PG Electroplast Share Price Target From 2025 to 2030: The stock market is pretty cautious and visionary as an investment. PG Electroplast Ltd. has become a market leader within the electronic manufacturing services sector and is a sort of stock in high demand. We will examine share price targets from 2025 to 2030 based on its financial fundamentals, market trends, and expert analysis within this comprehensive guide.

Company Overview

PG Electroplast Ltd. is one of the best names in the EMS and plastic molding category. The company deals in products ranging from automotive and consumer electronics to industrial. With complete commitment to innovation and quality, PG Electroplast developed the market share and boosted its position in the business line.

Key Company Information For PG Electroplast Share Price

- Market Capitalisation: ₹20,342 Crores

- P/E Ratio (TTM): 106.14

- EPS (TTM): 6.77

- Book Value: 93.45

- Dividend Yield: 0.03%

- Debt to Equity: 0.40

Financial Performance Highlights For PG Electroplast Share Price

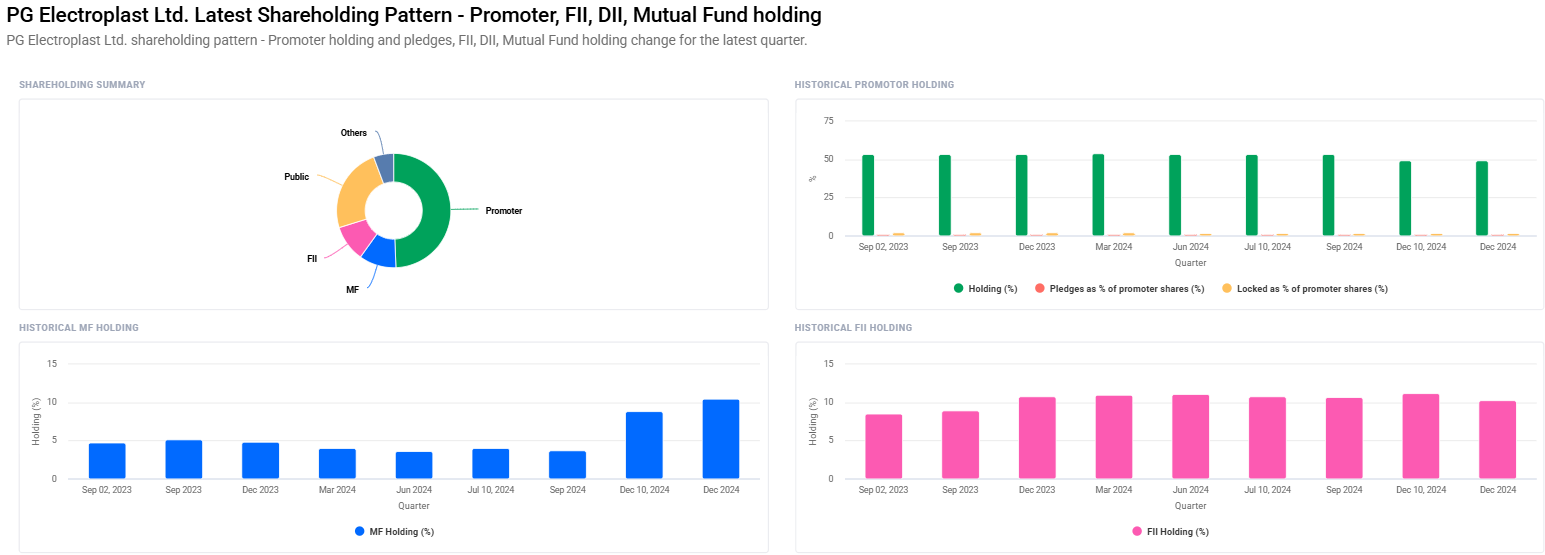

- Promoter Holdings: Decreased from 53.42% to 49.37% (Dec 2024 quarter)

- Mutual Funds: Holding of mutual funds increased from 3.75% to 10.52%

- FII/FPI Investments: Holding declined by 10.69% to 10.29% but FII/FPI investors increased from 142 to 186

- Institutional Investors : Holding increased from 20.49% to 26.51%

It indicates that the company is getting more interest from institutional investors and mutual funds, hence this confidence in the market about the growth potential of the company.

PG Electroplast Share Price Forecast (2025 to 2030)

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1200 |

| 2026 | ₹2200 |

| 2027 | ₹3200 |

| 2028 | ₹4200 |

| 2029 | ₹5200 |

| 2030 | ₹6200 |

The forecasted values use historical data, market movement, and technical analysis.

Technical Analysis For PG Electroplast Share Price

Day Technical Indicators:

- Momentum Score: 54.5, Neutral

- RSI (14): 38.1, Neutral Zone

- MFI: 42.6, Neutral

- MACD (12, 26, 9): -49.8, Bearish Signal

- Day ATR: 63.4

- ADX: 37.9. It is a moderate strength trend.

- ROC (21): -29.6

- ROC (125): 65.7

- Buy Order Quantity: 78.95%

- Sell Order Quantity: 21.05%

- Bid Total: 2,57,237

- Query Total: 68,587

- Total Traded Value: ₹8.91 Crores

- Volume: 1,22,176

Reasons for PG Electroplast Share Price Growth

- New Products: Molding plastic technologies and electronic manufacturing solutions that are under constant up-gradation

- Market Expansion: Tie-ups in automobile and consumer electronics

- Institutional Holding: Mutual fund and institutional investment

- Technological Advantages: Better manufacturing processes

- Environment-friendly: Focus on the green economy

Frequently Asked Questions for PG Electroplast Share Price

1. What will be the PG Electroplast share price in 2025?

Estimated price of PG Electroplast share for 2025, around ₹1,200.

2. Why should one invest in PG Electroplast?

PG Electroplast shares, with a good position in the market, new products and increasing institutional investments, make this a good investment.

3. What are the risks in PG Electroplast?

Variations in market, macro economy, and the competition EMS industries present some risks.

4. Trend of the promoter holding as it stood for recent quarters

The Promoter Holding, on the other hand is at a stage from 53.42 to 49.37%, hence possibly viewed at strategic readjustment at all.

5. Mutual fund is increasing its interest in PG Electroplast and what implications there could be

Mutual fund holding is up from 3.75% to 10.52%. That is an increase in confidence about the growth prospects of the Company.

6. Is this technical anallysis is positive for short-term investors?

MACD stays bearish, and RSI remains neutral; hence, the advisory to a short-term investor is to remain cautious.

Long-term investors will always look forward to PG Electroplast Ltd. It shows excellent fundamentals with new technologies and enhancement of the market. The short-term trading calls from a technical indicator are negative cautionary. However, based on PG Electroplast Share Price projections from 2025 to 2030, it is positive growth. Investors can think about bringing PG Electroplast into a diversified portfolio, keeping up to date with the market and corporate trends.