Indraprastha Gas Share Price Target From 2025 to 2030: Indraprastha Gas Limited (IGL) has been at the forefront of the clean energy revolution in India as it caters to the exponentially growing demand for CNG and PNG. With solid fundamentals and a good market presence, the company promises exponential growth in coming years. Here’s an in-depth analysis of the share price target of IGL from 2025 to 2030 and an interesting study of its market performance and prospect.

Snapshot of Indraprastha Gas (IGL)

| Parameter | Value |

| Open | ₹397.90 |

| 52-Week High | ₹570.35 |

| 52-Week Low | ₹306.10 |

| Market Cap | ₹28,357 Cr |

| P/E Ratio (TTM) | 15.36 |

| Dividend Yield | 2.22% |

| Debt-to-Equity Ratio | 0.01 |

| Book Value | ₹150.97 |

IGL is one of the favourite picks for stability and growth for investors because of the lowest debt and a prudent dividend policy.

Indraprastha Gas Share Price Forecast for the Years 2025-2030

2025: Indraprastha Gas Share Price Target ₹600

IGL will reap the rewards of increasing penetration of cleaner energy solutions. Solid network in urban markets with judicious expansion strategies will make the stock touch ₹600 by 2025.

2026: Indraprastha Gas Share Price Target ₹760

The higher penetration of the tier-2 and tier-3 cities, as well as high adoption of CNG vehicles, will make the stock a big winner by 2026.

Share price could move to ₹760 through a rising revenue base coupled with very healthy fundamentals.

2027: Indraprastha Gas Share Price Target ₹920

The Company IGL’s technology investment is about smart metering and gas distribution automation. With all these the stock can also take off and could touch the peak at ₹920.

2028: Indraprastha Gas Share Price Target ₹1,080

As India is aggressively shifting to renewable sources of energy, business of IGL will surge in an enormous way. By 2028, the stock is supposed to reach ₹1,080 as demand for eco-friendly fuels goes hand-in-hand with the rising growth in it.

2029: Indraprastha Gas Share Price Target ₹1,240

Gas for EVs and PNG in industrial segments are supposed to be the important new revenue streams for the business in 2029. Share price will be measured at ₹1,240.

2030: Indraprastha Gas Share Price Target ₹1,400

IGL will arrive in new peaks in terms of market penetration and revenue diversification in 2030. Its sustainability and efficiency would keep pushing the stock to a remarkable ₹1,400.

Why Indraprastha Gas is a Top Contender for Long-Term Investment

1. Strong Financials

- Debt-Free Operations: With a debt-to-equity ratio of just 0.01, IGL operates efficiently with minimal liabilities.

- Attractive Dividends: A consistent dividend yield of 2.22% adds steady income for shareholders.

2. Growing demand for Natural Gas

As more people become conscious about the environment, government policies have started to support clean energy. Consequently, demand for CNG and PNG is going up. In this expanding market, IGL’s infrastructure strength helps the company become the market leader.

3. Locational Advantage

IGL serves highly populous markets like Delhi, Noida, and Ghaziabad. Going forward, entry into smaller cities will increase the market share further.

4. Institutional Confidence

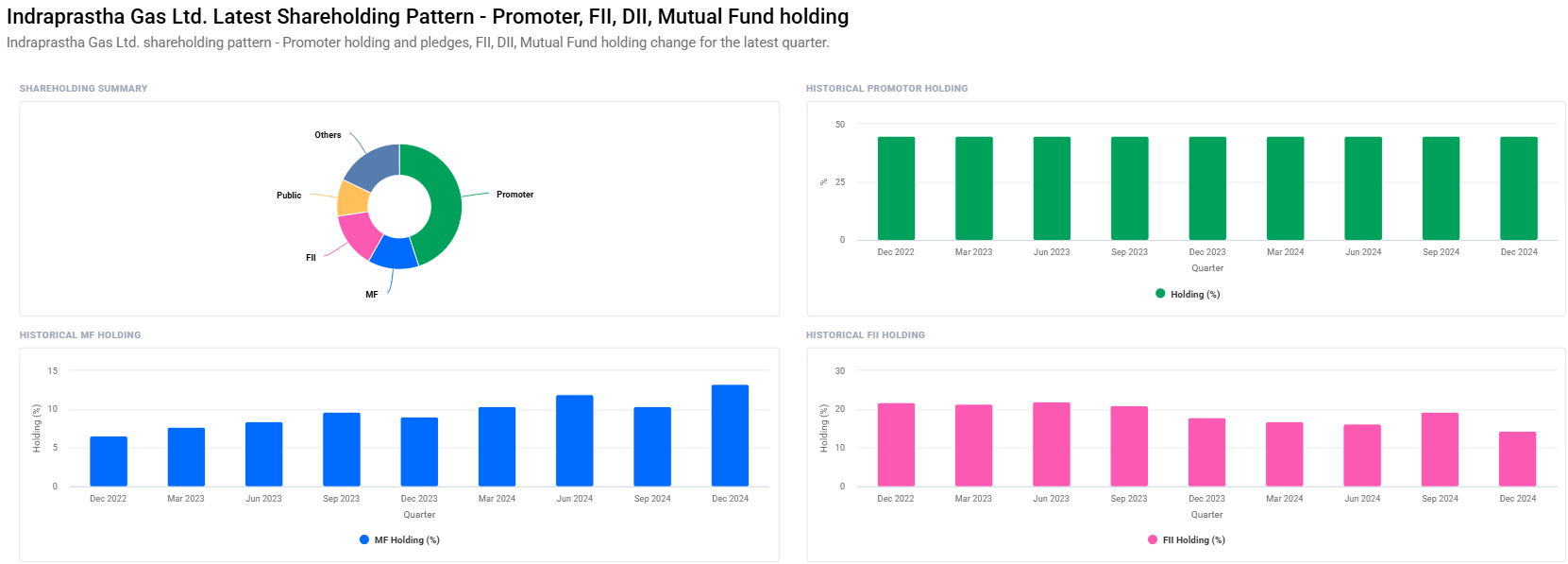

FII holding decreased to 14.32% from 19.29%, however Mutual Funds holding increased from 10.41% to 13.22%. This shows that the home- grown optimism that the future of the company holds good.

Technical Analysis: A Close Look

| Ratio | Value | Interpretation |

| Momentum Score | 39.7 | Neutral; no bulls or bears feelings. |

| RSI (14) | 50.4 | Equilibrium; neither over sold nor over bought. |

| MACD | Above center | Bullish trend revival chances. |

| ADX | 21.6 | The trend is weak but gaining strength. |

| ATR | 17.0 | Average moderate volatility in stocks. |

Strategies Working Towards IGL’s Future

- PNG and CNG networks: IGL is eager to see high penetration in industrial and domestic segments and strengthen the pipeline infrastructure of the newer geography.

- Transition to Electric Vehicles: The company looks forward to the opportunities arising due to the introduction of gas usage in charging stations for EVs, thereby creating a new horizon for growth.

- Digital Transformation: Implementation of newer technologies such as smart metering would reduce cost and help in gaining profitability with more efficiency in the direction of profit gain.

- Sustainability Initiatives: IGL is focused on green initiatives in perfect harmony with the Green Energy Push initiated by India for long-term purposes.

FAQs: What Investors Want to Know

1. Is Indraprastha Gas a good stock to invest for a long period?

Absolutely! Low debt and solid market positioning supported by a sound business model make it ideal for long term investors.

2. How does IGL compare with its peers?

IGL outclasses many peers in terms of having extensive infrastructure, brand reputation, and first mover advantage in key urban areas.

3. What are the risks that an investor should look out for?

The key risk factors would remain regulatory changes, fluctuations in international gas prices, and rising competitiveness from alternative forms of energy sources.

4. Would IGL continue to distribute dividends?

The answer is undoubtedly yes because, over the years, IGL has been sustaining continuous dividends for the income-seeking investor.

5. Which are the growth drivers of IGL?

The key growth drivers that can be noted include increased use of CNG and PNG, incentives from the government, and expansion by the company to new markets.

Indraprastha Gas Limited is an investment opportunity for India as she has been switching more and more to environment friendly energy. Having strong fundamentals and prudent strategy to grow, as well as monitoring innovation, this stock promises a lot of returns for the long-term investor. Soaring from ₹600 in 2025, the stock may create tremendous growth in your portfolio at ₹1,400 in 2030.