Patanjali Foods Share Price Target From 2025 to 2030: Patanjali Foods Ltd. Is considered considered considered one of India’s primary speedy-shifting customer devices (FMCG) and suitable for consuming oil businesses. Formerly known as Ruchi Soya Industries, the organisation modified into obtained through way of Patanjali Ayurved, marking a significant shift inside the Indian FMCG place. Patanjali Foods is thought for its robust emphasis on Ayurveda-primarily based products, natural food offerings, and a specific product portfolio, which embody healthful to be eaten oils, dairy products, and fitness dietary dietary supplements.

With a sturdy marketplace presence and competitive growth techniques, Patanjali Foods Ltd. Has received large hobby from investors. Patanjali Foods Share Price has visible sizeable price actions, making it a vital entity in the Indian inventory market.

Patanjali Foods Share Price Analysis

- Current Price: INR 1,766.95

- 52-Week High: INR 1,992.20

- 52-Week Low: INR 1,169.95

- Market Capitalization: INR 64.86K Cr

- P/E Ratio: 55.69

- Dividend Yield: 0.62%

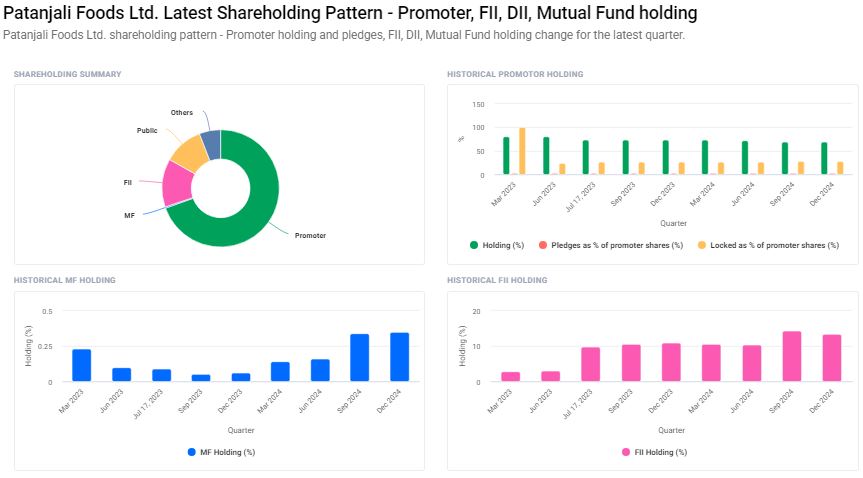

Institutional Holdings For Patanjali Foods Share Price

- Promoters’ Holding: 69.48% (slight decrease from the preceding sector)

- Foreign Institutional Investors (FII/FPI) Holding: 13.32% (decreased from 14.39%)

- Mutual Funds Holding: 0.35% (progressed from 0.34%)

Technical Analysis For Patanjali Foods Share Price

- Momentum Score: 40 9.2 (Neutral)

- RSI (14-Day): 44.2 (Neutral, neither oversold nor overbought)

- MFI (Money Flow Index): 38.1 (Approaching oversold ranges)

- MACD (12,26,nine): -0.9 (Bearish)

- Day ATR (Average True Range): 60.0 (Volatility Indicator)

- Day ADX: 14.8 (Low Trend Strength)

- ROC (Rate of Change – 21 days): -2.3 (Bearish)

- ROC (Rate of Change – 125): -1.5 (Bearish)

Patanjali Foods Share Price Target from 2025 to 2030

| YEAR | TARGET PRICE (INR) |

| 2025 | INR 2000 |

| 2026 | INR 2800 |

| 2027 | INR 3600 |

| 2028 | INR 4400 |

| 2029 | INR 5200 |

| 2030 | INR 6000 |

The above fee goals are based mostly on an evaluation of the agency’s increase capacity, market traits, and technical indicators.

Factors Influencing Patanjali Foods Share Price

- Expansion inside the FMCG and Organic Food Sector: Patanjali Foods is aggressively increasing into the organic meals and FMCG region, which has strong increase functionality in India.

- Government Policies & Regulations: Favorable authorities guidelines associated with agriculture, stable to devour oils, and Ayurveda-primarily based certainly products can enhance the economic business enterprise enterprise’s sales and inventory general performance.

- Rising Demand for Health & Wellness Products: Increasing purchaser hobby concerning healthful ingesting and natural meals consumption is expected to pressure earnings for Patanjali Foods.

- Global Expansion Plans: The corporation has been growing into worldwide markets, together with the Middle East and the usa, that could appreciably decorate revenue.

- Financial Performance: With a low debt-to-equity ratio of zero.10 and a strong bypass decrease lower back on equity (ROE) of 9.18%, Patanjali Foods maintains a robust economic characteristic.

- Competition from Other FMCG Giants: The company’s competition with giants like Hindustan Unilever, Nestlé, and ITC can effect its boom fee and market percent.

Risk Factors For Patanjali Foods Share Price

- Market Volatility: Share charge fluctuations due to macroeconomic situations.

- Regulatory Challenges: Government interventions in meals pricing and rules can effect profitability.

- Competition: Stiff competition from hooked up FMCG manufacturers.

- Supply Chain Disruptions: Dependency on uncooked cloth imports will have an impact on margins.

Frequently Asked Questions (FAQs) For Patanjali Foods Share Price

Q1: Is Patanjali Foods an extraordinary funding for the long time?

A: Patanjali Foods has robust basics and increase functionality. Its growth into the natural and FMCG sectors makes it a promising lengthy-time period funding. However, buyers need to consider marketplace risks and conduct due diligence.

Q2: Why has the percentage price of Patanjali Foods been volatile?

A: Stock rate volatility is because of elements like marketplace sentiment, global commodity prices, and institutional investor interest.

Q3: What is the predicted CAGR of Patanjali Foods till 2030?

A: Based on cutting-edge-day projections, the business enterprise is anticipated to make bigger at a compound annual growth charge (CAGR) of approximately 15-18%.

Q4: How do promoters and institutional shoppers effect the percentage price?

A: Promoters keeping a top stake within the organization (69.48%) indicates self warranty in its lengthy-term boom. However, a reduction in institutional investments may additionally additionally reason quick-term rate fluctuations.

Q5: Will Patanjali Foods benefit from India’s growing FMCG market?

A: Yes, India’s FMCG sector is unexpectedly growing, and Patanjali Foods’ sturdy logo presence will in all likelihood stress income increase inside the coming years.

Q6: What are the dividend opportunities of Patanjali Foods?

A: With a modern-day dividend yield of zero.Sixty two%, Patanjali Foods gives slight returns to dividend-looking for buyers. However, the company can also growth dividends as profitability grows.

Q7: What need to shoppers look beforehand to in the coming years?

A: Investors want to music quarterly profits, marketplace expansions, competition, and regulatory changes affecting FMCG and agriculture-based totally industries.

Patanjali Foods Ltd. Gives an exciting growth possibility within the Indian FMCG and natural meals area. With its robust market presence and enlargement plans, the organization is poised for massive growth over the following 5 years. While short-time period volatility is anticipated, long-term buyers can also advantage extensively via preserving onto their investments.

Investors ought to maintain an eye constant constant on the corporation organisation’s performance, corporation traits, and macroeconomic elements to make knowledgeable alternatives.