.

2027: IDBI Bank Share Price Target ₹190

The innovation process and retail banking expansion of the bank will be continuously stabilizing its position in the market. The share price of ₹190 is expected to touch the figure by 2027, as a healthy growth in earnings and an optimal economic scenario will drive it.

2028: IDBI Bank Share Price Target ₹230

The year 2028 would be a consolidation and maturity phase for the business model of IDBI Bank. With sustained profitability and improved asset quality, the share price is expected to touch ₹230.

2029: IDBI Bank Share Price Target ₹270

By 2029, IDBI Bank would have scaled up its digital offerings and expanded its customer base to a significant extent. The target price for the share for this year is ₹270, which indicates strong investor confidence.

2030: IDBI Bank Share Price Target ₹310

This means the strategic moves by IDBI Bank coupled with its leadership position in the market will drive up the share prices to ₹310 in 2030. Therefore, it places an overall perspective on the trend over the whole period and thereby stands IDBI Bank as one of the most reliable long-term investments.

Company Overview

About IDBI Bank

IDBI Bank Ltd., one of India’s largest, has been the soundest pillar to the country’s banking and finance since it opened its doors way back in 1964. Some of the services included retail banking, corporate banking, treasury, and financial inclusion. Over the years, this bank has secured the confidence of its stakeholders for being a firm institution. From its beginning days, IDBI Bank has attempted to apply more technology and innovative measures in addressing the shifting need of its customers in its everyday tasks.

Key Achievements For IDBI Bank Share Price

- Leading in retail banking and MSME financing

- Strong digital footprint with user-friendly mobile application and online banking services

- Continuous asset quality and profitability improvement

- Actively participating in the government’s PMAY and Mudra Loans initiatives

Frequently Asked Questions (FAQs) For IDBI Bank Share Price

1. Is IDBI Bank a good long-term investment?

Yes, because it has solid fundamentals, there could be some benefit from potential privatization, and it has recently focused on its digital transformation.

2. What is the projected share price of IDBI Bank in 2025?

The projected share price of IDBI Bank in 2025 is about ₹110.

3. How does IDBI Bank’s dividend yield compare to the industry average?

IDBI Bank’s dividend yield stands at 1.81%, which is pretty competitive and shows that it rewards shareholders well.

4. What are the key risks associated with investing in IDBI Bank?

The most significant risks are market volatility, regulatory changes, and macroeconomic uncertainties that can influence the performance of the bank.

5. What is the role of privatization in the future of IDBI Bank?

Privatisation would enhance its efficiency, attract strategic investors, and unlock its shareholder value, thus contributing to the growth of the bank.

IDBI Bank is set for big-time growth in the coming years, with robust fundamentals coupled with strategic moves and a favorable market situation. Long-term investment in the bank, going by the share price targets, ranging from ₹110 by 2025 and ₹310 by 2030, appears to be an attractive bet. It, with a dynamic financial arena in its making, stands out to be one of the key banks to watch on the Indian Banking landscape.