Jaiprakash Power Ventures Share Price Target From 2025 to 2030: Jaiprakash Power Ventures Ltd is part of the house of Jaiprakash Group, one of the leading entities in India’s power generation domain. Over the years, JPVL has established itself as a major power generation company from both hydroelectric and thermal sources. The article gives a financial analysis, along with market space and share price projection for the company between the period of years 2025-2030, holding all the key fundamentals, along with the composition details about the investor of the firm.

Jaiprakash Power Ventures Ltd.

The principal activity of Jaiprakash Power Ventures Ltd includes the generation of power based on hydro and thermal. It has dispersed power plants across India, and it is rated very high concerning its energy generation process. The company’s most prized assets include the 400 MW Vishnuprayag Hydro Power Project, the 1320 MW Jaypee Nigrie Thermal Power Plant, and the 500 MW Bina Thermal Power Plant. All these projects have contributed much to supporting India’s growing energy demands.

Key Financials For Jaiprakash Power Ventures Share Price

- Market Cap: ₹10,828 Cr

- P/E Ratio (TTM): 8.36

- P/B Ratio: 0.90

- Industry P/E: 20.82

- Debt to Equity Ratio: 0.33

- Return on Equity (ROE): 13.68%

- Earnings Per Share (EPS): ₹1.89

- Book Value: ₹17.51

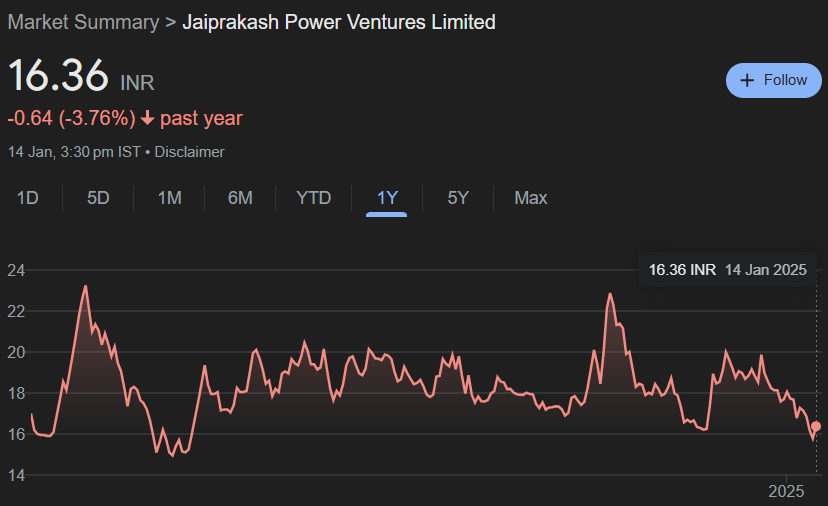

Jaiprakash Power Ventures Share Price Analysis

- Open: ₹15.79

- High: ₹16.44

- Low: ₹15.79

- 52-Week High: ₹24.00

- 52-Week Low: ₹14.35

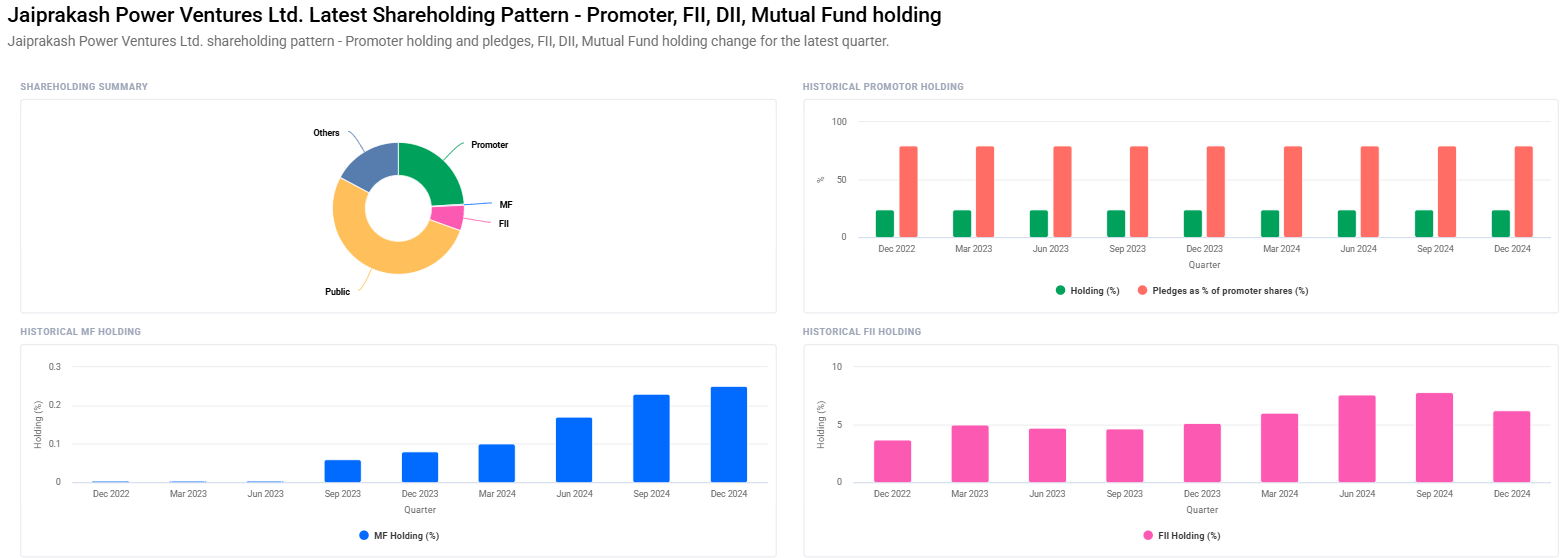

Shareholding Composition For Jaiprakash Power Ventures Share Price

- Retail and Others: 52.26%

- Promoters: 24.00%

- Other Domestic Institutions: 17.24%

- Foreign Institutions: 6.25%

- Mutual Funds: 0.25%

- Promoter Pledges: They have pledged 79.20% of the holding at a constant of previous quarters also.

Jaiprakash Power Ventures Share Price Range 2025 – 2030

With the help of market growth, sector-wise development and based on company fundamentals the Jaiprakash Power Ventures had projected Share Price Target each year, from which is discussed below.

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹25 |

| 2026 | ₹35 |

| 2027 | ₹45 |

| 2028 | ₹55 |

| 2029 | ₹65 |

| 2030 | ₹75 |

2025: Jaiprakash Power Ventures Share Price Target ₹25

The company will benefit from a rebounding energy sector and improved financial discipline. Moderate share price growth is expected because of improved profitability due to an increased utilization of its power plants.

2026: Jaiprakash Power Ventures Share Price Target ₹35

A concentration on debt to equity and a higher operating efficiency can attract more institutional investors hence the steady increase in share price would be expected in case of JPVL.

2027: Jaiprakash Power Ventures Share Price Target ₹45

By 2027, it will gain access to the renewable energy market and this is sure to entrench its leadership position in the industry. A macroeconomy which will be great for the power sector will also catapult its share price to the high end of the target range.

2028: Jaiprakash Power Ventures Share Price Target ₹55

A boost in revenues as well as investors’ confidence would be significantly improved with more attention to the renewables space, including solar and wind projects partnering in Jaiprakash Power Ventures.

2029: Jaiprakash Power Ventures Share Price Target ₹65

The positives that would propel the better financial performance would include improvement in operational efficiencies, expanded portfolio of energy businesses, and lesser promoter pledges.

2030: Jaiprakash Power Ventures Share Price Target ₹75

This company by 2030 would emerge as the leading energy entity in India through strategic initiatives and the increasing power demand. It will again witness fresh high in the share price.

Strengthners of Jaiprakash Power Ventures Share Price

- Diversified Power Portfolio: It consists of hydroelectric as well as thermal power plants. Hence, the revenue flows are relatively stable.

- High ROE: Return on equity stands at 13.68%, which leads to high return generation for JPVL’s shareholders

- Low Debt-to-Equity Ratio: This ratio stands at 0.33, which means that the company has effectively managed its finances and faces lesser financial risk.

- Domestic and Foreign Institutional Support: Such support stabilizes its shareholding pattern.

Problems Faced by Jaiprakash Power Ventures Share Price

- High Promoter Pledges: The 79.20% promoter pledge is a risk; any adverse market condition will make the share volatile.

- Sector-specific Challenges: There are regulatory hassles and volatility in prices regarding the power sector of India. This will always have a damaging effect on profitability.

- FII Holdings: A FII holding has reduced from 7.78% to 6.26%. It presents a case where overseas investors lost confidence.

Growth Opportunities For Jaiprakash Power Ventures Share Price

- Renewable Energy Diversification: The Company can opt for solar and wind energy as this is the new world trend

- Government Schemes: Power for All of the government will help the company like a tailwind

- New Energy Generation Technology Investment: Whichever industry is under question, in such an industry investment in the latest technology regarding energy generation is said to be responsible for bringing in efficiency while performing operations

FAQ For Jaiprakash Power Ventures Share Price

1. What would be the price expectation for the shares of Jaiprakash Power Ventures for the year 2025?

Jaiprakash Power Ventures Share Price will be between ₹18 and ₹22 by 2025.

2. What are the factors which can cause the share price of JPVL move in the next five years?

Diversification into renewables, improvement in financial metrics, and uptrend in power demand from India will be the key drivers.

3. Would it be a good investment for Jaiprakash Power Ventures?

Although the company boasts robust fundamentals, with a low debt-to-equity ratio and good ROE, the investors will have to be aware of the threats like high promoter pledges and sectoral challenges as well.

4. What is the market cap of the Company currently?

As of the latest available data, the market cap of JPVL is at ₹10,828 Crores.

5. What is the concern of JPVL regarding promotor pledges?

The share pledged for loan taken is termed as the promotor pledges. This may not be stable under circumstances with a pledge of 79.20% due to unfavorable circumstances in the market.

Jaiprakash Power Ventures Ltd, being an Indian energy entity, ranks as one of the most important players in its respective domain. Concentration on operational efficiency and control of debt plus diversification to renewable energy has made the company a good long term investment opportunity. However, high promoter pledges and regulatory risks have to be watched closely. Based on the prevailing trends and prediction, the Jaiprakash Power Ventures Share Price must increase gradually up to around ₹75 by the year 2030. With this in consideration, investors need to be quite cautious about every growth possibility along with risk factors before getting into investment.