RattanIndia Power Share Price Target From 2025 to 2030: RattanIndia Power Limited is a leading Indian company in the sector of power generation. The Company primarily focuses on clean energy as well as operates efficiently. The investors should, therefore, look towards RattanIndia Power if they seek the prospects for shifting power markets as long as the government of India continues its persistence in boosting energy supplies with increased production as well as the infrastructure. This report targets the share price forecast that RattanIndia Power will achieve in the period 2025 to 2030, keeping in mind only the most relevant technical indicators, market trends, and company fundamentals.

About the Company

RattanIndia Power Limited is an India-based company specialising in generating thermal power. It is the constituent of RattanIndia Group and is having humongous power plants as its owning entity. It is reported from recent trends that the global energy follows, as such this company has already studied about cleaner sources of energy. The market capitalisation of about ₹5,600 crore positions RattanIndia Power at a very pivotal rank of an important company in facilitating the rise in energy demand for India.

Fundamentals Needed For RattanIndia Power Share Price

- Market Cap: ₹5,600 Crore

- Debt to Equity: 0.78

- EPS (TTM): 20.04

- P/E Ratio: 0.52

- Book Value: 8.30

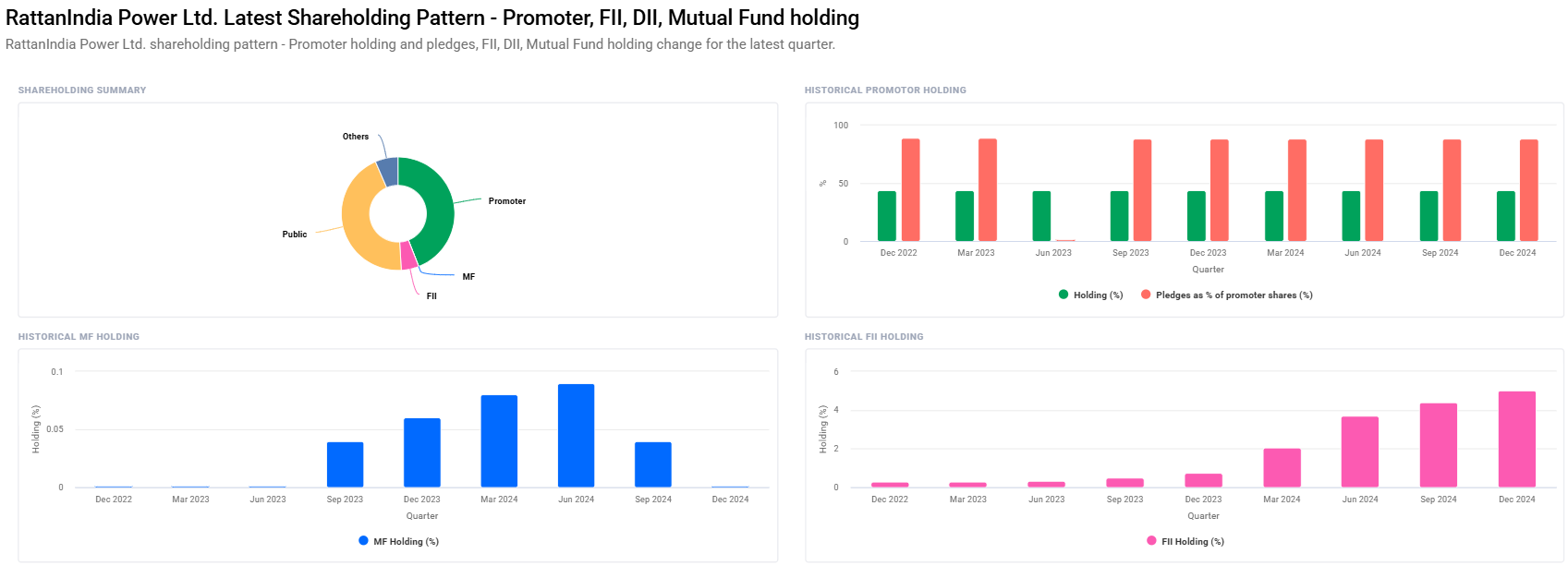

- Promoters Holding: 44.06%

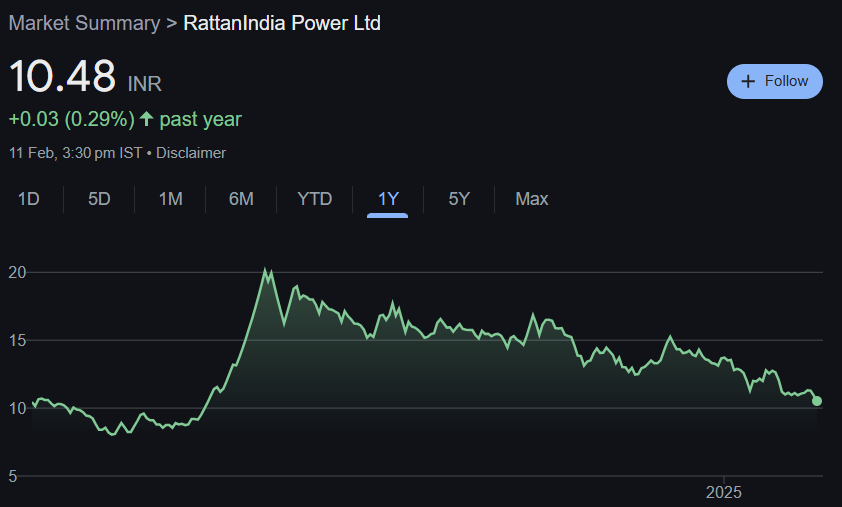

- 52-Week High: ₹21.10

- 52-Week Low: ₹7.90

- Industry P/E: 21.80

RattanIndia Power Share Price Forecast 2025 to 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹22 |

| 2026 | ₹35 |

| 2027 | ₹50 |

| 2028 | ₹65 |

| 2029 | ₹80 |

| 2030 | ₹95 |

2025: RattanIndia Power Share Price Target – ₹22

RattanIndia Power will emerge from the current bearish phases in the year 2025. With the betterment in the macro economy, the stock will once again bounce as it is doing. Growth drivers include increased consumption of power and effective management at the operational level.

2026: RattanIndia Power Share Price Target – ₹35

With green energy investment along with strategic management of the debt taken by the firm, the share price for the year 2026 will soar higher. Company growth and the policies favorable to this industry offered by the government will push this stock even higher in the coming years.

2027: RattanIndia Power Share Price Target – ₹50

Better infrastructural development and stabilized market will improve RattanIndia Power through 2027. Diverting towards clean energy system has excellent effects on the investors mentality that may also raise the price again.

2028: RattanIndia Power Share Price Target -₹65

The energies sector still well within its bulls as it diversifies the production energy capacity along with positive financial result, which shall make their equities propel further up in prices.

2029: RattanIndia Power Share Price Target -₹80

Northbound sustainable movement would be kept up with market development and strategic deals. For an efficient operations model and conducive market dynamics, the stock for RattanIndia Power has the potential for achieving this number.

2030: RattanIndia Power Share Price Target – ₹95

In FY2030, RattanIndia Power could be looking at a huge leap in its profile in the renewable energy space. The tight share price figure of ₹95 might work in favor of the share price for RattanIndia Power in case it sees growth in the operations and sustainable model.

Technical Analysis For RattanIndia Power Share Price

- Momentum Score: 35.5 Neutral

- MACD (12, 26, 9): -0.5 Bearish

- ADX: 18.3 Weak Trend

- RSI (14): 35.9 Neutral Zone

- ROC (21): -3.3

- ATR: 0.5

All of the above shown indicators are an indication of a technical position which reflects RattanIndia Power to be neutral in its point in time because it shows that it still has some room left to improve as regards stability around it in stabilizing the market.

Points to Invest For RattanIndia Power Share Price

- Debt to equity it keeps at 0.78 percent.

- Operational profitability, there is a hike opportunity too.

- Positive industry P/E is at 21.80.

Adaptability would be the most important factor in the power industry while moving toward sustainable energy.

FAQ Section For RattanIndia Power Share Price

1. What is the share price target of RattanIndia Power for 2025?

The target for share price of 2025 is set at ₹22.

2. How is the holding of the promoter changed recently?

Promoter holding is retained at 44.06%. Not many changes are noted in the Qtr Dec. 2025.

3. What is the Debt-to-Equity Ratio of RattanIndia Power currently?

The company’s debt-to-equity ratio is at 0.78 currently.

4. Company Technical Indicators State what?

The technical indicators of the company are neutral and bound to change according to the trends in the market and other related strategic moves initiated.

5. Why Stock Expected to Rise Between the Periods 2025 – 2030?

Strategic maneuvers on debt management, increased energy production, diversification into clean energy, and government policies.

6. What are the risks involved with investing in RattanIndia Power?

Market volatility, new regulation, or competition in energy.

7. What is the Market Cap of RattanIndia Power?

Today, the Market Cap stands at Rs 5,600 crores.

8. How has its share movement been historically?

The High price from the 52-week high till date is 21.10 and lowest 52 wk is 7.90, so it ranges pretty high from there .

RattanIndia Power Limited stands as one of the best long-term investment opportunities. The company is cost-effective and working toward debt management and green initiative. Since RattanIndia Power has announced an interminable list of share price targets that begin with 2025 to 2030, it suggests progressive growth and would play a vital role in the evolving Indian energy scenario.