Macrotech Developers Share Price Target From 2025 to 2030: Macrotech Developers, the Lodha Group, is one of the best companies in India in the real estate businesses. The company has been highly successful in attracting a significant amount of investors since it was providing premium residential and commercial properties. Its promising business model with steady growth along with increasing demands for real estate in cities places Macrotech Developers on a very promising horizon for its shareholders. This report includes the Macrotech Developers Share Price range for 2025 through 2030. Some of the important metrics along with technical charts have also been provided.

About the Company

Macrotech Developers Ltd is a realty firm, whose headquarter lies in Mumbai, Maharashtra. The group caters to both luxury as well as the affordable housing sector. Its businesses include residential apartments, retail as well as office space portfolios.

Financial Indicators For Macrotech Developers Share Price

- Market CAP: ₹1,09,937 Cr

- P/E Ratio (TTM): 43.83

- P/B Ratio: 6.20

- ROE (Return on Equity): 11.37%

- Debt to Equity: 0.44

- Dividend Yield: 0.20%

- Book Value: ₹177.99

- Face Value: ₹10

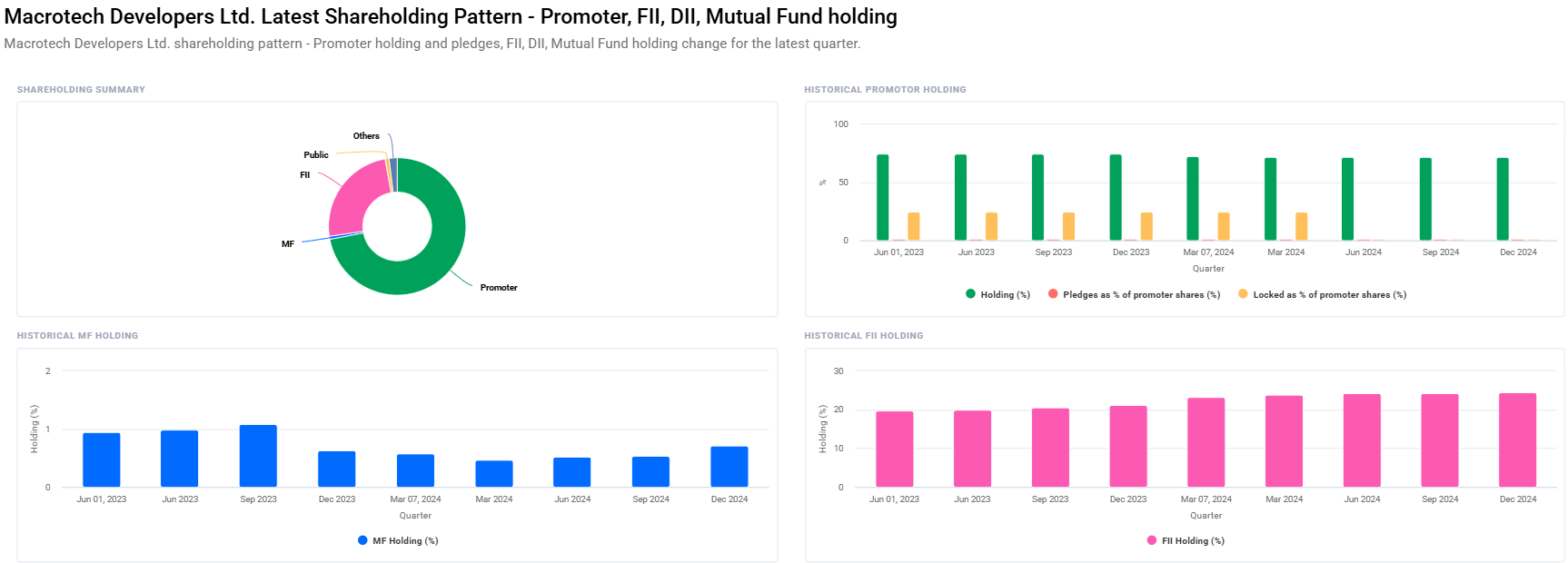

Shareholding Pattern (%) For Macrotech Developers Share Price

- Promoters: 71.98%

- Foreign Institutions: 24.45%

- Other Domestic Institutions: 1.93%

- Retail and Others: 0.93%

- Mutual Funds: 0.71%

Marginally decreasing promoter holding is indicative that the management confidence is sustained. Since FII/ FPI stake has increased, such a hike would be marked by the interests of the stakeholders abroad.

Macrotech Developers Share Price Target until 2025-2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1700 |

| 2026 | ₹2380 |

| 2027 | ₹3060 |

| 2028 | ₹3740 |

| 2029 | ₹4420 |

| 2030 | ₹5100 |

2025: Macrotech Developers Share Price Target ₹1,700

The growth of the company will be continuous in 2025. Here, the growth in demand for urban real estate and infrastructure is expected to happen to be the most influencing factor. Supportive government policies toward affordable housing will increase more revenue to it.

2026: Macrotech Developers Share Price Target ₹2,380

A strong and rising portfolio of residential and commercial projects will reach maturity by the end of 2026. Foreign investments in the Indian real estate sector would swell a great deal when valued.

2027: Macrotech Developers Share Price Target ₹3,060

2027: By 2027, the company will tap into its full potential in smart cities and green housing project technology. It would speak the same tune as the vision of the Indian nation’s modernization was doing and the share price would move northwards.

2028: Macrotech Developers Share Price Target ₹3,740

Improvement would be seen in the urbanization growth, and the requirement in Tier 1 and Tier 2 cities would remain highly robust. Sales would be strong, and the stock price would be on the northbound journey.

2029: Macrotech Developers Share Price Target ₹4,420

However, with steady growth, Macrotech Developers can even forge new tie-ups with foreign investors that would again strengthen financial structure.

2030: Macrotech Developers Share Price Target ₹5,100

By 2030, Macrotech Developers would be the list of Indian market leaders. It is only when the huge infrastructure project and starts new territories with it can easily push the share prices skyhigh.

Technical View For Macrotech Developers Share Price

Momentum Value: 37.3 (Neutral)

Readings above 70 are technically strong. Readings less than 35 are technically weak and a zero read means the investor that levels have been equal to him.

Day RSI (14) Value:33.4

This stock is close to the oversold area. Once RSI moves downwards and touches the bottom line, at 30 or below it acts as a buy signal as it bounces.

Day MACD (12, 26, 9): -69.2

MACD is now below the signal line also below the middle line. These are short term bearish signals,

Day ADX: 26.4

At this juncture of time, this is a medium trend strength level. Thus in the short run, the stock is going to experience medium type moves with regard to its price.

Day ATR: 56.7

It is the measure of the latest stock price volatility. Such an ATR captures the movement at the middle category of price levels.

Day ROC (125): -18.9

It will be having long-term bearish trends if the stock is having a negative ROC. There may still be hope for reversal when the stock covers up.

Drivers of Upward Surge in Macrotech Developers Share Price

1. Trends in Real Estate Markets: More impressive growth drivers are an increase in the level of urbanization and premium housing. The house solutions pertaining to sustainable and smart houses may advance with this company’s projects.

2. Government Policies: Revenue generating favorable government policies to the company include PMAY- Pradhan Mantri Awas Yojana and tax benefits to homebuyers.

3. Debt Management: The company is healthy and well capitalized enough to raise more debt money for further expansion as its debt to equity ratio stands at 0.44.

4. International Investments: Surging FII/FPI interest reflects the fact that the sector is sure of India’s real estate.

Risks to Watch Out for Macrotech Developers Share Price

- Interest Rate Volatility: Changes in interest rates may affect demand for housing.

- Macroeconomic Factors: Slow-down of the economy or a global crisis may affect sentiments of the buyer.

- Regulatory Changes: Unforeseen changes in real estate rules may be difficult to handle by the company.

FAQs For Macrotech Developers Share Price

1. Is Macrotech Developers a good long-term investment?

Yes, Macrotech Developers has sound market presence and consistency in growth, and a sound financial structure.

2. Why the stock is bearish at present?

Negative signals from technical indicators like MACD and ROC for this stock in the aftermath of decline in consideration of negative market mood and international influence. Long-term is positive.

3. Macrotech Developers Upside potential by 2030

Seize every short-term advantage that the company can avail of from urbanization, government policies, and international investments. ₹5,100 in share price by 2030.

4. Some Major Risks Tied with This Stock:

Interest rate volatility, macroeconomic insecurity, or the real estate being impacted by regulations are the two significant risks the stock offers.

5. Comparison with Industry

Macrotech Developers is the company doing premium projects with sustainable housing initiatives. Competitive P/E Ratio and good ROE compared to the industry average enables the company in giving it a head start amongst its peers in the real estate sector.

With a good base and constant growth of the demand for house along with support from a well-designed policy environment, Macrotech Developers will expand exponentially during the period from 2025 through 2030. Short-term technical indicators would appear to have a bearish trend; the long term seems a bit positive in nature. With the intention of making an investment, Macrotech Developers will form one of the advised Indian Realty Companies for their investor.