Kotak Mahindra Bank Share Price Target From 2025 to 2030: Capturing investors’ interest as being India’s most reliable and strong banking financial institution, Kotak Mahindra Bank is well-distributed in three broad areas that are retail, wealth management, and corporate banks and is growing steadily because of these. Analysis In this discussion, the bank’s stock price trend with regard to fundamentals and technical, future prospects analysis of the shares at target price has been done and covered for period from 2025 to 2030.

Kotak Mahindra Bank: Overview

- Market Cap: ₹3.76 Lakh Crores

- P/E Ratio (TTM): 16.71

- P/B Ratio: 3.40

- ROE (Return on Equity): 17.77%

- EPS (Earning Per Share): ₹113.32

- Book Value: ₹556.52

- Dividend Yield: 0.11%

- Debt-to-Equity Ratio: 0.00 (Almost debt-free)

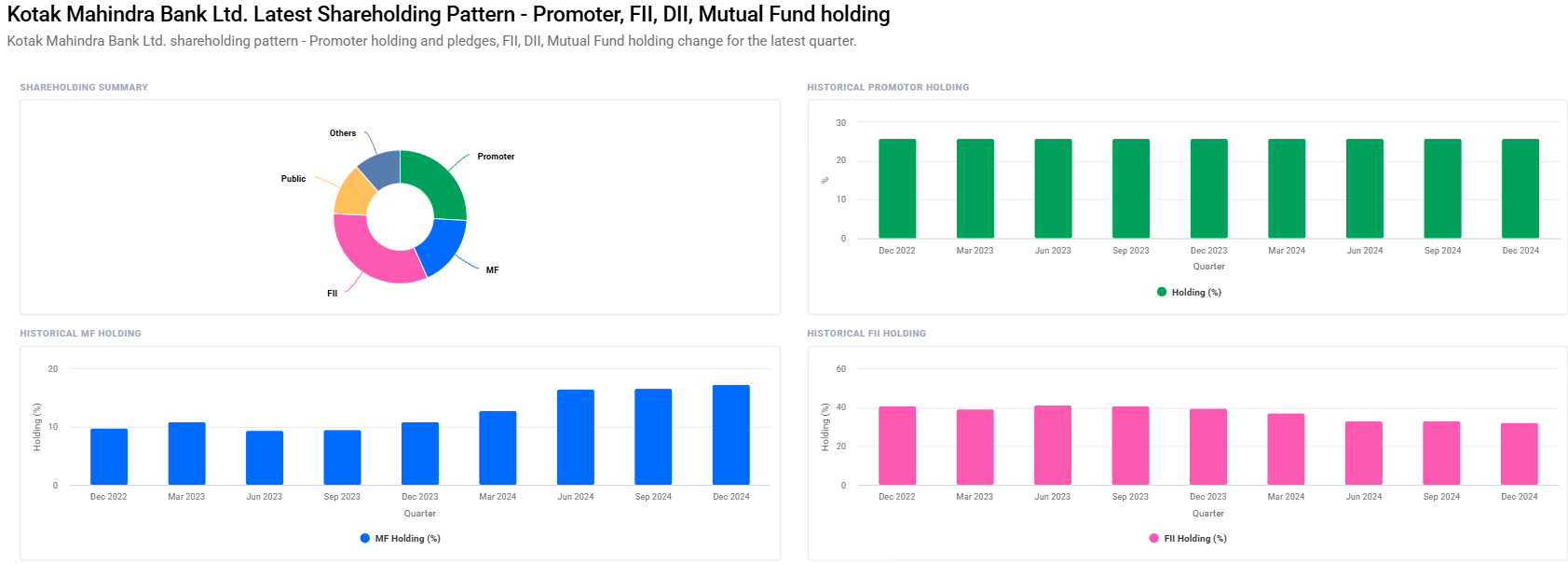

Promoters and Institutional Shareholding For Kotak Mahindra Bank Share Price

- Promoters: 25.89% (Consistent)

- Foreign Institutions (FII/FPI): 32.48% (Marginally decreased from preceding quarters)

- Mutual Funds: 17.44% (Increased from 16.69%)

- Retail Investors and others: 12.85%

- Other Domestic Institutions: 11.34%

Institutional investors continue to invest, and mutual funds are actively participating, which are thumbs-up for the long-term potential of Kotak Mahindra Bank.

Technical Analysis Highlights For Kotak Mahindra Bank Share Price

Day Momentum Indicators

- Momentum Score: 61.6 (Moderately Strong)

- MACD (12,26,9): 25.7 (Bullish Signal)

- RSI (14): 64.8 (Neutral, almost in the overbought zone)

- ADX: 17.0 (Reflecting a weakening up trend strength but still positive)

- MFI (Money Flow Index): 60.2 (Healthy accumulation of the stock)

Volatility and Strength Indicators

- ATR: 44.2 (Moderate volatility).

- ROC 21-D: 9.9 (Positive for short term )

- ROC 125-D : 9.8 (Positive for the long term)

Technically, Kotak Mahindra Bank has remained in the bull state as well due to a high level of institutional activity along with improvement in the stock’s sentiment.

Kotak Mahindra Bank Share Price Targets from 2025 till 2030

| YEAR | TARGET SHARE PRICE (₹) |

| 2025 | ₹2000 |

| 2026 | ₹2400 |

| 2027 | ₹2800 |

| 2028 | ₹3200 |

| 2029 | ₹3600 |

| 2030 | ₹4000 |

2025: Kotak Mahindra Bank Share Price Target Rs, 2,000

With strong financial fundamentals along with investment in digital banking, which had been growing sequentially, the ₹2,000 mark may be breached for Kotak Mahindra Bank by 2025. Loans are expected to climb and stay well through net interest margins, which means that the hike would be sturdier.

2026: Kotak Mahindra Bank Share Price Target ₹2,400

By 2026, when Indian consumer banking will continue to grow with the economy, the stock of Kotak Mahindra Bank would touch ₹2,400. Its growth will be supported by an increase in digital offerings and cost optimization.

2027: Kotak Mahindra Bank Share Price Target ₹2,80o

In 2027, the bank would further advance fintech partnerships and innovations. Its share price will jump to ₹2,800 as earnings will be higher, and ROE will go up.

2028: Kotak Mahindra Bank Share Price Target ₹3,200

Kotak Mahindra Bank would focus on corporate lending and wealth management services. It would finally reap from that focus area in 2028 and shoot the share price up to ₹3,200. This growth will be fuelled by a benign interest rate environment and increased consumer confidence.

2029: Kotak Mahindra Bank Share Price Target ₹3,600

By 2029, Kotak Mahindra Bank will touch a share price of ₹3,600 through revenue diversification and further reduction in the cost-to-income ratio. This will be driven by the growth in foreign investment and the overall strength of the banking ecosystem.

2030: Kotak Mahindra Bank Share Price Target ₹4,000

By 2030, Kotak Mahindra Bank will touch ₹4,000 on the back of long-term strategic initiatives, enhanced operational efficiencies, and increased presence in rural and semi-urban markets.

Key Growth Drivers of Kotak Mahindra Bank Share Price

- Digital Transformation: Investment in digital banking solutions and fintech partnership.

- Retail Banking: Expansions to semi-urban and rural geographies.

- Corporate Lending: Opt for corporate lending with proper risk management practices.

- Wealth Management: Leverage the strength in the space of wealth management.

- Sustainable Practices: Align with ESG (Environmental, Social and Governance) objectives

Company Information:

Kotak Mahindra Bank is one of the banks that were founded in 1985. The headquarters is in Mumbai, India. This bank provides all financial services to customers, which include retail banking, asset management, insurance, and investment banking. Over time, it has built a name for innovation and customer-centric services.

Frequently Asked Questions For Kotak Mahindra Bank Share Price

1. Is Kotak Mahindra Bank a good long-term investment?

Yes. Kotak Mahindra Bank is a sound long-term investment as it brings good fundamentals with low levels of debt and healthy growth in the retail and corporate banks.

2. What is the price that shares of Kotak Mahindra Bank can be expected at in the year 2030?

The bank shall hopefully reach a mark of ₹4,000 by 2030 with earnings growth and strategic moves.

3. What are the risks in case of investment in Kotak Mahindra Bank?

Major risks include regulatory changes, new-age fintech companies, and macroeconomic risks.

4. How does Kotak Mahindra Bank stand its peers?

Kotak Mahindra Bank stands out uniquely with superior financials, superior ROE, and smart digital transformation and, therefore, distantly leads most of its private banking competitors.

5. Why is the dividend yield of Kotak Mahindra Bank historically low?

Low dividend yields are a consequence of the stress of the bank to plough the profits for growth and expansion.

Kotak Mahindra Bank has tremendous growth potential over the next couple of years. Its thrust on innovation, customer satisfaction, and operational excellence make it a very sound long-term play. At ₹4,000 in 2030, there’s plenty of upside for the risk-tolerant investor who is willing to ride the waves.