IRFC Share Price Target From 2025 to 2030: IRFC stands for Indian Railway Finance Corporation and helps in expanding the modernization of Indian Railways by being a part of India’s economic development. With being a Government-sponsored company along with good holding power in the market, stability and growth accompany IRFC. The article discusses the in-depth analysis of IRFC share price target from the year 2025 to 2030 along with its present-day financial health and market dynamics followed by its upcoming growth prospects.

Company Overview

Indian Railway Finance Corporation, or IRFC, is the wholly owned financing and leasing company of Indian Railways. IRFC was incorporated in the year 1986, basically to cater for the purpose of mobilizing funds to meet the Indian Railways’ capital expenditure requirements. These funds thus mobilized are being utilized for rolling stock assets procured, for the construction of infrastructures, and modernizing the technology needed by the Indian Railways. IRFC is PSU and lies directly under the aegis of Ministry of Railways.

Important Take-A-Ways

- Head Office: New Delhi, India

- Market Capitalization: ₹1.69 Lakh Crores

- P/E Ratio: 25.97

- Dividend Yield: 1.16%

- 52-Week High: ₹229.00

- 52-Week Low: ₹104.25

IRFC is playing a very significant role in the infrastructure development process of India and therefore it has all the possibilities to become a very good investment avenue for all those who are looking for stability and long-term growth within the Indian equity market.

Current Financial Status For IRFC Share Price

- Opening Price (in Shares): ₹134.00

- High Price of the Day: ₹135.77

- Low Price of the Day: ₹127.71

- Price Now: ₹129.18

- Market Capitalisation: ₹1.69 Lakh Crores

- EPS is not provided

- P/E: 25.97

- Dividend Yield: 1.16%

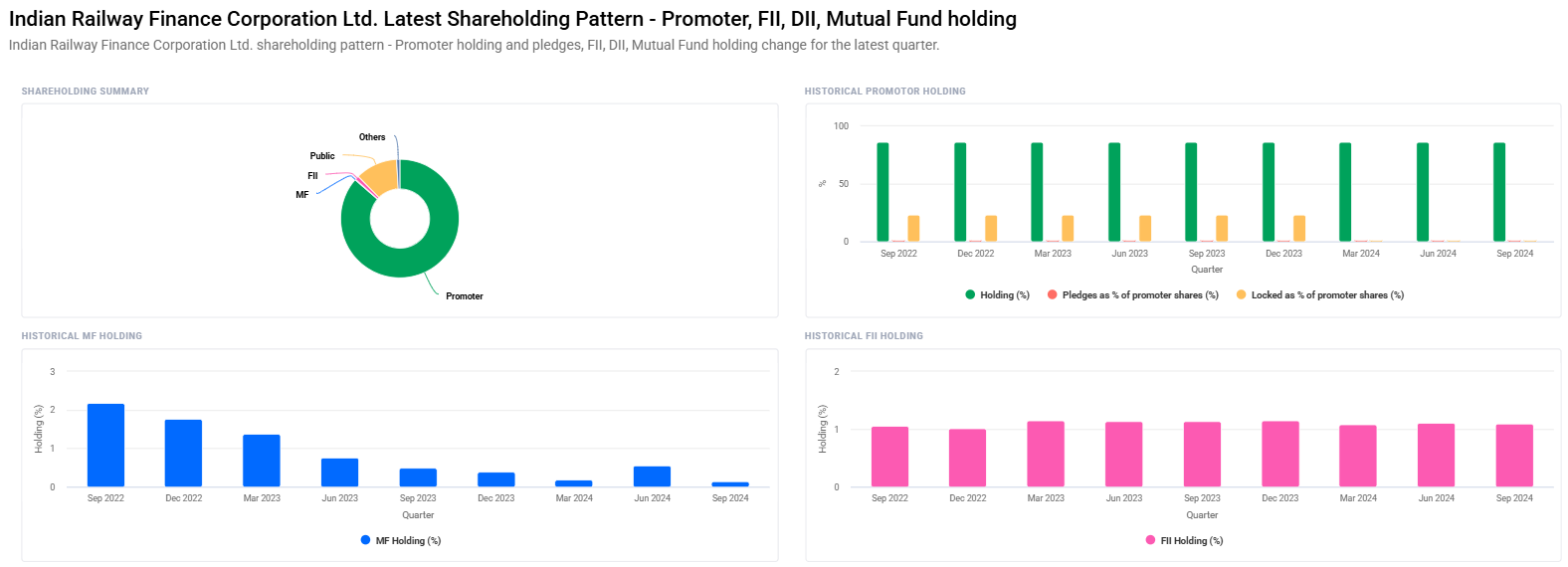

Shareholding Pattern For IRFC Share Price

- Promoters: 86.36% No change

- Retail and Others: 11.46%

- FIIs: 1.09% from 1.11%

- Mutual Funds: 0.15% from 0.55%

- Other Domestic Institutions: 0.93%

The decline in holding of FIIs and mutual funds does not affect IRFC promoter-dominated shareholding.

IRFC Share Price Forecast (2025-2030)

In short run IRFC shall double due to a solid financial platform along with government backing and investment into Indian Railways.

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹250 |

| 2026 | ₹375 |

| 2027 | ₹500 |

| 2028 | ₹625 |

| 2029 | ₹750 |

| 2030 | ₹875 |

Growth Drivers for IRFC Share Price

1. Indian Railway Expansion

The current Indian Railways is the expansionary and the modernized rail network through an electrified rail track along with high speed railway corridors and all the passenger, freight infrastructure; thus, here, IRFC shall directly enjoy.

2. Lease-based stable income source model

IRFC is a lease-based source of income model. The Indian Railways takes rolling stock and other assets on lease. This brings a stable income, with no volatility attached to it. Hence it is a low-risk investment.

3. Support from the government

As a PSU, this business has taken a good push from the Indian government. And with a very high promoter holding at 86.36%, which reflects good confidence over the operation and soundness of finance over IRFC

4. Infrastructure development in India

Focus by the nation of India on infrastructure developments including logistic connectivity has placed an important funding role for the nation’s growth at the hands of IRFC.

5. Increased Freight traffic of railways

As more freight is transported via railway due to surging logistics and e-commerce, the revenue will increase for Indian Railways thereby increasing the performance indirectly of IRFC.

6. Attractive Valuations

Even with a P/E of 25.97, much more than any PSU, it comes with a dividend yield of 1.16%. This brings investors a blend of growth as well as income

7. Investment by Retail Investor is increasing.

A part of 11.46% of the total share holding held by retail investors, and can only gain on recognition with being an all name in popular books of IRFC.

2025 : IRFC Share Price Target ₹250

2025 Share Price of The price of the shares will reach ₹ 250 by the year 2025. It is also coming based on complete electrification of the railways in India and the increased concentration of governments on railway projects.

2026: IRFC Share Price Target ₹375

Share Price is going to touch ₹375 in 2026. All important railway projects have been completed and good revenue has been coming through the rolling stock leased form the bedrock for growth.

2027: IRFC Share Price Target ₹500

Indian Railways will offer a higher lease income, and the financial stability of the company will make valuations soar of IRFC stocks to ₹500 by 2027

2028: IRFC Share Price Target ₹625

The stock would break the ₹ 625 mark by 2028. That would be with developed freight corridors and new high-speed trains driving that growth.

2029: IRFC Share Price Target ₹750

The reason was the continuance of Modernization of Indian Railways along with Stable Revenue Model for IRFC continued to attract Institutional as well as retail investors.

2030: IRFC Share Price Target ₹875

With more investments in Indian Railways, higher freight traffic, and better lease revenues, the IRFC will touch the share price of ₹875 by 2030.

FAQs For IRFC Share Price

1. Is IRFC a good long-term investment?

Yes, IRFC is a good long-term investment due to a stable revenue model and government support coupled with the growth of Indian Railways.

2. Why is the mutual fund holding going down for IRFC?

The mutual fund holding has reduced to 0.15% from 0.55%. On account of fund managers rebalancing the portfolio might be one factor. The stable stock of promoter holding is actually stabilizing for the company itself.

3. What sources constitute the major contributors to the company’s revenue stream at IRFC?

IRFC raises funds by leasing rolling stock assets consisting of locomotives and wagons to Indian Railways. It is an operating lease-based model. Such a model ensures steady and ascertainable income.

4. What is the dividend yield of IRFC?

Independent of any sectoral growth trend, the IRFC indeed yields an impressively high dividend of 1.16%. That would attract many significant dividends in return on investment by many.

5. Why the price of stocks at IRFC does not oscillate?

Well, it simply reflects in its steady and stable stock prices with due to IRFC’s lower business risk quotient with high-level governmental support combined with the revenues arising from such steady leasing.

6. What are the risks in investment in IRFC?

The major risks that lie with one while investing in IRFC are dependence of Indian Railways on revenues, fluctuations on account of a change in regulatory environment brought in by the government, and competition from other financing bodies.

7. How does IRFC contribute to Indian Railways?

IRFC is funding acquisition of rolling stocks, upgrading infrastructures, and upgrading technologies that are preliminary activities for modernization of Indian Railways.

IRFC happens to be at the core of railway infrastructure financing for India, which is supposed to multiply manifold in the years ahead. The IRFC Share Price targets for 2025-2030 would give a strong message of returns the company promises to long-term investors. Alongside a stable revenue model, strong government support, and the important role it plays in infrastructure development for India, IRFC will make an interesting investment proposition for long-term investors.