JBM Auto Share Price Target From 2025 to 2030: JBM Auto is a well-established player in the automobile and engineering space that has steadily picked up speed because of their innovative products and sustainable mobility solutions. With an important focus on electric vehicles, auto components, as well as other engineering verticals, the company stocks have become a point of huge interest for investors. Below is the detailed share price prediction of JBM Auto from 2025 to 2030, along with Company Insights, Technical Trends, and key market information.

Current Market Performance and Financial Metrics For JBM Auto Share Price

- Open: 733.00

- High: 739.50

- Low: 719.15

- Market Cap: ₹17,371 Cr

- P/E Ratio (TTM): 90.79

- P/B Ratio: 14.10

- Debt to Equity: 2.14

- ROE: 15.20%

- EPS (TTM): 8.09

- Dividend Yield: 0.10%

- 52-Week High: 1,214.18

- 52-Week Low: 663.02

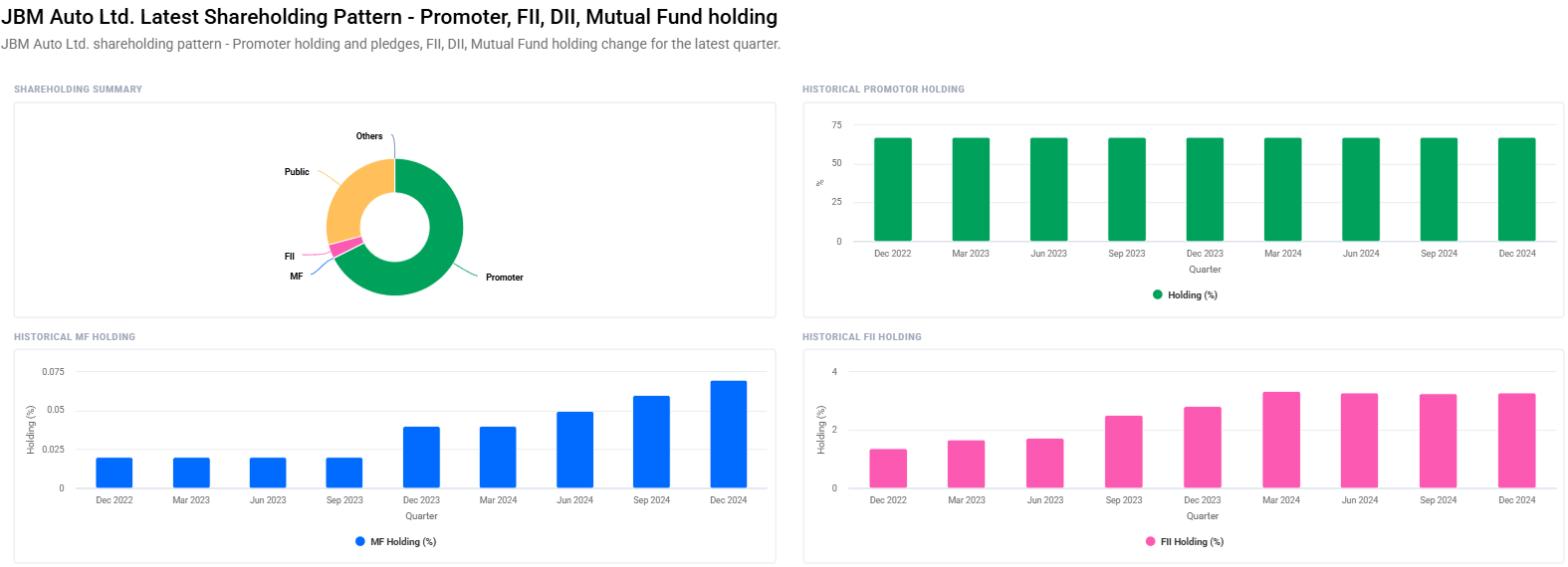

Ownership and Institutional Holdings For JBM Auto Share Price

- Promoters: 67.53%

- Retail and Others: 29.12%

- Foreign Institutions (FII/FPI): 3.28%

- Mutual Funds: 0.07%

- Other Domestic Institutions: 0.01%

Promoters held on the face of 67.53%. The FII/FPI has seen a surmount of 3.28%. The marginal increase in mutual fund holding reflected a surge in institutional investment.

Technical Analysis Summary For JBM Auto Share Price

- Momentum Index: 34.5 (Technical weak)

- MACD (12, 26, 9): -11.1 (Bearish indication)

- ADX: 13.1 (Trend is weak)

- RSI (14): 44.4 (Neutral zone)

- MFI: 73.6 (Oversold and can pull back)

- ATR: 38.3 (High volatility)

JBM Auto Share Price Target for 2025-2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1250 |

| 2026 | ₹1800 |

| 2027 | ₹2350 |

| 2028 | ₹2900 |

| 2029 | ₹3450 |

| 2030 | ₹4000 |

2025: JBM Auto Share Price Target of ₹1,250

Thus, electric vehicle parts and the green solutions through JBM Auto shall be sources of income streams. As more and more institutes get interested in this stock, it can well start moving northward gradually.

2026: JBM Auto Share Price Target – ₹1,800

As the overseas business shall expand its presence along with associations in the ecosystem of the EV, this would help boost growth from now on. That will further increase the addition to its stock value and manufacturing prowess with improvement in technology.

2027: JBM Auto Share Price Target – ₹2,350

JBM Auto will be one of the strongest companies in the components category for EV by 2027. The other advantage is the competitive advantage as it keeps on making strategic investments in R&D going higher.

2028: JBM Auto Share Price Target ₹2,900

Diversified portfolio and higher order books from global clients will enable steady growth. Companies with green practices will attract green investors.

2029: JBM Auto Share Price Target ₹3,450

Continued technological progress coupled with market leadership of the company in its core business areas will be delivering very robust financials to the organization.

2030: JBM Auto Share Price Target of ₹4,000

Two-three years down the line, JBM Auto would be one of the big weights in this global automobile segment not only worldwide but even in India, by 2030.

About the Company

JBM Auto Limited is a conglomerate group. The automobile business along with sectors like engineering, renewable energies, as well as other educations feature in the list of company portfolio. It brings high-end solutions in manufacturing as well as transportation in sustainable ways, Electric Vehicles.

- Auto Components: Dealing in quality parts with leading auto manufacturers.

- Engineering Services: All engineering solutions in various sectors.

JBM Auto-the company, truly dedicated toward new age innovations along with sustainability. It forms a very important pillar in the changed landscape of the automobile industry.

FAQ Section For JBM Auto Share Price

1. Is JBM Auto a good long-term investment?

JBM Auto has grown steadily and will hugely profit from a global drive towards sustainable transportation solutions. Its investments in electric vehicles as well as technological innovation make it a highly promising long-term investment.

2. What are the growth drivers of JBM Auto’s stock price between 2025 and 2030?

Growth drivers for the rapid growth in stock price for JBM Auto between 2025-2030 are as follows:

- Expansion of the electric vehicle segment

- Advancement of technology

- Strategic partnership

- Demand for sustainable automotive solutions at a global level

3. What are the risks involved in investing in JBM Auto?

Potential risks are as follows:

- Market competition

- Changes in regulations

- Fluctuations in raw material price

- Disruption in technology

4. How does P/E in JBM Auto compare with the industry average?

JBM Auto has an aggressively high P/E, but simultaneously, there is also huge scope for growth for the company.

5. What do the promoter holdings in JBM Auto indicate?

Promoters hold a high stake of 67.53%, which entails complete confidence about the firm’s future prospects.

6. What does JBM Auto contribute to the electric vehicle market?

JBM Auto is an inevitable part of the EV market as the company manufactures electric buses along with providing EV parts, thus driving the green mobility solutions into users’ hands.

With this technological and sustainability benefits’ help, JBM Auto has full scope to achieve growth at massive rates and has remained an investment opportunity for any investor who has been searching for options to bet his money in terms of change happening in the automobile industry.