MOIL Share Price Target From 2025 to 2030: This company, initially named Manganese Ore (India) Limited was the flagship company engaged in manganese ore mining activities in India. MOIL has high-spread operations across Maharashtra and Madhya Pradesh-an important source of manganese ore; these are crucial raw materials in the steel industry and other industries. Company built up through efficient operations and strategic expansion, and in recent times, one of the important pillars of India’s mining sector.

Its infrastructural strength and innovative ideas help it maintain its prices below the competitive market. Its focus on the environment with green initiatives and clean mining technologies will always make a product from it very reliable.

Financial and Technical Analysis For MOIL Share Price

- Open: INR 324.70

- High: INR 326.50

- Low: INR 316.05

- Market Capitalisation: INR 6.52K Crore

- P/E Ratio: 18.74

- Dividend Yield: 1.89%

- 52-Week High: INR 588.00

- 52-Week Low: INR 259.50

Fundamentals For MOIL Share Price

- Debt to Equity Ratio: 0.23

- Return on Equity (ROE): 15.85%

- EPS (TTM): INR 16.18

- Book Value: INR 97.28

- Face Value: Rs. 2

- P/B Ratio: 2.38

- Industry P/E: 48.30

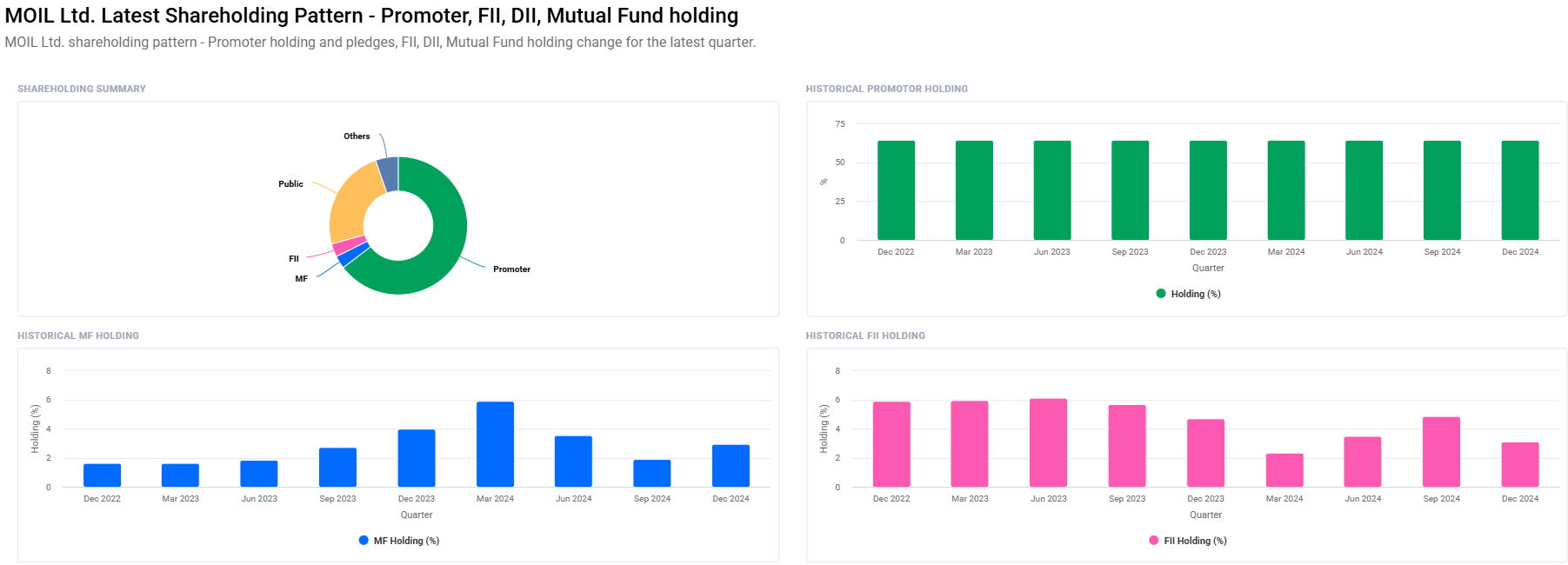

Investor Trends For MOIL Share Price

- Promoters Holding: 64.68% (No Change)

- FII/FPI: 3.12% (Drop from 4.87%)

- Retail & Others: 22.84%

- Mutual Funds: 2.98% (Up from 1.90%)

- Other Domestic Institutions: 6.10%

MOIL Share Price Prediction to 2025-2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹600 |

| 2026 | ₹950 |

| 2027 | ₹1300 |

| 2028 | ₹1650 |

| 2029 | ₹2000 |

| 2030 | ₹2350 |

2025: MOIL Share Price Target Rs. 600

Higher demand for the commodity from automobile and steel industries will leave MOIL to benefit from the scenario. Moreover, higher government investment in infrastructures as well as an increased global production of steel, the price will raise further.

2026: MOIL Share Price Target INR 950

As long as it keeps efficiency in operations and improves on technology, this company can only improve with profits. Manganese-based batteries, used by new-generation electric vehicles globally, should be the reason why the valuation of the company moves upwards.

2027: MOIL Share Price Target INR 1300

Such a measure by MOIL towards enhancing production capacity will serve both the demands-from the domestic markets as well as foreign markets-for it has to see the burgeoning chart of the huge increase in the demand. Sound financial stability along with a track record for providing dividend each quarter will be a positive attractive factor towards investors towards the Company.

2028: MOIL Share Price Target INR 1650

This should prove to be quite a good catalyst for the consistent growth of the stock, in light of which manganese prices too are increased on a proportional scale, government support for mining as well as for manufacturing.

2029: MOIL Share Price target Rs 2000

Profitability over long term will emanate from strategic steps taken on the cost optimization front as well as due to better efficiency, for which MOIL has not left a single stone unturned. Here the share price ought to be appreciated further at this juncture.

2030: MOIL Share Price Target INR 2350

By technological upgradations, penetration, and the resultant increased demand for quality manganese products, the final numbers will be likely to take MOIL’s stock to INR 2350.

Technical Analysis Insights For MOIL Share Price

- Day Momentum Score: 63.0 Technically moderately strong

- Day MACD (12, 26, 9): 3.4 Bullish indicator

- Day ADX: 19.4

- Day RSI (14): 63.7 Stock is not yet overbought.

- Day MFI: 80.4 Extremely overbought, a potential pullback likely

- Day ATR: 10.7 Moderate price movements

- Day ROC (21): 13.6

This technical analysis shows moderate strength, and so there can be some significant bullish trends that may occur with respect to the MOIL stock in the forthcoming days or weeks.

Q&A on MOIL Share Price Targets

1. What will be the estimated price of MOIL share by 2025?

The estimated price of the share of MOIL by 2025 will be INR 600.

2. Why is MOIL a good long-term investment stock?

An organization having excellent market presence and operational efficiency along with strategic plans for expansion like MOIL will always have a significant role in supporting the steel industry and further has an opportunity from the demand side of EV batteries, hence making it a very attractive long-term investment option.

3. How is the financial health of the company?

MOIL boasts a healthy credit profile with debt-to-equity ratio standing at 0.23 while ROE stands at an impressive 15.85%.

4. What is manganese used for today?

Manganese is used mainly in making steel, while emerging applications also come in battery technology for electric cars.

5. In the near term, will company dividend pay-outs increase?

MOIL is financially sound, good operational growth; Dividend payments will grow up and the investors’ money shall get valuable

6. What factors might influence MOIL share price growth?

Factors that shall contribute to moving price of Share for MOIL will be-demand of manganese rising and its growth-technology enhancements on EV-battery-Government new infrastructure-Infrastructure and planned plans by MOIL.

7. How do the investors minimize risks in share investment in MOIL?

The investor can minimize risk if they have proper information of the trend that is prevalent in the industry; if they observe the company performance and diversify their portfolio.

MOIL Limited is one of the promising investment opportunities in long-term growth, with robust operations and strategic expansion backed by financial stability. Its share price can be expected to reach INR 600 by 2025 and INR 2350 by 2030. MOIL is in a good position to capitalize on changing industrial landscapes and new technologies, making it a good investment for those looking for exposure to the mining and materials sector.