NTPC Green Share Price Target From 2025 to 2030: NGEL is the key subsidiary company of NTPC Limited. Over the last decade, this has become the key player for the renewable energy sector in India. With ever-increasing emphasis toward clean and green energy all over the globe, NTPC Green becomes one of the rapidly emerging players on the route toward green energy for India. Share Price Targets of NTPC Green 2025-2030 would focus on the fundamentals and technical insights coupled with much more future growth avenues with the advent of renewable energy.

Company Overview: NTPC Green Energy Ltd

NTPC Green Energy Ltd is a subsidiary of NTPC Limited, India’s largest energy conglomerate. This company deals with renewable energy projects, which include the production of solar and wind power with an aim to play a major role in the set targets by the Indian government in the additional capacities of renewable energy. With this vision of increasing its portfolio in renewable energy, NGEL is well positioned to be one of the key forces behind the clean energy revolution for the country.

Major Business Events For NTPC Green

- Renewable Energy Projects: The fact that NGEL has quite a high number of solar and wind energy projects in its pipeline really strengthens the company’s long-term prospects.

- Strategic partnerships: The company has selected global as well as local firms to create further development into the green energy venture

- Government support: It has benefited from favorable policies regarding renewable energy, which had placed NGEL at an advantageous position in front of its competition in the market.

- Future Expansion Plans: NTPC Green aims to scale up its renewable energy capacity to over 60 GW by 2032, placing the company at an advantageous position in the energy transition in India.

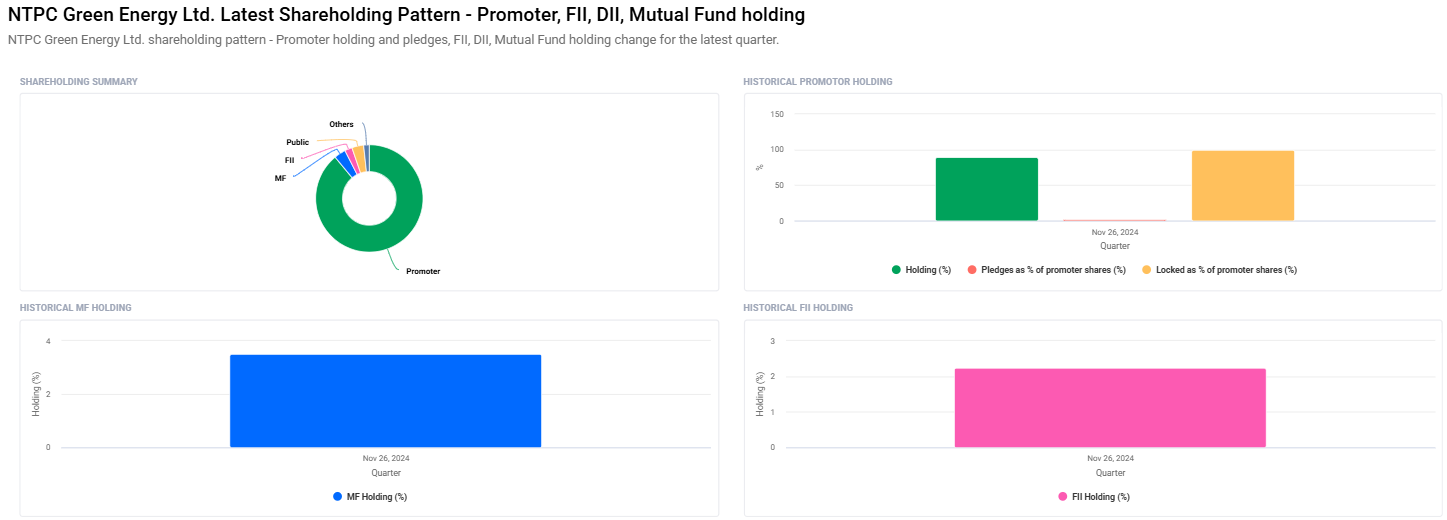

Promoters and Shareholding Pattern For NTPC Green Share Price

- Promoters holding is 89.01 percent and it is the most important and stable as well as the direction of the company.

- Retail and other investors at 3.68 percent, it indeed shows the growing interest amongst the retail investors

- Mutual funds standing at 3.52 percent and Foreign institutions are at 2.24 percent.

Important Market Statistics For NTPC Green Share Price

- Market capitalization: ₹1,03,000 Cr, and therefore a relatively large-scale enterprise and market influence.

- P/E Ratio (TTM): 331.17, which indicates that the concern is highly capitalized by future earnings.

- P/B Ratio: 5.61, which says investors are showing faith in potential growth.

- Debt-to-Equity Ratio: 2.20. It reflects leveraging for aggressive business expansion.

- ROE: 3.82%, which means yield out of shareholder equities.

Technical Analysis For NTPC Green Share Price

- Day Momentum Score: 12.0 Technically weak, below the threshold limit of 35

- MACD (12, 26, 9): -5.2 Strong bearish signal below the signal line

- ADX: 14.3 Trend strength low as it reflects the consolidation stage

- RSI (14): 49.1 Centering in neutral territory, not in the oversold or overbought range

- ATR: 6.3 indicates fair price movement.

Last NTPC Green Share Price movements

- Opening: ₹122.00

- Highest: ₹123.48

- Lowest: ₹120.40

- 52-Week High: ₹155.35

- 52-Week Low: ₹109.41

The long-term outlook of NTPC Green is positive, however, the short-term technicals of NTPC Green are weak because it is rapidly foraying into the renewable sector.

NTPC Green Share Price Forecast 2025-2030

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹160 |

| 2026 | ₹205 |

| 2027 | ₹250 |

| 2028 | ₹300 |

| 2029 | ₹350 |

| 2030 | ₹400 |

2025: NTPC Green Share Price Target ₹160

The stock of NTPC Green would increase steadily by 2025 with the ongoing renewable projects by the company. Revenue from government policies regarding solar and wind energy would also raise the revenue of the company, reflecting a positive sentiment in the market.

2026: NTPC Green Share Price Target ₹205

NGEL will complete some big projects in 2026, which will enhance the installed capacity. Growth will also continue to progress due to tie-ups with international energy companies and developments in the renewable energy space.

2027: NTPC Green Share Price Target ₹250

Share Price Target for the year 2027: Share price will jump since the investor confidence will be at all time high since NTPC Green will meet its goal for the target of the renewable energy capacity. With new international markets and innovative financing models, the institutional investors will throng the firm.

2028: NTPC Green Share Price Target ₹300

The company is going to dominate the leadership position in India’s renewable energy segment; the share price will be touching the skies. The high-cap solar and wind power commissioning of project will enhance market domination.

2029: NTPC Green Share Price Target ₹350

It is going to utilize new technologies developed and realize operational efficiencies till 2029 and garner profitability gain. The increasing governmental focus on carbon neutrality will fuel growth in the company.

2030: NTPC Green Share Price Target ₹400

Target share price at 2030 for NTPC Green reflects the leadership of the former in renewable energy space. Long-term achievement of capacity with sustainable returns for the shareholders shall establish it as the world’s leader in clean energy.

Factors for NTPC Green Share Price Growth

- Policies, Government: Schemes and facilitation through tax and other policies along with benefits and purchase orders on the basis of purchase made on the basis of renewals would nicely be viewed upon NGEL

- Technology Developments: State-of-the-art application, for example, floating solar, and energy storages are able to enhance its efficiency

- Trend: Clean energy use is surging all over the world with opportunities for high-level international cooperation

- Sustainability Agenda: Net-zero by 2070 – Sustainable investment window in renewable energy opportunities in India

Frequently Asked Questions (FAQs) For NTPC Green Share Price

1. What is NTPC Green Energy Ltd.?

NTPC Green Energy Ltd. is an associate company of NTPC Ltd., where it engages itself with renewable energy venture works like solar and wind power generation.

2. What is the estimated NTPC Green Share Price target for the year 2025?

The share price target for the year 2025 of NTPC Green shall be ₹160.

3. Why NTPC Green is a good investment?

NTPC Green is an attractive investment idea with a robust renewable energy pipeline, government support, and long-term prospects in the clean energy space.

4. Future plans of the company:

NTPC Green aims to take its total renewable energy capacity to over 60 GW by 2032, making the company a critical player in the clean energy journey of India.

5. Compare NTPC Green with others:

This is one stock, based on the strength of the parent company, government support, and singular focus on renewables.

6. What are some risks in investment in NTPC Green?

High valuations, dependency on government policy, and private competition in the renewable sector.

7. What is the firm’s debt/equity ratio?

NTPC Green Debt/Equity Ratio at 2.20 is a levered operation for pushing growth in business.

NTPC Green Energy Ltd. is well placed to capitalize on the renewable energy growth wave. It is a technically weak company in short-term prospects but an extremely attractive proposition as far as growth prospects are concerned in the longer term. Ambitious plans to increase capacities, strategic partnerships, and governmental support will significantly enhance the NTPC Green Share Price between 2025 and 2030. In fact, NTPC Green continues to be one of the best opportunities in India’s renewable energy sector for investors seeking long-term gains.