Inox Wind Share Price Target From 2025 to 2030: Recently, much new attention has come to one of the leaders of renewable energies in Inox Wind. Even as the world pushes ahead for clean energies, a firm as well-placed as Inox Wind Ltd will find much more help than most participants in the arena. This review of the stock takes into account the basic information about the company itself and technical observations regarding its promise, along with providing future share prices up to the end of 2025 and 2030.

Company Description of Inox Wind Ltd.

Inox Wind is the market leader in providing services on wind turbine solutions in manufacturing, construction, and operations & maintenance. It contributes to the major developments of the Inox Group towards renewable energy in India.

Key Highlights

- WTGs and their components.

- It has three state-of-art manufacturing plants across the locations of Gujarat, Himachal Pradesh, and Madhya Pradesh.

- Its emphasis is quite significant on innovation and sustainability through renewable energy.

- Aggressive expansion of the project portfolio in a quest to grab a high international market share.

Inox Wind Share Price Fundamentals

- Market Cap: ₹18,664 Cr

- P/E Ratio (TTM): 96.72

- Book Value: ₹20.47

- Debt-to-Equity Ratio: 1.33 (highly moderate)

- ROE (Return on Equity): 7.21%

- EPS (Earnings Per Share): ₹1.48

- Dividend Yield: 0.00%

The fundamentals are good from market cap perspective and earning perspective too; thus the implication will be very low pay-out for dividends and good re-investment.

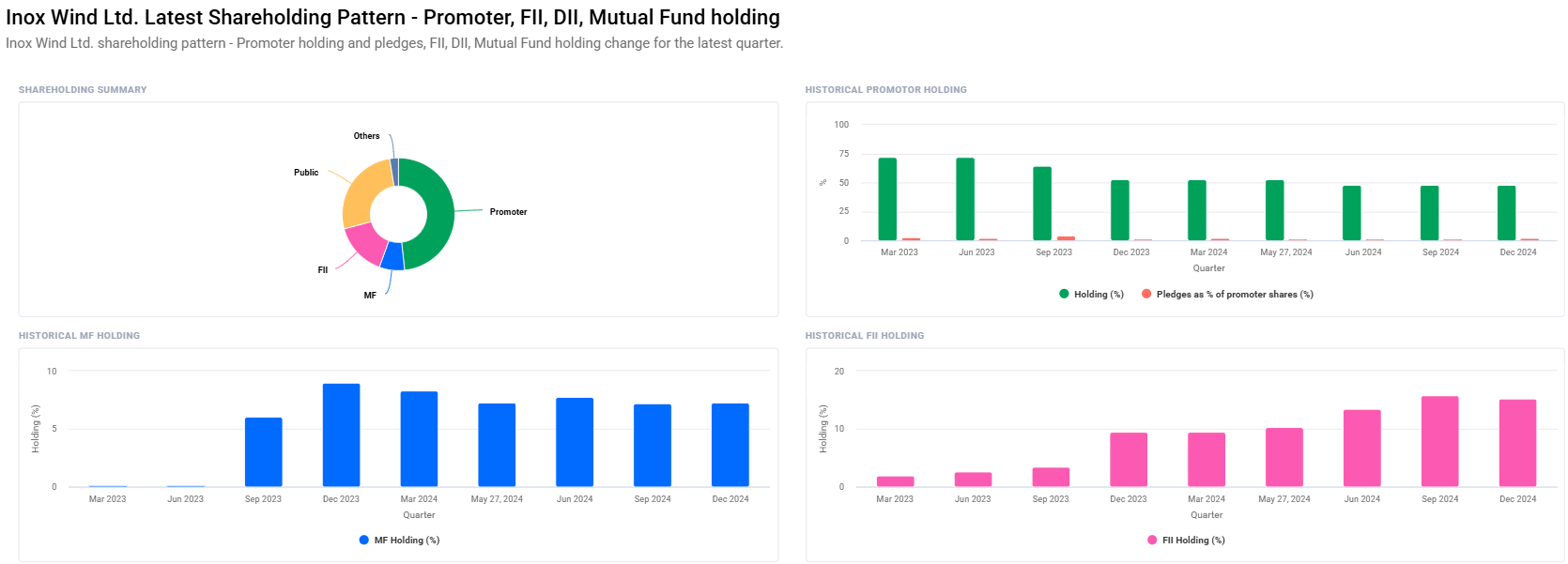

Shareholding Patterns For Inox Wind Share Price

- Promoters: 48.27% (pledged 1.73% shares)

- Retail and Others: 26.66%

- FII/FPI: 15.26%

- Mutual Funds: 7.28%

- Promoters holding is good with very marginal changes in the last quarter.

- Mutual Funds have marginally increased shareholding, because of which one can say that institutional confidence into the company is reflected.

Inox Wind Share Price Day Technical Analysis

- Momentum Score: 29.6 The stock is technically weak.

- Relative Strength Index: 25.6

- MACD: Downside signal and Center line. It seems like a Bearish Trend

- ADX (Average Directional Index): 31.1, indicates the strength of the trend is medium

- MFI (Money Flow Index): 41.6 is neutral.

Technically now the stock comes in a bearish zone. Here also the rebound will come as now entered into highly over sold area.

Inox Wind Share Price Targets: 2025 to 2030

These are share price targets and based on the growth path followed by the company, the rising requirement of global renewables and, as well, normal macro-economical trends.

| YEAR | TARGET PRICE |

| 2025 | ₹280 |

| 2026 | ₹430 |

| 2027 | ₹580 |

| 2028 | ₹730 |

| 2029 | ₹880 |

| 2030 | ₹1080 |

Year 2025: Growth platform

Predictive Inox Wind Share Price: ₹ 280.

This would fall into Inox Wind’s benefit as a high focus on wind energy would serve best to ensure major tenders are covered. Further growth is supported by added leadership in renewable for India besides government support.

2026: Operating Scaling

Inox Wind Share Price Target: ₹430

International expansion and partnerships with companies across the world will drive the revenue chain. Productivity of the manufacturing division will improve along with deliveries on the project fronts, contributing to higher margins.

2027:Mass Demand Acceleration

Inox Wind Share Price Target: ₹580

The renewable energy sector will go exponentially high in the year 2027, and with Inox Wind being one of the prime leaders in the industry, the confidence of the investors would go high, thereby making the stock value go high.

2028: Riding on the Green Energy Wave

Inox Wind Share Price Target: ₹730

The company’s wind turbine technology is bringing down the project prices that will eventually become the margins; hence, its share price is on a rise.

2029: Renewables Leadership

Inox Wind Share Price Target: ₹ 880

With the leadership of Inox Wind in the renewable energy space consolidated further, strategic investment in the R&D along with the diversification of the portfolio would continue to take forward the momentum

2030: Cross the ₹1,000 mark

Inox Wind Share Price Target: ₹ 1,030

The targets which Inox Wind is about to achieve some tremendous milestones within both the international and domestic arenas by 2030. These shall make an even stronger and more visionary ground become a choice of preference for the long term investor.

FAQs For Inox Wind Share Price

Q1. Are Inox wind good stocks that are good in terms of investments?

Yes, Inox Wind is one promising stock for long-term investment with the wishful eye of anyone to capitalize on a renewable energy boom. However, investors must always be up in monitoring market trends and technical indicators.

Q2. Why is Inox Wind’s P/E ratio more than the industry average?

P/E of Inox Wind is the indication of future growth it holds in the renewable energy sector. As the sector is in the growth stage, a higher P/E is tolerable for those firms which hold better prospects for the future.

Q3. What are the investment risks in Inox Wind?

- Higher debt-to-equity ratio which reflects financial leverage.

- Dependent on government policies and schemes supporting renewable energy.

- The renewable energy business is pretty aggressive and rather uncertain.

Q4. Does Inox Wind payout dividend?

Inox Wind does not issue any dividend payout as all profits are reinvested in the firm to expand their business and make R&D more productive.

Q5. Whether Inox Wind has performed comparatively against competition?

Inox Wind has pretty domination in Indian markets of wind energy. The company is considered to have managed a good competitive position relative to the marketplace because of its well established and potent manufacturing capability; yet, firms such as Vestas and Suzlon leave footprints too in India as well.

Inox Wind would do very well with the swing that focus on renewable energy worldwide is going to take in the near future. In each of those cases, with solid underpinnings being a leading approach and experience a greater demand for renewable energy, the stock would do just fine for ten years. Of course, this cannot rule out the risk entirely, but this is quite a seductive long-term narrative when imagining an adjustment of portfolios that meaningfully resonate with an eco-friendly investment.