Jio Financial Services Share Price Target From 2025 to 2030: Being a Reliance-backed financial powerhouse, Jio Financial Services Limited is something that is finding its place due to the latest approach of introducing digital financial services in the country. Let’s head into the future and discuss more about the prospects of JFSL in growth, Jio Financial Services Share Price, and why every investor mustn’t miss Jio Financial Service.

Key Statistics: All about Jio Financial Services

- Current Opening Price : ₹279.00

- Day’s High: ₹280.00

- Day’s Low: ₹271.15

- Market Capitalisation: ₹1.74 Lakh Crores

- P/E Ratio (TTM): 109.07

- EPS (TTM): ₹2.53

- 52-Week High: ₹394.70

- 52-Week Low: ₹237.10

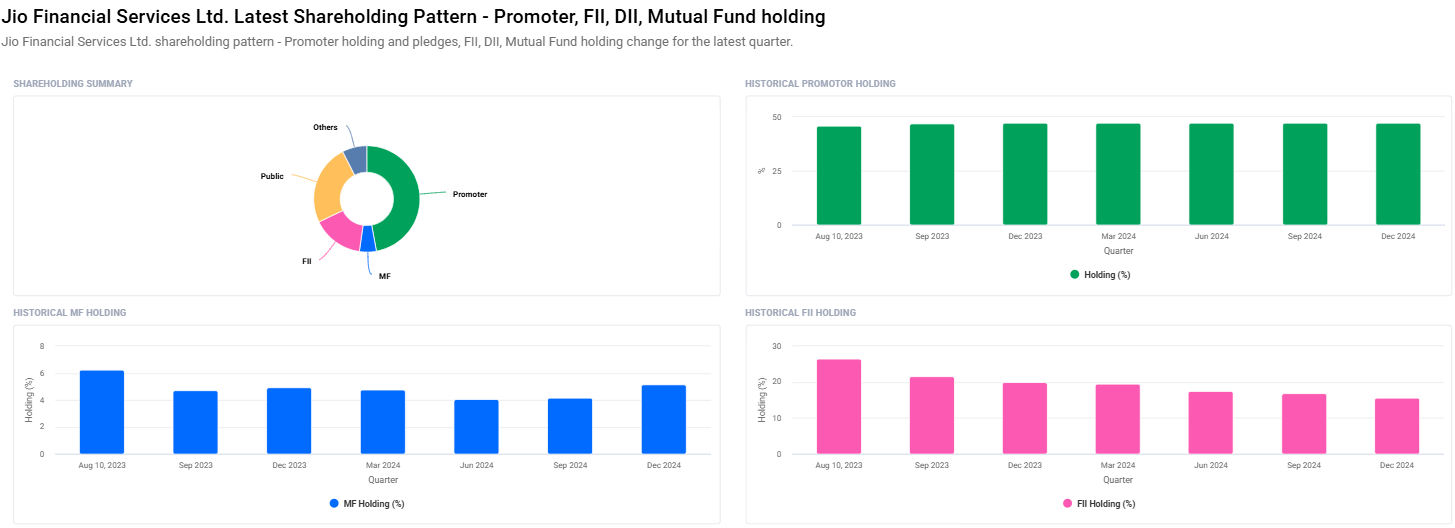

Shareholding Pattern For Jio Financial Services Share Price

- Promoters: 47.12%

- Retail Investors: 24.70%

- Foreign Institutions: 15.62%

- Mutual Funds: 5.13%

Jio Financial Services Share Price Targets: 2025 to 2030

| Year | Predicted Price | Growth Catalyst |

| 2025 | ₹400 | Strengthening its digital lending portfolio and scaling payment services. |

| 2026 | ₹550 | Expansion into rural financial markets, targeting the underserved population. |

| 2027 | ₹700 | Continued innovation in wealth management and insurance services. |

| 2028 | ₹850 | Strategic partnerships to drive user adoption and revenue growth. |

| 2029 | ₹1000 | Leadership in the fintech space through new AI-based offerings. |

| 2030 | ₹1150 | Make the company the profitability leader and hence the story of profitability is well-based. |

Technical Analysis For Jio Financial Services Share Price

Short Term Technical For Jio Financial Services Share Price

- Momentum Score: 28.2 Technically weak yet chance to rebound.

- RSI (14): 32.9 at overbought levels close entry chances

- MACD: -12.3 In the bearish trend yet expected trajectory to the long term shift.

Long Term Indicators For Jio Financial Services Share Price

- Day ADX: 43.2 Been in the strong trend for quite a while now.

- MFI: 51.8 Inflows = outflows in the short term lately.

Investor Note For Jio Financial Services Share Price

Long term shall throw cautionary signs yet shall be very tempting ideas of investment if patient enough.

Why invest in Jio Financial Services?

- Reliance Backed Power House: With the behemoth at the helm – Reliance Industries, such a huge quantity of resources to be accrued with Jio Financial will definitely see it march onward to market leadership steadily.

- Unique Market Access: Along with Jio’s telecom network comes a direct access to millions of users along with unprecedented opportunities for cross-selling.

- Digital Inclusion: The firm specializes in making financial services more accessible to rural and semi-urban areas, but it hasn’t yet attained much growth.

- AI-Powered Leadership: Jio Financial employs the most advanced AI and machine learning capabilities for offering customized financial solutions, making it very different from other similar ones.

- Institutional Repute: Mutual fund holding increased from 4.17% to 5.13%, where more confidence from the institutional front is seen with the vision of the company.

Company Overview

Jio Financial Services Limited: The company will revolutionize the finance services market in India with innovative, affordable, and accessible financial products.

Business Segment:

- Digital Lending

- Payment Systems

- Insurance Services

- Wealth Management

- Vision: Every Indian beneficiary of innovative technology with easy services.

Growth Drivers For Jio Financial Services Share Price to ₹1150 by 2030

- Technological Innovation: Using AI for Efficiency and Satisfaction of Customers

- Rural Expansion: Reaching out to India’s unbanked and under-banked population

- Strategic Collaborations: Collaboration with international finance institutions on the modernization of products

- Regulatory Framework: Pro-government policies propel fintech innovations.

- Strong Brand Identity: Legacy brand image and credibility of the brand Reliance Jio Financial subsidiaries.

FAQs: All That You Want to Know

1. Is it safe to invest for the long run in Jio Financial Services?

Yes, with the robust support, focusing on technology, and with its potential in the market, Jio Financial is good as an investment for a long period of time.

2. Why does the stock look technically weak these days?

With the low RSI and MACD, long-term investors are presented with an opportunity for short-term price correction to get into.

3. Why is Jio Financial different from the others?

A mix of Reliance’s ecosystem, cutting-edge technology, and customer-centricity will be unique.

4. What are the risks an investor should be aware of?

The major risks are regulatory changes, a high P/E valuation, and competition from established financial players.

5. Does Jio Financial Services have plans to reach out to the world?

Its core focus is India; however, long-term expansion plans may include partnerships and global forays.

Conclusion: The Road to ₹1150

Jio Financial Services is not just a stock; it is a revolution in India’s financial ecosystem. From ₹400 in 2025 to ₹1150 by 2030, the company’s journey is fuelled by innovation, market penetration, and strong brand backing.

Investor Tip: Short-term corrections are golden entry opportunities for long-term players. If you’re looking to ride the wave of India’s fintech boom, Jio Financial Services is your ticket!