Manappuram Finance Share Price Target From 2025 to 2030: Manappuram Finance is amongst the best NBFCs in India. In all respects, it can be said to be a good investment option for investors who are looking at the sort of steady growth and the perfect market positioning strategy. The NBFC boasts excellent fundamentals and, above all, great performance in the area of the gold loan business, which will enable it to deliver nothing short of extraordinary financial performance. This report provides the targets in Manappuram Finance share price from 2025 to 2030 by giving data, technical indicators, and expert forecast from the market.

Current Market For Manappuram Finance Share Price

- Open: 205.98

- High: 210.00

- Low: 200.01

- Market Cap: ₹17,631 Crores

- P/E Ratio: 7.80

- Dividend Yield: 1.58%

- 52-week High: 230.40

- 52-week Low: 138.35

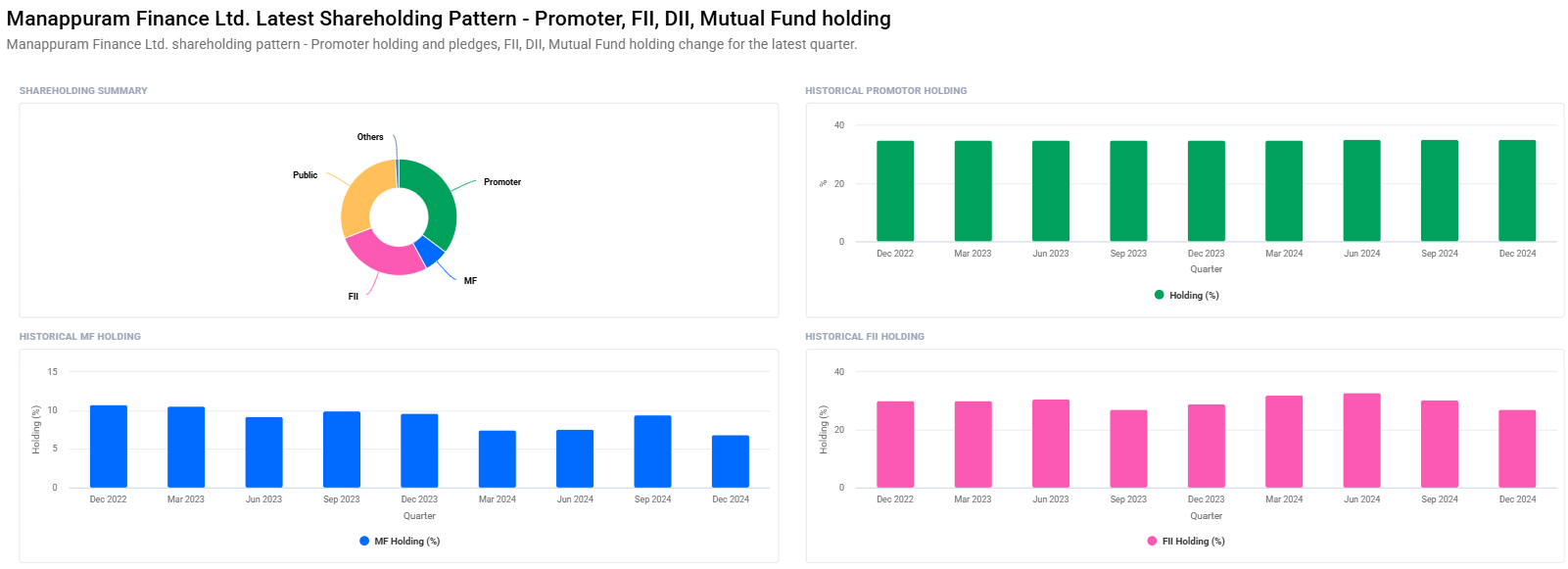

Stock Holding Pattern For Manappuram Finance Share Price

- Promoters: 35.25%

- Retail & Others: 29.86%

- Foreign Institutions (FII/FPI): 27.01%

- Mutual Funds: 6.86%

- Other Domestic Institutions: 1.02%

This has been seen in the percentage change by drop in FII/FPI holding from 30.36% to 27.01% and mutual fund holding from 9.49% to 6.86%.

Technical Indicators For Manappuram Finance Share Price

- Momentum Score: 56.5 (Neutral)

- MACD (12, 26, 9): 6.2 (Bullish)

- ADX: 18.2 (Weak Trend)

- RSI (14): 66.8 (Crossing Overbought)

- ROC (21): 15.7 (Positive Momentum)

- MFI: 82.5 (Strong Overbought)

- ATR: 7.6

Manappuram Finance Share Price Target Prediction 2025 to 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹250 |

| 2026 | ₹350 |

| 2027 | ₹450 |

| 2028 | ₹550 |

| 2029 | ₹650 |

| 2030 | ₹750 |

Manappuram Finance share price target in 2025 INR 250

The company would focus on its advantage of being strong in the long-term gold loan business and its widening digital lending business. Hence, Manappuram Finance would see slow and steady growth. Experts might keep the target price around Rs 250.

2026: Manappuram Finance Share Price Target INR 350

By 2026, further diversifications and technological upgradation would have shifted the share price to Rs 350. The loan disbursal would continue with even more operational efficiency.

2027: Manappuram Finance Share Price Target INR 450

With stabilized prices of gold and upsurging demand for credit services, it should be priced at INR 450 in Manappuram Finance. There would be an acquisitive and JV period .

2028: Manappuram Finance Share Price Target INR 550

Then the share price of the company would be scaled to INR 550 with steady innovations of fintech solutions and rural markets. Stable dividends for the investors.

2029: Manappuram Finance Share Price Target INR 650

By 2029, Manappuram Finance would be with tremendous profit having deeper market penetration and return on assets to welcome the expected share price of INR 650.

2030: Manappuram Finance Share Price Target INR 750

After having healthy financial health, with diversified sources of revenue, Manappuram Finance would reach the share price of almost INR 750 by the year 2030. It would be able to become the unchallenged leader in NBFC in India

Company Details

Manappuram Finance Limited is a Non-Banking Finance Company founded in India way back in 1949. Manappuram Finance is one of the largest finance companies in India in gold loan, microfinance, vehicle finance, and home loans. It has a very strong presence both in urban as well as in rural markets, and it stands among the most creditable financial partners to millions of users.

Success Factors of Manappuram Finance:

- Pant-India spread branches

- Strong digital lending solutions.

- Good performance, with constant dividend.

Future Outlook:

- New lending categories

- Techno-based services with enhanced uptakes

- Enhanced relation with fintech companies.

FAQs For Manappuram Finance Share Price

1. What will be the share price of Manappuram Finance in 2025?

In 2025, Manappuram Finance will be at share price INR 250.

2. Why to invest in Manappuram Finance?

The company has a high market share for gold loan; it has good financial and strategic growth approaches that make Manappuram Finance an investment worth making.

3. Risks Involved in investing in the Company Manappuram Finance

The risk factors include variations in the markets of gold rates, changes in regulations, and competition from the other financial institute.

4. How does it intend to differentiate its products portfolio?

The company aims at diversifying the loan portfolio in the digital line, enhancing the micro-finance business, and enhancing market share in car loans and home loans.

5. What is the dividend yield of the company?

The current dividend yield is at 1.58%.

6. What is the change in the promoter holding?

The promoter holding has remained static at 35.25%.

7. What is the debt-to-equity ratio of Manappuram Finance?

With 3.12 debt to equity, thus healthy financial structure on a leveraged side.

8. What shape technicals are projecting in the future vision of this stock?

Short term technicals comprise MACD, RSI and ROC that has positive sign short side; However MFI states that it had overbought the stock from the charts.

Manappuram Finance holds pretty good prospects for tremendous growth over the next ten years. Positives include a good fundamental strength, smart strategies in the markets, and good technological advancement that should propel upward share prices and handsome returns over the long period. Manappuram Finance is one of the value players in the space of NBFC. Estimated share price for the year 2030 will be around INR 750.