Kisan Mouldings Share Price Target From 2025 to 2030: Kisan Mouldings Ltd. is one of the leading players in the Indian market for the manufacture and supply of polymer-based products. This company has its expertise in developing innovative piping and plumbing solutions in various sectors of agriculture, industries, and houses. Kisan Mouldings has built itself as a company that delivers excellent quality products while satisfying customers through its commitment to quality and satisfaction.

Kisan Mouldings’ portfolio includes PVC pipes, fittings, and other polymers to cater to the industry’s changing requirements. This company also sustains its present market reach because it has an extensive network of distribution and technological advancement focus.

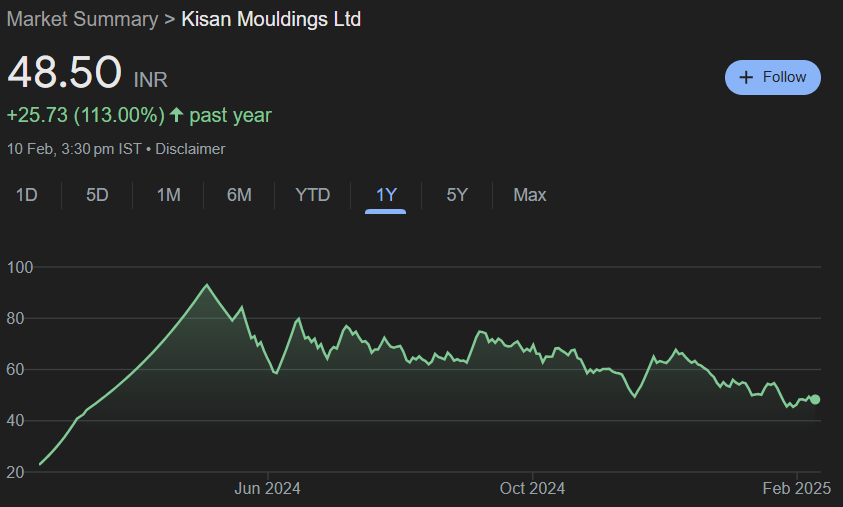

Market Performance For Kisan Mouldings Share Price

- Market Capitalization: ₹574 Cr

- P/E Ratio (TTM): 6.19

- P/B Ratio: 3.69

- Debt to Equity: 0.11

- EPS (TTM): 7.77

- Book Value: 13.04

- Dividend Yield: 0.00%

Kisan Mouldings Share Price

- Open: ₹45.10

- High: ₹49.64

- Low: ₹45.10

- Previous Close: ₹48.08

- 52-Week High: ₹93.47

- 52-Week Low: ₹22.77

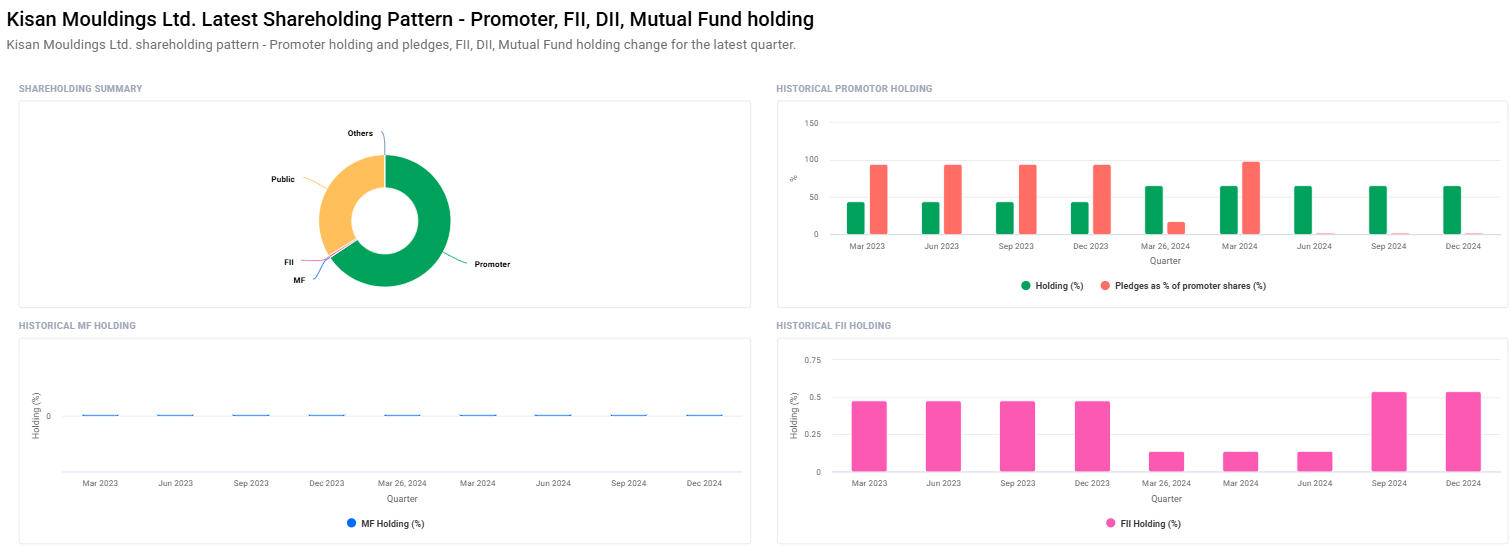

Shareholding Pattern For Kisan Mouldings Share Price

- Promoters: 65.65%

- Retail and Others: 33.81%

- Foreign Institutions: 0.54%

Promoters and institutional investors have maintained their stake in the company over the past few quarters, indicating optimism in the company’s growth prospects.

Technical Analysis Summary For Kisan Mouldings Share Price

- Day Momentum Score: 36.5 (Technically neutral)

- MACD (12, 26, 9): -1.8 (Bearish signal)

- Day ADX: 26.1 (Neutral trend strength)

- Day RSI (14): 43.6 (Neutral with a potential for upside)

- Day MFI: 39.4 (Moderately oversold)

- Day ATR: 3.1 (Moderate volatility)

Kisan Mouldings Share Price Target Projections (2025 to 2030)

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹100 |

| 2026 | ₹170 |

| 2027 | ₹240 |

| 2028 | ₹310 |

| 2029 | ₹380 |

| 2030 | ₹450 |

Analysis and Logic For Kisan Mouldings Share Price

- 2025 (₹100): With the rising need of quality plumbing and piping solutions by the agriculture and industrial sector, the company’s business is expected to pick up in coming years.

- 2026 (₹170): There will be robust revenue expansion due to further improvement in the product line as well as better distribution networks.

- 2027 (₹240): In view of adopting modern techniques of manufacturing, and cost effectiveness, the profit will increase even further.

- 2028 (₹310): This stock will find support in market sentiment coupled with increasing infrastructure investment.

- 2029 (₹380): This stock can really boost its revenue with improved international co-ordination and export prospects.

- 2030 (₹450): This stock will also finally bring in long-term positive yields with even the consistency of the company in innovation and penetration in markets.

Key Growth Drivers For Kisan Mouldings Share Price

- Technological Upgradation: New manufacturing process deployment for maximum efficiency.

- Infrastructure Development: Govt. support on infrastructure and agriculture schemes.

- Sustainability Focus: Growing demand for environment-friendly and durable polymer solutions.

- Market Growth: Entry into newer geographies and customer segments.

FAQs About Kisan Mouldings Share Price

1. What are the main growth drivers for Kisan Mouldings Ltd.?

The key growth drivers include advancements in manufacturing technologies, growing distribution networks, increasing demand for polymer products, and government policies for infrastructure development.

2. Is Kisan Mouldings Ltd. a good long-term investment?

Yes, given its strong market presence, innovative product offerings, and focus on sustainable solutions, Kisan Mouldings holds significant potential for long-term growth.

3. What challenges should investors focus on before entering Kisan Mouldings Share?

Investors should be keen on market conditions, competition offered by other manufacturer, and prospective changes in rule and regulation prevailing in the line of business.

4. Comparing Kisan Moulding with its Industries

Kisan Mouldings has a fair reputation for delivering quality products coupled with customerorientation; however it faces stiff and intense competition to the market compared to larger conglomerates in this polymer and pipings industry line.

5. What is the present market position of the company?

Kisan Mouldings enjoys a good position in the Indian market with a thrust towards residential and industrial applications of polymer products.

6. How far does the shareholding pattern of the company influence investor confidence?

The stable promoter holding of 65.65% and consistent institutional investor presence give an idea of confidence in the growth prospects of the company.

7. What technical indicators should investors watch out for in Kisan Mouldings stock?

Investors must keep a watch on key indicators such as MACD, RSI, and MFI to assess the stock trends and market sentiment.

Kisan Mouldings Ltd. is capable enough to upsize in the upcoming years. Though the projected share price targets touch ₹450 by 2030, this company will benefit due to upgradation of technology, rising demand of polymer products, and innovation that are getting sharp and pointed. It is an investment for long term as it produces according to the market cyclic pressure and competitive pressure due to the fact that it has a solid base of fundamental strength and strategic growth initiatives.